This blog was written by Rosana Kapeller, CSO of Nimbus Therapeutics, as part of the “From the Trenches” feature of LifeSciVC.

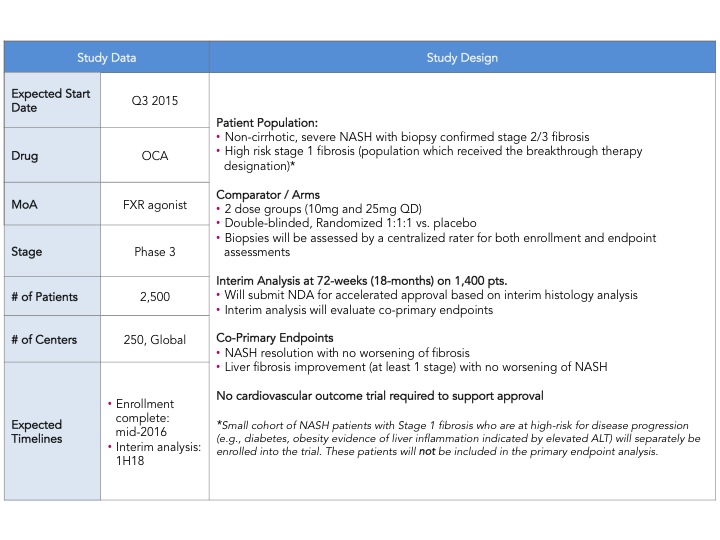

Early this week, Intercept Pharmaceuticals announced the much awaited design of their Ph. 3 clinical trial of Obeticholic Acid (OCA) in NASH (non-alcoholic steatohepatitis) with liver fibrosis (here). The trial, named REGENERATE, will be the first Ph. 3 trial ever in NASH and plans to enroll a total of 2,500 patients with an interim histology endpoint at 72 weeks in 1,400 patients to support initial approval. There were a couple of major surprises: (1) the use of co-primary histological endpoints including: (i) liver fibrosis improvement with no worsening of NASH and (ii) resolution of NASH with no worsening of fibrosis (2) the size of the study is larger than expected. This announcement sent pharma, biotech and investor communities into a frenzy, as this trial sets the bar with regard to approval endpoints, number of patients, time of treatment and follow up. Intercept just raised the bar, maintaining its pole position in the race to treat NASH and creating even more excitement in an area of research and development that has been neglected for a very long time.

NASH is hot!

As recent as 2013, when we told potential pharmaceutical partners and investors that we were developing a liver-directed allosteric Acetyl-CoA carboxylase (ACC) inhibitor, which blocks endogenous fatty acid synthesis and promotes fatty acid utilization, for treating NASH (here), people looked at us as if were speaking about the unattainable ‘pot of gold at the end of the rainbow’. Some common comments were: “No need for a drug to treat NASH, people just need to lose weight and exercise”, “ There is no clear path into registration, endpoints are not defined”, “You will need an outcomes trial, this is a graveyard”, etc

That all changed abruptly in January 2014. Intercept Pharmaceuticals (ICPT) released their interim data on their Ph. 2 FLINT (Farnesoid X Receptor Ligand Obeticholic Acid in Nonalcoholic Steatohepatitis Treatment) trial, which was stopped early due to the highly positive results in their primary endpoints: decrease in non-alcoholic fatty liver disease activity (NAS) score by at least 2 points and significant improvement on fibrosis from baseline to the end of treatment. In two days Intercept stock price increased six fold and the world woke up to NASH, a disease that can lead to the development of cirrhosis and hepatocellular carcinoma and is projected to surpass hepatitis C as the leading cause of liver transplants by 2020. Intercept deserves a lot of credit for having the courage and foresight to brave NASH’s New World. Tom Hughes covered this topic on his blog FLINT, NASH, And Biotech: How Big Things Happen (here).

