In recent years, acquisitions of early stage private biotechs have frequently included an upfront value coupled with significant future milestone payments.

These earnouts resemble the “biobucks” common to product licensing deals: stretching out over 5-10 years, they get ravaged by R&D’s high attrition rates and are certainly not expected to be paid out in full. But the presence of these milestones helps to bridge the gap between buyer and seller expectations of value, and to incentivize closing an early stage deal by preserving some of the upside for the seller in a success scenario. The presence of these earnout payments in deals has been in part what has pushed great companies into the arms of buyers rather than the public markets.

But there’s little data out there on whether these structured earnout M&A transactions, which really became common after 2005, have paid out any of their milestones. Data are very difficult to obtain, confounded by both undisclosed figures as well as typically scant mentions in most buyer’s SEC filings.

To try to shed some light on this, I’ve assembled a small dataset by piecing together insights from RecapIQ (Deloitte), SEC documents, and discussions with friends about rumors and facts. This is by no means a comprehensive or correct dataset; it’s an attempt to put some data into the public domain. I’m hoping that by posting it here in the public eye that we’ll be able to crowdsource a more refined and appropriate curation and enumeration of this dataset.

So here’s the dataset. These data are focused on “earnout” deals in therapeutics, and is arbitrarily defined as any M&A deal where at least 20% of the total value is represented by the future milestone payments. These include different flavors: acquisitions followed by milestones (e.g., Gloucestor-Celgene, CovX-Pfizer), options-to-buy (e.g., Ception-Cephalon, AkaRx-Eisai), or staged acquisitions of equity (e.g., Actimis-BI).

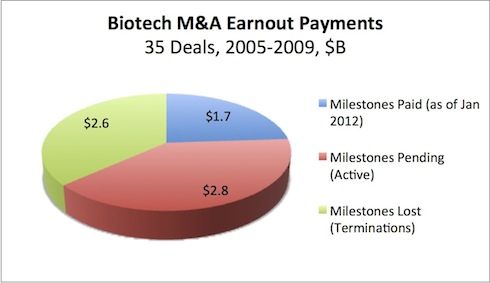

Using these criteria, this dataset contains 35 therapeutic biotech M&A deals that closed in the five-year time period between Jan 2005 and Dec 2009. These deals represent $11.3B in total M&A deal values; $4.3B in upfront payments, and $7.0B in potential milestones.

Of these 35 deals, 25 have programs that remain in active development at their acquirer; 10 of these deals have seen their programs’ development terminated or severely curtailed (unlikely to pay any further milestones). At least 16 of these deals have paid at least one milestone to date.

While the specific milestone data are not definitive for any/all these deals, the aggregate numbers are likely directionally-correct and of potential interest:

- At least 24% of the milestones ($1.7B) have already been paid out to date from these deals. This was surprising and it is higher than my expected ‘consensus’ estimate from discussions with others.

- Approximately 40% of the total milestones ($2.8B) are linked to deals with active programs and could still pay out in the future (caveat: not clear what proportion of those milestones have already been missed).

- Lastly, at least 37% of the total milestones ($2.6B) have been lost due to terminations of the underlying programs/deals.

It’s worth noting that the only three of the milestones were for product approvals (Salmedix, Ovation, and Gloucestor); a number of other large payments were for clinical development and platform milestones (CovX, Agensys, Ception, others).

While the analysis above represents “older” deals where payouts of milestones would be more anticipated, I also looked at a more recent, less mature deal vintage between 2010-2011: another 13 M&A deals have milestones representing greater than 20% of their deal value and all of these remain active to my knowledge (i.e., no program terminations). At least two of these have paid earnouts to date: Biomarin has paid LEAD an $11M milestone for their IND filing, and Pfizer has paid FoldRx shareholders several milestones to date. Alnara is the only one with visible, public setbacks, though Lilly is apparently conducting another Phase 3 trial.

Another caveat to this dataset is that by filtering for deals with greater than 20% of their value in milestones, a number of large deals get cut from the analysis. Two $400M+ Atlas exits with earnouts, Adnexus and Novexel, both had approximately 15% of their deal value in downstream payments, some of which have already been paid. The aggregate impact of deals like these on the above metrics and payout percentages for milestones is unclear.

As mentioned above, curation by the broader community would make this data far more interesting, and help us all begin to appreciate the impact of these earnout structures on the value of future deals. Please feel free to email me, or post (anonymously if you’d like) to share further information on these deals. In particular, if I’ve got the data incredibly wrong. I’ll update the spreadsheet and repost.