Slate’s piece on drug costs has really caused some fun and excitement in the life science community. For those that haven’t followed, Tufts Center for Study of Drug Development published a widely cited number in 2003 of $800M+ to bring a drug to market. Recent estimates are above $1.2B. Slate’s piece refers to a new study, by Donald Light and Rebecca Warburton in the London School of Economics journal Biosocieties, that claims the number should be around $50M. They challenge almost every assumption of the Tuft’s study.

Derek Lowe’s blog has already had some great commentary on it, and I can’t argue with or add much to amplify any of his points. Either the drug industry is actually doing great with R&D productivity and we just didn’t know it, or their assumptions are off. I suspect that latter.

We can all debate what the right statistics are for the R&D costs to support a drug: direct costs per phase, time per phase, failure rates, etc… It all depends on the drug itself, its safety profile, how many fumbles it has in development, what indications (diseases) it goes after, what the organizational overhead costs are, how bureaucratic your processes are, etc… Venture-backed biotechs have a very different cost structure than a Big Pharma. Some firms build Fords and others build Cadillacs. So the median and mean are essentially meaningless; the ranges and distributions are more interesting.

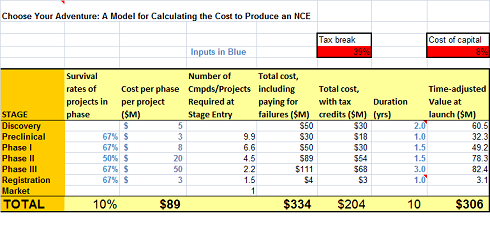

With all the good online discussion, I thought I’d have some fun and throw a model into the mix to see if crowdsourcing can generate a better answer. The link is below the image.

Its like the old “Choose your adventure” books. Put in the numbers you think are right and it will give you your very own value. Feel free to share a post with your total value number.

I’ve got a ‘lean’ $25-30M from discovery to Phase 1b/2a PoC model in there – looks like a total adjusted cost of $300M or so. Still not cheap.

Choose Your Own Drug Cost – Model

Looking forward to hearing from you on the ‘right’ answer from your experience.

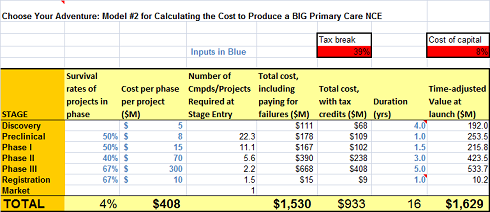

ADDITION of MODEL #2 (added to original post on 3/10/2011)

To respond to some good comments and further stimulate the debate, as well as provide an example of a Big Pharma primary care chronic drug package (with some Big Pharma attrition #’s), I’ve added a more “extensive” development cost and timelines and decreased the success rates. Its now about 1 in 25 from Candidate to Approval, in line with some industry estimates. The model now spits out $1.6B. Amazing what a few changes do. With this Model and the original, we’ve probably got some bookends on reality.