The news of Intercept receiving Breakthrough Therapy Designation from the FDA for Obeticholic Acid (OCA) in NASH with liver fibrosis in January 2015, raised the hope that a registration path for NASH was possible without an outcomes trial. In March of this year the summary of the findings and recommendations from the FDA and AASLD jointly sponsored workshop (held in Sept. 2013) to develop guidance on diagnostic and therapeutic modalities for NASH was published in Hepatology (here). Although an outcomes trial is the desired design for approval, it was recognized that it was unrealistic given the long time of disease progression from NAFL to cirrhosis/liver failure and the urgent need of drugs for the treatment of NASH required a novel approach. According to the FDA/AASLD recommendation “ the reversal of steatohepatitis with no evidence of progression to advanced fibrosis (stage 3 or 4), may be an acceptable surrogate endpoint suitable both for phase 2b and 3 trials that enroll patients with NASH and evidence of early fibrosis”. Despite the publication of the joint recommendation, an official FDA guideline has yet to come forth and the community is anxiously awaiting the publication with the hope that it may further clarify the path to approval of drugs for the treatment of NASH. In the meantime, Intercept’s announcement further supports the view that initial approval can be achieved by meeting histological endpoints. Post-marketing follow up of patients until the occurrence of liver-related outcomes, including progression to cirrhosis, to confirm clinical benefit may be needed for full approval.

At EASL’s 50th International Liver Congress in Vienna, the excitement around the new data on potential drugs for NASH was palpable. This meeting, which has been focused on HCV for the past 10 years, is rapidly shifting its attention to NASH/NAFLD (non-alcoholic steatohepatitis/non-alcoholic fatty liver disease) reflecting what is happening in the broader liver disease research community. Looking forward to AASLD meeting in San Francisco in late 2015!

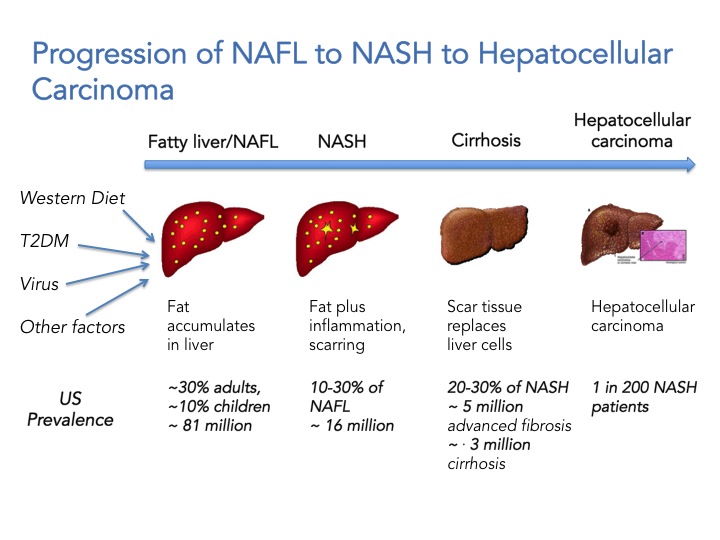

What is NAFLD/NASH and why we should care

First we need to appreciate that NAFLD is not one disease, but a continuum ranging from simple fat accumulation in the liver (steatosis; NAFL) to inflammation, hepatic cell death and fibrosis (NASH) to cirrhosis and ultimately hepatocellular carcinoma. It has a variety of causes including obesity, type 2 diabetes, viral infections, and genetic predisposition but is not associated with high alcohol consumption. Extra-hepatic complications include increased cardiovascular risks and NASH is associated with a two-fold increase in cardiovascular-related mortality and a 10-fold increase in hepatic failure and death. To date there are no FDA approved drugs for the treatment of NASH and the first line of treatment is lifestyle modification. The scary thing is that it also affects children. The current estimate is that 81 million Americans have NAFLD, 10% of those are children (8.1 million children!). 10-30% of individuals with NAFLD will develop NASH which translates to ~ 16 million Americans, and from these 20-30% will develop advanced fibrosis and cirrhosis, and are at increased risk to developing hepatocellular carcinoma. In summary, if you have NASH and you don’t die of a heart attack or liver failure, you may die of cancer or have a liver transplant in your future. The healthcare cost and burden to society will sky rocket in the next 10 years and is estimated to reach $35 billion by 2025. NASH is now portrayed as “The Next Big Global Epidemic”.

