Several recent stories from WSJ and VentureWire have highlighted the challenging performance of the IPO markets for biotech in 2011. It has indeed been tough: more shares offered at lower prices = more painful dilution. From a pricing perspective, the Class of 2010’s thirteen biotech IPOs faced similar challenges.

Surprisingly, however, the markets have been reasonably good to the 2010 class since their IPOs. Here is the price performance relative to their IPO price as of today:

The average and median performance of this “Class” is 18% and 14%, respectively – which is quite abit better than several of the recent prior classes performance. Ventrus, Aegerion, AVEO, Anacor have all appreciated by more than 30% since their IPO.

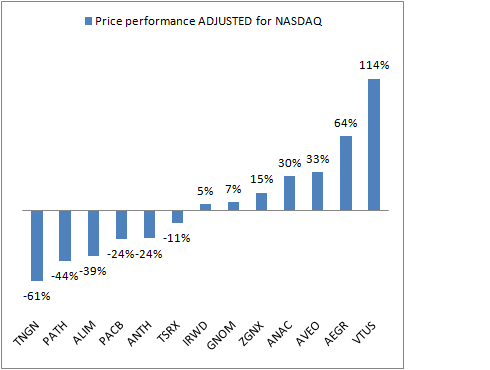

However, the NASDAQ itself has also been on a tear, up above 30% since mid-2010. To get a sense for individual company outperformance vs the market, I’ve adjusted the performance of the Class by the NASDAQ’s performance from the individual IPO dates:

The order shifts as one would expect in a bullish stock market with newer IPOs moving up in the ranking (less adjustment) and older IPOs moving down (more adjustment). Importantly, however, the class average stock performance was still up 5% after adjusting for NASDAQ market performance. That’s respectable.

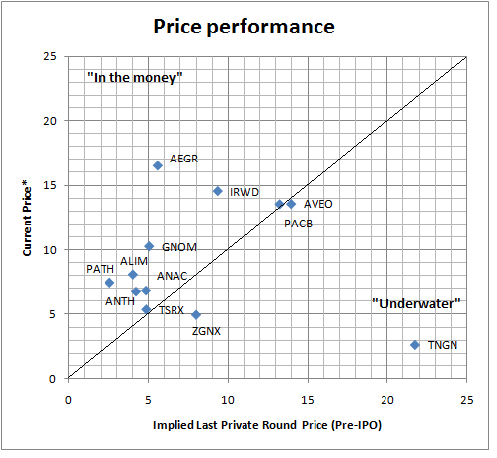

From a venture standpoint, since IPOs are financings not exits, understanding the price performance relative to their last private round is important. From what I can tell, it has actually been pretty strong. Here’s a snapshot of performance of 12 of these 13 where I could get the last private round pricing (courtesy of a friendly biotech investment banker). Unfortunately I don’t have data on Ventrus Biosciences. I’ve plotted the current stock price on the Y-axis and implied “last round” pre-IPO price on the X-axis. Any ticker above the line is at least “in the money” for the last private investor (maybe or maybe not for the early investors depending on the step-ups or cramdowns along the way); below the line are “underwater” positions for that last round. Good news is most are near or above the line – with considerable outperformance for Aegerion (nearly 3x) and Complete Genomics (2x). Tengion is sadly quite an underformer – roughly 10 cents on the dollar.

The takeaway message here is that despite the ‘doom & gloom’ around biotech IPOs, there’s some glimmer of hope in the post-market performance for the “Class of 2010”.

Hopefully the pricing struggles of Class of 2011 will be forgotten with some strong stock performance ahead.