The FDA approved 20 new molecular entity NDAs in the first half of 2011, which is an impressive count. Of the 20, eighteen are new therapeutics (two were diagnostic reagents). This number of approvals is exciting, especially since in 2011 only 21 similar NDAs. This news was celebrated by some in the media as a turnaround for Pharm’a pipelines, and welcomed more skeptically by others.

Undoubtedly, more approvals are a good thing, but its certainly hard to draw any profound positive conclusions about the state of the Pharma R&D pipeline from this dataset. Digging into the specific approvals highlights two observations worth noting.

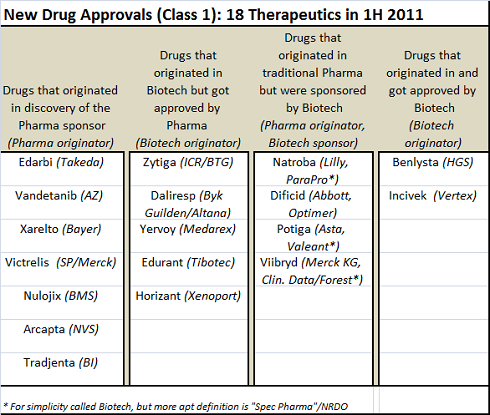

First, this batch of NDAs is as much a triumph of Business Development as it is about R&D. A quick-n-dirty analysis of where these drugs originated and who sponsored their FDA registration (which could be wrong, I admit) showed that a many of these NDAs had at least one if not several key BD transactions in their past that helped bring them to approval

- Of the 18, only seven of them were originated from and sponsored by traditional large Pharma, and these included five incremental innovations: ARBs (Edarbi), multi-targeted kinases (Vandetanib), long acting beta agonist (Arcapta), DPP-IV (Tradjenta), and CTLA4-Ig (Nulojix). Two were truly first-in-class with direct Factor Xa (Xarelto) and HCV protease (Victrelis).

- Five biotech-originated drugs ended up getting sponsored by Big Pharma due to smart deal-making. Zytiga (abiraterone) was discovered at the Insitute of Cancer Research under a BTG-funded program before being licensed by Cougar, which was bought by J&J. Daliresp was discovered at Byk Gulden in Germany, merged into Altana, then licensed by Forest. Edurant was discovered by the virology experts at Tibotec before being acquired by J&J. And Horizant was discovered by Xenoport before being licensed by GSK.

- Spec Pharma companies, driven in large part by sharp BD strategies, were responsible for four approvals: Natroba, Dificid, Potiga, and Viibryd. All of those drugs were discovered within traditional Pharma and licensed/abandoned before the Spec Pharma picked them up. Successful delivery of the No-Research, Development Only model.

- Lastly two of the 18 were discovered and sponsored (or at least co-sponsored in the case of Benlysta) by the original biotech. Vertex’ Incivek is a great example.

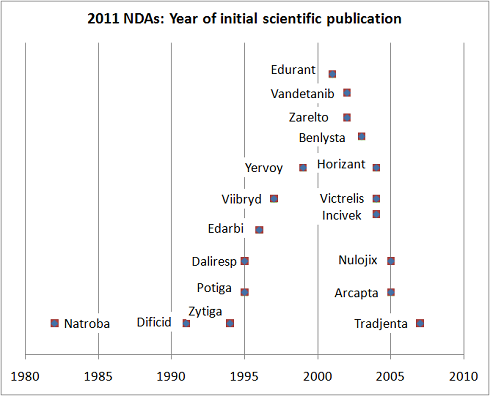

The second key theme that arises from these NDAs is that most of these drugs were discovered many mergers and several restructurings ago, and are essentially the product of legacy discovery organizations. Pfizer’s ex-R&D head John LaMattina pointed out this fact already, but, to add some further data, a quick PubMed search reveals a timeline for this group of drugs. The chart below highlights the date of the first peer-reviewed publication for each drug. Since most Pharma don’t publish until drugs are in the clinic, this suggests that the majority of these drugs were born in the 1990s and certainly prior to the many R&D reshufflings and productivity taskforces of the past decade. The jury is clearly still out on whether those initiatives will ultimately impact the volume of NDAs approved.

So while there’s much to be celebrated with these 18 new drugs, there’s a lot more nuance in the specifics of these NDAs that needs to be considered before drawing any conclusions – other than the obvious two: BD strategies are important in the life of a drug, and R&D timelines are so long as to make R&D strategy changes hard to judge over even a decade.