NASH drug development landscape

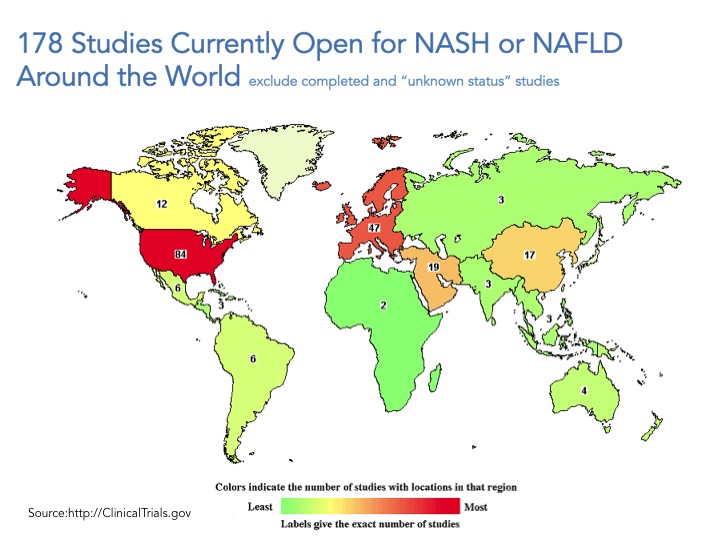

Go to www.clintrials.gov and search for NASH or NAFLD trials, exclude completed trials or trials of unknown status and what you are left with is 178 total open trials (search conducted May 10, 2015). Certainly this is an underestimate of what is happening all over the world but a good place to start. The trials registered in the site are mostly being conducted in the US and Europe, and only roughly a third of them (61 trials) involve drug intervention whereas the great majority of these trials focus on lifestyle modification, dietary supplements, procedures, devices and “other” which include natural history of the disease/longitudinal studies and biomarkers.

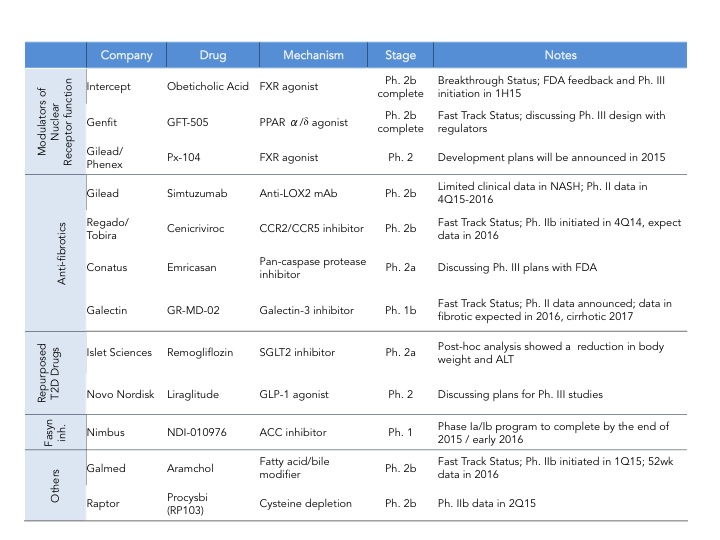

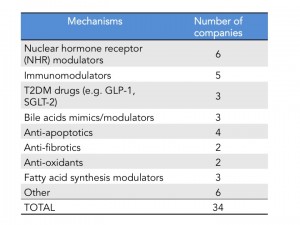

As of last count there are 34 companies that have disclosed that they have clinical stage programs in NASH. The mechanisms of action range from nuclear hormone receptor modulators, fatty acid synthesis inhibitors, anti-apoptotics, anti-fibrotics and immunomodulators. There are also several drugs being repurposed into NASH including drugs used for T2DM and autoimmune diseases.

