Corporate venture capital’s role in the new biotech ecosystem couldn’t be understated today. They are a major syndicate partner for those of us in the early stage arena, and we couldn’t power up our startups without them.

I’ve written on this before (Debunking Corporate Venture Capital), as have many others, but thought I’d put some numbers behind two points: how important they are in early stage, and how big they actually are.

Corporate VCs are now truly “preferred partners” for our early stage deals.

To quantify the impact of CVCs on our portfolio, we assessed how many deals had some participation from their funds. The chart below captures it for us. From 2000-2005, Atlas invested in nearly 40 Life Science companies from Funds V and VI. Only 5% of those had any corporate VC involvement. Fund VII was deployed from 2006-2008 and a third of those deals had a corporate syndicate member. And since 2009, 67% of the deals in our Fund VIII (our current vintage) have at least one corporate venture group. And many of the deals have several corporates (e.g., Nimbus has SROne and Lilly Ventures; Bicycle has SROne and Novartis; RaNA has SROne and Monsanto; F-star has MerckSerono, Mitsubishi, and SROne). I suspect this metrics won’t reverse in our portfolio anytime soon – we’re likely to build most of our companies with at least some element of a Pharma equity partner at our sides for the foreseeable future.

Corporate VC funds have very large implied “assets under management”.

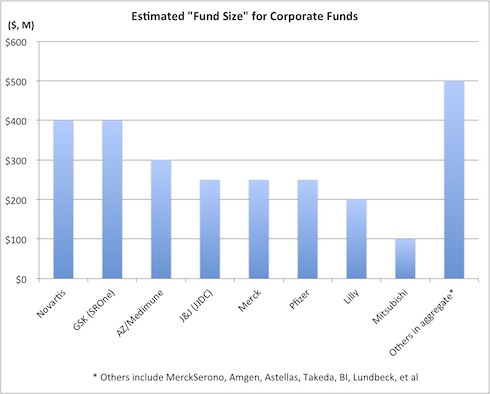

Based on discussions with those funds about the pace and scale of their investments, I’ve tallied up the implied “fund size” for a number of corporate VCs. This estimate for implied fund size is a function of taking the annual investment pace and assuming a traditional four year investment period, with reserves thereafter. For example, $50M per year direct investments, or $100M of investments plus their future reserves, equates to a roughly $400M standalone fund. Here are my guesstimates for a set of CVCs:

This group of corporate VCs (and I almost certainly forgot a few) represent about $2.5B+ worth of “traditional” venture funds by conventional measures of fund “size”. This is a significant amount of capital. While there are larger life science dedicated funds in existence, the typical early stage life science funds (or life science allocations within diversified funds) are in the $100-250M range. These funds are clearly dwarfed by the size of several of these early stage corporate VCs.

In addition to direct investments, many corporate pharma groups have been active in becoming strategic LPs in venture funds. This further augments their role in supporting early stage innovation, and is a trend that is likely to continue.

Reality is every early stage investor now has their favorite CVCs on speed dial for their next startups’ funding round.