A new FDA approval marks a major milestone in the biopharmaceutical business; relatively few biopharma companies are ever able to lay claim to having discovered, developed, or marketed a recently approved medicine.

As of mid-October, the FDA has approved 17 new medical entities in 2016. Earlier this year, John Carroll at Endpoints had a good summary of where things were through July (here). While only 17 approved new medicines significantly lags the tally of the past two years, it’s worth noting 2014 and 2015 were the highest in nearly two decades. Further, in the mix this year is a solid list of impressive medicines: Tecentriq from Roche and Venclexta from AbbVie, to name just two. Based on historic trends in 4Q approvals (almost always a burst in the last few months of the year), we could see mid/high 20s this year.

Importantly, the FDA has been aggressively taking steps to improve the path to approval for innovative new medicines. In the past 12 months, 42 drugs have received the FDA’s Breakthrough Therapy Designation, designed to expedite the development and review of high impact medicines. Just over 30 drugs received BTD status in each of 2013, 2014, and 2015. At least five of this year’s approvals were previously granted BTD status. These numbers bode well.

Since 2011, the FDA has approved 170 new molecular entities, or NMEs (excluding imaging agents, fixed dose combinations, and biosimilars).

Given the size of this cohort of approvals, it provides a robust data set to explore the nature of the companies involved in these new medicines. Specifically, we’ve done two simple analyses by mapping these approvals onto the Thomson Cortellis pipeline information (which lets us examine the originators of the drugs): first, looked at the approvals of drugs through the lens of the Top 25 largest companies versus all the small and mid-cap players; and second, by examining the venture capital roots (or not) of the companies that originated these medicines.

Before sharing the findings, it’s worth noting that FDA approvals reflect years of work, and in some cases decades. Back in 2011, a timeline of the first publication dates of a recent crop of NDAs showed that most were likely discovered in the 1990s, a dozen years earlier (here); thus, many of those drugs were “born” before all the mega-mergers in the early 2000s brought massive bureaucracy into large pharma R&D organizations. So any discussion of “responsibility” for the recent five-year vintage drug approvals needs to be done with that historical context and caveat in mind. In short, today’s approvals often reflect drug discovery archeology.

Big versus Small Companies

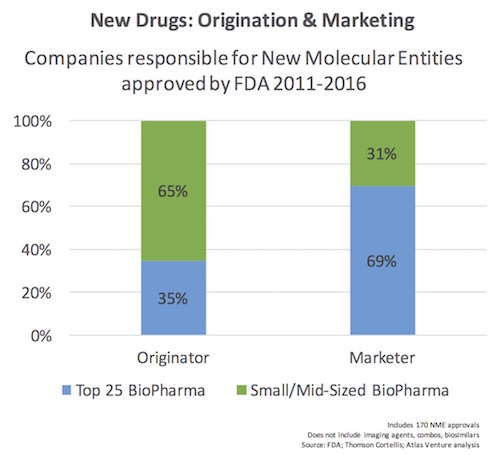

We examined the 170 NMEs and categorized whether or not they originated from one of the Top 25 BioPharma companies in the world (by revenue, which means >$5B in annual sales). We also categorized the marketer of the drug as well. Below is the simple chart capturing the results.

As is clearly evident from the chart, the majority of new drug approvals were discovered outside of the Top 25 largest players, with almost a perfect inversion when it comes to who is responsible for marketing those drugs.

This reflects the increasing collaboration and convergence in the biopharma ecosystem, and affirms the trend over the past decade where larger companies are increasingly sourcing innovation externally. As was discussed on this blog previously, 75% of the most “transformational” pipeline drugs in big pharma 2014 were externally sourced via business development (mergers with other larger players, acquisitions of small companies, or licensing deals). Successful R&D becomes as much about good science as it is about good business development.

In light of the bias in NME origination towards smaller companies, it’s interesting to speculate on the relative R&D spending supporting these discoveries. Unfortunately, this isn’t a straightforward comparative analysis: although I’d estimate that the Top 25 bopharma companies make 80-90% of the industry’s overall R&D investments, much of this budget goes to late stage development and post-approval clinical work, including new indications and label expansion studies, rather than the discovery of new medicines. That said, I think it’s highly likely that the smaller companies responsible for originating these NMEs spent far less in research than the Top 25 players.

Lastly, a portion of these approvals (125) have consensus sales forecasts for 2021 in the Thomson Cortellis dataset. The drugs marketed by the Top 25 largest companies have 2x higher sales forecasts than those that are marketed by smaller players ($1.5B vs $0.7B, respectively); while intuitive on some level, it also affirms that the biggest companies are exceptionally good at powering up the sales of blockbuster drugs. Interestingly, the drugs that originated with smaller players have essentially the same sales forecast as the drugs which originated in the Top 25 ($1.55B vs $1.45B, respectively). Squaring these two data points, it appears that the biggest pharma companies are quite good at identifying blockbusters and either building them or acquiring them, as well as out-licensing smaller products that they discover to other players. Forecasts for drugs in 2021 are obviously subject to huge caveats (especially since market projections are notoriously off the mark), but interesting data nonetheless.

Role of VC-backed Biotech

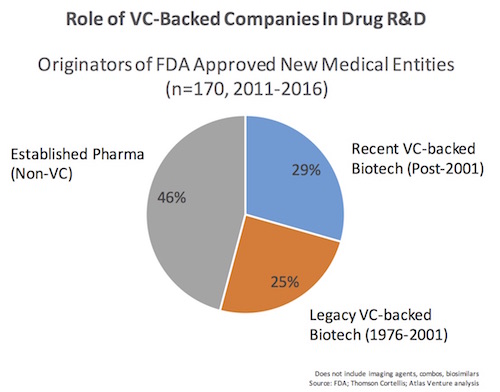

Most new biotech companies created over the past few decades have been launched as private firms with support of institutional investors like venture capitalists. We examined the list of companies that originated these NMEs, and determined whether they had roots as VC-backed startups. We bucketed the group into two: if they were supported by VC-backed private financings after 2002, or were recipients of VC funding in the proceeding 25 years (1976-2001) when Genentech was founded. The former was deemed “recent” and the latter “legacy” in terms of their VC-backing. Here’s a simple chart of the findings:

In summary, biopharma companies that were previously backed with venture capital were involved with the origination of 54% of the NMEs approved in the past five years. Further, 29% of these approvals involved firms that were recently venture-backed in the past 15 years. Given the long time frame it takes to move a new drug candidate through discovery and development, it’s likely that many of the latter companies were VC-backed emerging biotechs when they discovered the NME.

Biotech firms with public offerings in the IPO window of 1991-1994 are prominently represented on the list as originators of a number of new drugs: Alkermes, Human Genome Sciences, Imclone, Ionis/Isis, NPS Pharma, Protein Design Labs, Regeneron, and Vertex, to name a few. These were clearly “legacy VC” biotechs; many of the drugs approved in the portfolios of this cohort of companies actually came during the last five years, highlighting how long it takes from idea/concept to new medicine.

Venture capital only participates actively in formation and initial “building and scaling” phase of most biotechs, spanning from a few years to more than a dozen, after which point the public markets or larger players (via acquisitions/deals) finance the continued development of the medicines discovered years earlier.

The richness of the biopharma ecosystem is evident in these data – meaningful contributions to new medicines from companies of all stripes – small and large, VC-backed and not, old and young. It’s also evident that collaboration and connectivity amongst these diverse players is crucially important as well, and we should all expect to see this increase over time.

Would like to thank my colleague Steve Robinette for his contributions to the data analysis.