Intercept leads the race with their FXR agonist, Obeticholic Acid (OCA) a bile acid mimic. Activation of FXR, a nuclear hormone receptor, leads to decreased expression of lipogenic enzymes, decreased inflammation and fibrosis, improvement in insulin sensitivity and therefore is expected to have a positive impact in stopping the progression of NASH. That was indeed observed in the FLINT Ph. 2 trial (here) where they saw statistically significant decreases in liver steatosis, inflammation and fibrosis. However, what is also expected from this mechanism is an increase in LDL cholesterol, which was also observed in this trial. In the recent EASL meeting, a post-hoc analysis of the FLINT data was presented showing that cholesterol increases can be partially controlled with statins (here). The other most common adverse event was pruritus due to the accumulation of OCA in the skin. As mentioned above Intercept just announced its Ph. 3 design and is expected to start the trial in the next few months and file for approval in 2019. I have summarized the key feature of the REGENERATE trial in the table below.

Genfit, is closely behind Intercept with GFT505, a dual PPAR ?/? agonist, however it’s Ph. 2b trial failed to show statistically significant improvement in NASH histological endpoints (hepatic steatosis and fibrosis) as compared to placebo (here). Genfit claims that if they analyze the results without patients with early disease (stage 1) then their trial was actually a success and still plans to start a late-stage program as soon as possible- it will be interesting to see how that will play out with the regulatory agencies. Gilead is investing big in NASH and has two programs in development: data on their the anti-fibrotic Simtuzumab (anti-LOX2 antibody) Ph. 2 NASH trial is expected by the end of 2016 and Gilead is also initiating a Ph. 2 trial for their FXR agonist acquired from Phenex (more details on this deal will be provided further down). If both work we can expect a combo therapy down the line with their proprietary drugs. In addition to these three major players there are several companies throwing their hat on the race. Some of them are depicted in this table but for a quick summary of who is who in NASH, Luke Timmerman’s blog NASH is the Next Monster Pharmaceutical Market. Here Are The Players (here) is a must read.

Coming attractions

In addition to the 34 programs in clinical development there are several more nearing IND filing. Of notice:

- NGM Biopharmaceuticals, now in partnership with Merck (see below), is planning to test NGM282, an optimized version of Fibroblast Growth Factor 19 (FGF19) in NASH. NGM282, which has the potential to mimic the benefits of gastric bypass surgery and positively impact the metabolic distress that leads to obesity, diabetes and NASH, is currently in development for primary biliary cirrhosis.

- Zafgen is planning to file an IND for ZGN-839, a novel chemical class methionine aminopeptidase 2 (MetAP2) inhibitor, in NASH. Zafgen’s Beloranib, a fumagillin-class MetAp2i, is in Ph. 3 in obese subjects with Prader-Willi syndrome.

- Enanta Pharmaceuticals, plans to select a drug candidate for its FXR agonist program this year. Enanta is well known for its hepatitis C drug which is now partnered with Abbvie.

2015 NASH monster deals

This year alone, and we are only in May, we have seen three major deals in NASH:

- In January Gilead acquired the FXR agonist program from Phenex for a total deal value of $470 million (here). PX104 is in Ph. 2 for NAFLD and unlike OCA, it is a fully synthetic FXR agonist. Ph. 2 trials in NASH are expected to start later this year.

- Merck is betting on NGM’s NGM282, an improved FGF19 that has the potential to mimic the benefits of gastric bypass surgery. NGM282 is currently on Ph. 2 trials for PBC and has received Orphan Drug Status and Fast Track Designation from the FDA. This is a very important deal for NGM which, in addition to the upfront cash ($94 million) and equity investment ($106 million for 15% equity stake), will also receive $50 million a year for the next five years in R&D support (here) bringing the grand total to $450 million.

