The sky is falling. The sky is falling. Seems like every day there’s another piece of news about the drop in Life Science venture capital (and here), with bouts of flagellation around each new quarterly press release from NVCA/PwC MoneyTree, Dow Jones VentureSource, or CB Insights. Everyone repeats the news with the same grim perspective and soon enough it just becomes well accepted fact, and runs the risk of being self-fulfilling. We all deride public investors for being too focused on quarterly numbers and yet here we are in the long-term venture industry whining about quarterly ups and downs. The reality is over the past decade Life Sciences venture capital has been incredibly stable source of capital.

Here’s the data – using the 1995-2011 quarterly dataset from PWC MoneyTree and the NVCA. Life Sciences is defined here as Biotech, Pharma, and Medical Technologies.

A few takeaways:

- Since Jan 2001, Life Science investing as a percentage of total VC investing each quarter has averaged 26% with a standard deviation of only 5%. That’s reasonably consistent. And in 2011, at 26%, we’re squarely on that decade average. Quarterly volatility may be up, but that’s reflective of the broader capital market gyrations as well.

- In terms of dollars invested per quarter, its averaged $1.6B with a standard deviation of $400M since Jan 2001. Again, quite consistent over much of the last 10 years

- LS investments as a share of VC investing are up considerably from the 2nd half of the 1990s, 3x in terms of dollar flows and 2x in terms of its share of venture flows.

So the longer term data don’t support the Chicken Little view of our sector.

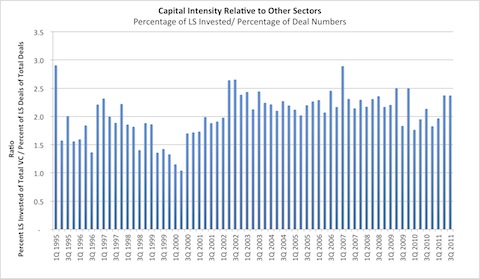

Another common refrain is the increasing capital intensity of LS relative to other sectors. Its true that our biotech deals tend to raise more than internet startups, but the relative capital intensity vs all other sectors has been incredibly stable. The chart below plots the ratio of the percentage of dollars in VC that go to LS companies vs the percentage of the total deal numbers that are LS deals. Simply put, its a ratio that captures relative investment per deal. Its been 2.2 +/- 0.3 since 1995. So our deals haven’t become more or less capital intensive vs other sectors for much of the last 15 years. In recent years, its clear most sectors have become more capital efficient – virtualization of biotechs and “

lean startups” on the Tech side. More signs of consistency in our funding patterns relative to other sectors.

The conclusion for me is we should stop whipping ourselves into a frenzy about the dismantling of Life Science venture capital every time a quarterly report comes out or a firm decides to bail out on raising their next fund. We’re still financing

a good number of new companies. Yes, we need to improve returns in venture as an asset class and LS will do its part in improving that (starting from

better position than other VC sectors I might add). Yes, we need to continually refresh the pool of VCs that have active funds to deploy. But I don’t see the sky falling: Life Science is a core part of the venture community and will continue to provide a steady source of funds to startups, and hopefully quality returns to LPs.