This blog was written by Ron Renaud, CEO of RaNA Therapeutics, as part of the “From the Trenches” feature of LifeSciVC.

It is that time of the year again when we start to get ready for the New Year. It is also the time of the year that involves an inordinate amount of hectic activity with board meetings, regulatory deadlines, presentation preparation for JP Morgan, and general holiday stress. Even with the craziness, there is usually an excitement because we know there is a brief lull with the holidays that allow us to catch our collective breath before we descend on San Francisco to get on the biotech roller coaster ride of the New Year.

This season feels a bit different though. While I am excited about what is in store for 2016 for our company and our industry as a whole, I am tired of the anti-pharma/biotech industry drumbeat that seems to be getting louder by the day. How did this sentiment get so bad? This seems like a question with an obvious answer given some of the recent issues around drug pricing and the distasteful behavior of individuals purported to be in our industry. Or, is it that we, collectively as an industry (biotech and pharma together)– are not doing a good job speaking up for ourselves. It is likely some combination of both

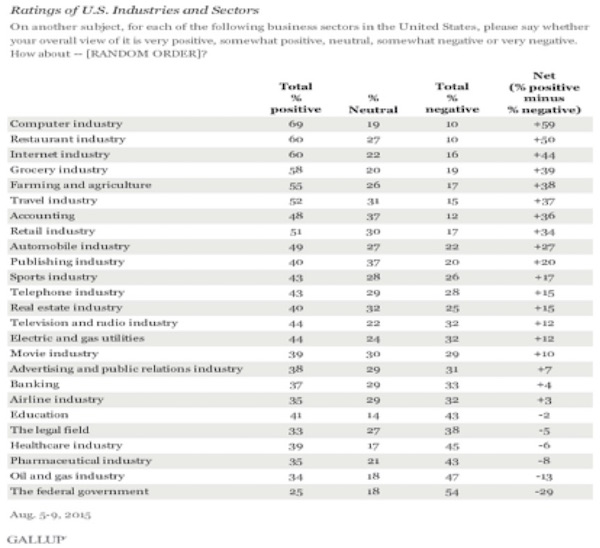

In a recent poll conducted by STAT and the Harvard T.H. Chan School of Public Health, over 1,000 adults were asked, “Do you think pharmaceutical and drug companies generally do a good job serving their consumers?” An incredible 40% said no and another 10% had no answer. Only half of the respondents thought that the pharmaceutical industry is serving them well. Consider the following data from a Gallup poll conducted in early August 2015.

Our industry is ranked below the airline industry and only a few notches above the federal government. Next time you are in the long TSA line at the airport, try to remember these statistics. My guess is that we would be in the same neighborhood as tobacco if it were included in the questions.

My point is not to highlight all of the negatives. In fact it is quite the opposite – in an industry with so many bright, motivated and passionate people – most focused on treating or curing grievous illness, how is that we are perceived so poorly? Let’s start with where the general public has focused their anger – how we price our products. The cost of pharmaceuticals is an easy target for demagoguery by the mainstream media, politicians and many other pundits. According to much of what I read in the press, one might conclude that the easy solution is to simply lower the price of drugs and problem solved. That said, this is an undeniably complex process with many inputs and drivers that are unique to each company in our industry. A few companies are quite good at the full process of drug discovery, development and commercialization and many companies are good at certain aspects of that process. Add another layer of complexity such as the cyclical nature of success. Companies often hit their stride with strings of successes and then biology happens and failures occur. The good thing is that because of the sheer volume of truly innovative and inventive research that is occurring in academic and industry labs, the failures are often short-lived as another success is usually no too far away. The key attributes of our industry are invention and innovation and they are both very expensive.

I have heard many make comparisons of pricing pharmaceutical and biotechnology-based therapeutics to the pricing of cars, iPods and laptops over the last few months and it makes me cringe. Without any expertise in the auto or computer industry, I do know that there have been improvements to each of these products. Compared to the year 2001, cars can now drive themselves, the iPod has morphed into an iPhone and the processing power of laptops have made desktop computers almost obsolete. That said, cars still perform the same exact function and that is to transport us from point A to point B. Because the car can now parallel park on its own or go 175 miles per hour does not impact my (or anybody’s) real health, especially on the Mass Pike at 8:15am. The iPod was launched in 2001 at a price of $399 and it could play 1,000 songs and not much else. Today, it is an incredibly convenient iPhone with a price tag that ranges from $650 – $850 and can read my email and give me hockey scores on voice command (thanks Siri!). In fiscal 2015, Apple reported a little more than 231 million iPhones sold with net revenues of $155 billion. This is impressive considering that while there are apps that increase its functionality and can help me monitor my health, I have not heard of any iPhones halting tumor progression or killing a virus.