- Boehringer Ingelheim has just exercised its option to acquire global ownerhip of Pharmaxis’ anti-inflammatory drug candidate PXS4728A (a VAP-1 inhibitor), including all intellectual property associated with the program, for $31 million upfront, and additional development, regulatory milestones and earn-out payments with a potential value that could exceed a total of $600 million (here).

The big questions

Although we are now all convinced of the need to create drugs for the treatment of NASH, and many companies are racing to be the first to get there but, there are some big questions that need to be addressed by the research community at large to ensure that we are successful on our quest. The questions below are ‘borrowed’ from the excellent Define Health Insight series webinar: The Dash to Treat NASH: The Next Big Global Epidemic by David Lomb and Brent Tetri (here). Let’s examine these questions and possible solutions.

1. “Which primary endpoint(s) is the FDA most likely to accept for regulatory approval of new treatments for NASH?”

This is the multiple billion dollar question. Without official FDA guidance, trail blazer companies like Intercept, Gilead and Genfit are paving the way. Based on Intercept’s Ph. 3 clinical trial design, which was planned in close consultation with the regulatory agencies, showing histological reversal of NASH and improvement of fibrosis, albeit not necessarily in the same patient, may be required for initial approval. Working closely with the FDA and EMA is a must for all companies seeking approval for NASH and the same group that played a key role in advancing drugs for the treatment of HIV and HCV, the Forum for Collaborative HIV Research has now started a Liver Forum with the goal of working with the academic and patient communities, the regulatory agencies and industry to develop the best regulatory path for approval of drugs to treat NASH (here). An official FDA guidance is expected sometime this year.

- “When will non-invasive tools for diagnosing NASH and monitoring response to treatment become more widely used in the clinic?”

One of the biggest challenges in developing robust surrogate markers for NASH is the lack of detailed longitudinal studies. To date, the gold standard for NASH diagnosis and monitoring is liver biopsy. NASH is confirmed by histological findings of hepatic cell death, inflammation, hepatocyte ballooning and initial fibrosis. Imaging and serum markers abound but without a 1-1 correlation with the histological findings they are not recognized as ‘true’ surrogate endpoints. This is a Catch 22, since serial biopsies would be required to establish this correlation and there is very little change that this type of studies would be allowed by the regulatory agencies. The good news is that with the field becoming so “hot”, and so many ongoing clinical trials, as the data becomes available we will gain a better understanding on the best surrogate endpoints/markers and they will become more widely used by docs to diagnose and monitor NASH in their clinical practices.

- “How will clinicians determine which NASH patients to treat and what criteria will payers use to determine which NASH patients are eligible for treatment?”

About 20% of NASH patients will progress to cirrhosis and it can take 20-30 years from first diagnosis. Therefore we are left with a big dilemma, when drugs become available should we treat the whole population and if not how can we determine which patients are mostly at risk? We can envision that docs will pick patients first based on clinical history, associated co-morbidities such as diabetes and cardiovascular disease and stage of disease. These are the ‘easy’ ones, but if we limit treatment to only these patients, we may leave out many others that could benefit from treatment. However, as the field is progressing rapidly, the optimistic view is that plasma biomarkers and gene signatures such as PNPLA3 mutation, will become available in the near future to help stratify the patient population that will mostly benefit from treatment.

What does the future hold?

The race is on, and it is only a question of time until an effective treatment for NASH is developed. There is a worldwide need for new therapies to treat this global epidemic and the cost to society will be enormous if that is not achieved in the next few years. The potential market is gigantic with analysts predicting north of $35 billion by 2030. With such a large unmet need, market potential and disease heterogeneity we expect many players to join this race and hopefully cross the finish line. A few things to keep in mind, patients may need to be treated for a long time, 20-30 years; therefore the drug(s) need to show pristine safety, be easy to use, inexpensive and easily accessible. So, dear colleagues, let’s get back to work – we have a lot to do to get there, and fast, as NASH is expected to become the leading cause for liver transplant by 2020.