The past few weeks have been full of bad news about biotech venture: the numbers were abysmal as venture investments into biotech during the first half of 2012 were off some 40% from last year. This drop can’t be a good thing for the ecosystem.

However, although concerning, it’s not the reduced capital flows into biotechs that I find so worrying – quarterly variations happen, these things are cyclic, etc… It is certainly as hard as it’s ever been for bioentrepreneurs to raise money, but deals are getting done. There was still $1.5B that flowed into ~200 venture-backed biotechs in the US in the first half of 2012; this volume represents more companies than any of the 16 other sectors tracked by the NVCA/PWC Moneytree venture capital survey outside of software (541), including media and entertainment (186) and IT services (165). So we’re still a sizeable venture sector. And assuming the economic and political uncertainties don’t create havoc, I expect venture-backed biotech’s numbers to rebound somewhat in the 2nd half with the typical lumpy variability of quarterly data.

But what I do find really disturbing is the longer term macro trend around the shrinking number of venture firms active in biotech – and the number of partners in those firms. Seems like every month there’s another diversified firm leaving healthcare (like Scale Ventures), or healthcare VC firms winding down altogether (like Prospect). See recent tweets alluding to the subject here, here.

Even in a capital constrained world – and clearly the data suggest biotech venture is getting leaner – one of the biggest constraints on the ecosystem is the bandwidth of individual, active investors: what new startups are you working on forming, how helpful you are to the entrepreneurs you’re backing, what existing portfolio companies do you spend time on, how effectively are you leveraging your network for the portfolio, how many frogs (new opportunities) are you kissing, etc… And as an active investor looking for syndicate partners in our portfolio, the dwindling “available bandwidth” of the biotech VC universe is a real concern. Many are too busy working on their portfolios to do more than 1-2 deals a year (including me). This bandwidth issue is as or more important of a constraint on the number of biotechs that get funded than the amount of capital itself.

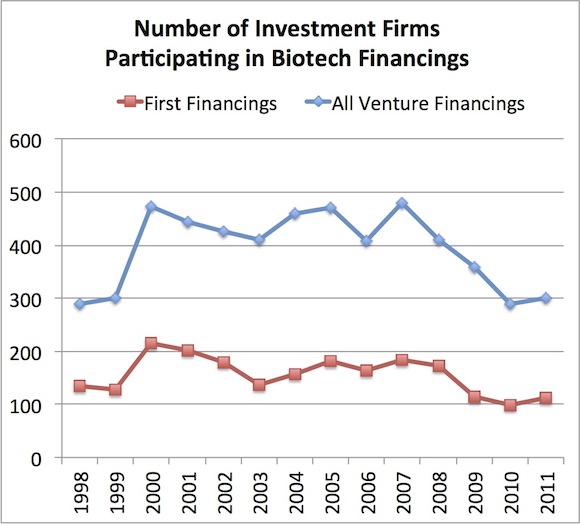

To put some statistics around this concern, here are some data from the Dow Jones VentureSource database. In the chart below, I’ve plotted the number of investment firms participating in at least one biotech financing by year since 1998, for both “first financings” (startups) and all venture financings (first and later rounds).

This reveals a 40% drop from 2007 in the number of participating investors overall, but also startup (“first financing”) investors. For context, the number of “active” VC firms according to the NVCA only dropped from ~10% from 2007-2011.

These data help quantify the massive contraction in the number of firms investing in biotech that we all know and feel.

A surprisingly positive finding embedded in the data is that there are so many investment firms on the list to begin with. Since 2008, 169 venture firms have invested in at least one “first financing” in biotech – I skimmed the list and it seems credible. Hard to know exactly how many of these actually did more than a few investments, and undoubtedly a version of the Pareto principle is in effect: 60-80% of the deal volume is probably done by the most active 20%. But with over 2000 rounds of funding in biotech since 2008, the ranks of the less active 80% are still doing a few rounds a year on average.

But even with those players, the data in the chart above would suggest we’ve lost nearly half of the investment firms willing and able to do deals in LS over the past five years. A reasonable number of those are dead or are zombies unlike to ever raise another fund. A good number are probably distracted by lengthy fundraisings, and praying for an exit to catalyze a close. Whatever the reason, they are out of the picture today and possibly forever.

In line with this data, Luke Timmerman of Xconomy recently wrote a very good piece on who are the last remaining active early stage VCs in biotech, and shared a bit of data from Thomson Reuters. Its clear that the shortlist of active biotech VCs is indeed shorter than its been since the mid-1990s.

Is this going to change anytime soon? Not likely. Jon Norris of SVB recently published a great pair of reports (here, here) worth reading. Among many insights that I’ll bring up in the future, there were two great analyses with regard to venture investors:

- Big Exits in the Life Sciences are up from 2005-2011 – but they are concentrated in the portfolios of relatively few firms. Of the 170 Big Exits since 2005, the Top 10 venture funds (in terms of numbers of these hits) were involved with 52% of all the big exits. The Top 20 expands that to 66%. It’s a world of Haves and Have-nots. For those funds without big exits, fundraising won’t likely happen.

- Investing has outpaced Fundraising. Since 2005, SVB estimates that there’s been 25% more money flowing out from VCs into biotech comapnies than into new VC funds earmarked for biotech. This deficit in dry powder has to catch up to the sector, and it appears the numbers are beginning to reveal it.

The silver lining in the SVB data is that Life Science liquidity (distributions) in 2011 has outpaced both of investing and funding (as I also pointed out back in January) – and over time these improved returns would undoubtedly increase LP interest in Life Science investing, which should help to stem the tide of ever-shrinking biotech financings. Looking forward to the day!