Comparatively, something else that hit the market in 2001 was Gleevec. In May of 2001, the FDA approved Gleevec to treat patients with advanced Philadelphia chromosome positive chronic myeloid leukemia (CML). At a launch price of ~$2,200 per month, this completely new approach to treating CML did not have a robust, long-term data set to determine impact on survival but the data from three mid-stage trials showed major cytogenetic responses in patients with advanced CML. Today, Gleevec costs about $9,000 per month. That appears to be a significant jump in price for a 14-year old drug but consider that with Gleevec (and other tyrosine kinase inhibitors), all-cause mortality in CML has declined to low single digits, versus a historical rate of 10-20%, and the estimated 10-year survival has increased from less than 20% to above 80% according to published reports. Additionally, Gleevec now has 10 indications many with improvements in overall survival. Investment into drugs like Gleevec do not end once the drug is approved as witnessed by the multiple new indications following the initial indication in 2001. In the same fashion, revenues from success stories are not only reinvested into that specific drug but in to the rest of the pipeline to generate additional potentially life-saving or life-extending therapies like Gleevec. There are many more stories like Gleevec and making economic comparisons to iPhones or automobiles seems idiotic.

It is well understood that every success in biotech and pharma is not at the magnitude of Gleevec but investment by shareholders into many successful and unsuccessful companies, private and public, have led to treatments for multiple genetic disorders, keeping HIV at bay, curing HCV, and increasing survival in many deadly cancers. There is no doubt that the price we pay for healthcare, specifically medications, is high but it also enables the innovation required to keep research and development moving forward and that should provide a major benefit to society as a whole. It is not a perfect system by any metric and the “price x volume” equations for many drugs may seem untenable but if we want cures for cancer, Alzheimer’s, diabetes and HIV, the investment has to be shared by investors and consumers alike. While I am sure the R&D efforts of trying to develop a bigger screen, incorporating Wi-Fi in in a new model car or including a higher resolution camera are challenging, so is drug discovery.

I am sure that some will read this and brush it off as a biotech CEO whining about the press not getting our industry right and pharmacoeconomists will probably find many holes in this as well. Both are probably right. But, when you are preparing your presentations for JP Morgan or any of the other dozens of meetings you are likely to have in the first month of 2016 – think about your company. Think about the countless hours that your R&D organizations are spending on getting the biology, chemistry, and clinical development right. If we, as an industry succeed – patients will ultimately benefit. This is the message that we need to counter the negative drumbeat on biotech and pharma in 2016. My guess is that our respective trade organizations have similar messages but we need to take it upon ourselves as individual companies to hammer these points every chance we can.

It is perfectly acceptable to be proud of our industry and the work that many of us do to bring novel approaches to treating and hopefully eliminating many grievous illnesses. This is made possible by venture and institutional investors as well as reinvestment of profits back into the industry (R&D, partnerships and M&A). Egregious actions like raising drug costs of a 60 year-old drug by 5,000% and claiming that will be used to fund innovative research is difficult to comprehend. We must take any and every opportunity we can to make sure that the public realizes that companies like Turing are not related to or representative of the vast majority of companies in biotech and pharma. Turing is about as close to our industry as the Kardashians are to any hard-working family in the America. Most readers of this blog are fatigued with the Turing nonsense but as long as mainstream media outlets keep giving them airplay, we will need to keep drawing the distinctions. If you need further proof – I recommend you go read the Twitter feed of the folks from Turing and ask yourself if that is what we are about.

We should make a collective New Year’s resolution to turn this sentiment around. News like Keytruda helping President Carter and Pamela Anderson being cured of her HCV are helpful but we must take it upon ourselves to reinforce the innovative and inventive nature of our industry. This will be difficult during an election year but not insurmountable. We cannot leave this to a few of the big pharmas and biotechs to carry the torch for all of us. We must also speak up for ourselves.

Keep the following in mind as you think of what our industry has accomplished:

- There have been 42 new molecular entity and new therapeutic biological product approvals through December 11, 2015. More than all of 2014;

- 17 approvals in 2015 were for oncology indications or oncology-related;

- According to Bio, there are approximately 1,200 biopharma companies with more than 90% not earning a profit – but these companies are developing more than 60% of new product candidates;

- Bio also estimates that approximately 3,500 medicines in clinical development are potential first-in-class molecules;

- With more than 800,000 employees in the US biopharma sector, PhRMA estimates that our industry is one of the most research and development-intensive with more than 10 times the amount of R&D investment per employee than all manufacturing industries overall.

These are some facts and figures that we should be proud of.

Happy Holidays and best wishes for a great 2016!