There’s been talk about a “bubble” in venture capital recently. If there is one to debate, its not in the life sciences.

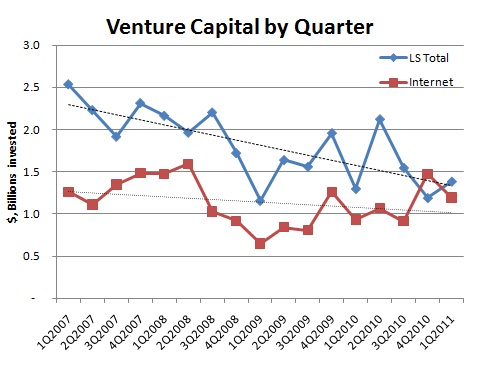

While we’ve been relatively steady on an annualized pace in 2009 and 2010, we are down considerably from the recent highs in 2007 and 2008. See the chart below generated from PWC/NVCA MoneyTree data. LS is both biotech and med tech. The trendline shaves about $1B off the aggregate LS numbers in a few years; sadly, that’s about 100 companies worth of financings.

As you can see above, this compares poorly to the trend in “internet-related” investments, according to the PWC/NVCA MoneyTree data, which have bounced back from 1Q 2009 and are in line with pre-crisis levels.

As you can see above, this compares poorly to the trend in “internet-related” investments, according to the PWC/NVCA MoneyTree data, which have bounced back from 1Q 2009 and are in line with pre-crisis levels.

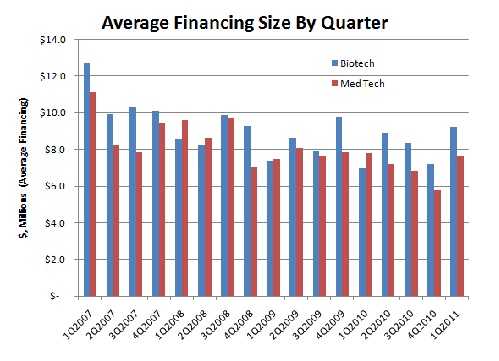

According to the latest press releases, there was also talk about round sizes getting bigger in venture capital, presumably driven by anecdotes of huge raises by the ‘halo’ deals like Groupon, Zynga, Twitter, etc… We’re certainly not seeing that in the Life Sciences. While its true the “average” 1Q 2011 financing was bigger than 1Q 2010 ($9.2M vs $7M in Biotech, respectively), the quarterly variation is too large to draw any real conclusions from it.

Here’s the trend in average financing size per deal. It certainly doesn’t support a trend towards bigger financings, on average (btw, wish I had the data and would plot distributions, medians and more useful metrics than averages).

So, unfortunately the data doesn’t support a frothy market for LS venture financings these days. Too bad, as we could use some frothiness, frankly.