Most of Big Pharma have been trying to reinvent themselves as nimble Biotechs, at least in the eyes of Wall Street, in order to be perceived as being innovative R&D-driven companies. Despite the restructurings, Big Pharma is struggling with that transition. Since corporate change has to start from the top, a lack of biotech-savvy corporate governance may be at the heart of the issue: the reality is there are few if any biotech voices in Big Pharma boardrooms.

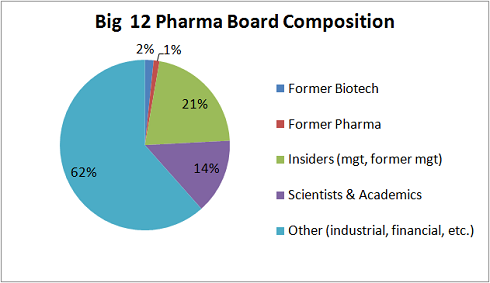

According to data from CapIQ this spring, twelve of the largest Big Pharma companies have a combined 182 Directors. Less than 2% (3) of these are former Biotech senior executives, and two of those (Art Levinson and Dale Edgar) are there from acquisitions of Genentech by Roche, and Hypnion by Lilly. The third is Vicki Sato, who serves on the BMS Board, and was formerly of Vertex and Biogen.

Here’s the pie chart that captures the breakdown:

To have less than 2% of the voices in the board room from biotech while trying to become more biotech-like seems like an absurdity, especially when there are a large number of seasoned (and often retired) executives from biotech available with experiences at Genentech, Gilead, Genetics Institute, Immunex, Centocor, and certainly an even longer list of venture-backed biotechs. Board members with intimate knowledge of ongoing experiments like asset-centric project financing and virtual discovery and development models would bring a new perspective into the strategic dialogue.

To be fair, about half of the Scientists & Academics on their boards have had exposure to biotech as either scientific founders, advisory board members, or as formal board directors. Even being generous, that still means that less than 10% of their Board Directors have any real biotech experience or exposure. Importantly, while these distinguished academics certainly bring great backgrounds, advisory or founding science roles aren’t executive decision-making positions so lack some of the experiential perspective of a Levinson or Sato.

The majority of the Directors in these 12 Big Pharma companies are industry executives from other sectors, like banking, insurance, manufacturing, services, consumer products, and retail. Most if not all of them are accomplished, seasoned leaders in their fields, and presumably know a lot of running businesses. But the drug business is truly a special one. The difference between most sectors and the pharmaceutical industry couldn’t be more profound: major R&D productivity issues exacerbated by incredibly long R&D timelines and extensive upfront investments, significant regulatory risks both in R&D and post-approval, unparalleled scientific and clinical risks, complex healthcare payor, pricing, and reimbursement systems (where the consumer, prescriber/decider, and payor are separated), reliance on the international patent system for protection from competition, etc… This combination is unlike any other sector.

I’m not claiming that current or former biotech executives are experts on all these subjects, but certainly their familiarity with the details and decision-making around the nuance and complexity of these issues would be of great benefit during strategic dialogues in the Pharma board room. And their mere presence on more boards would help subtly shift the culture of the boardroom.

A Board is supposed to provide objective oversight of the business on behalf of the shareholders, and so different perspectives and skills (especially for audit committee work) are important, but the case for a major restructuring of the Pharma Boardroom couldn’t be stronger given these data and the challenges Pharma faces today. Shareholders of these big firms should be demanding it, and activist investors should be pushing for it.

Here’s the snapshot on a company by company basis according to our analysis of biography data from CapIQ:

To give credit where its due, this theme of inadequate corporate governance caused by the skewed composition of Big Pharma Boardrooms has been a common refrain from Stelios Papadopoulos. I heard him mention it several years ago, and then again at the recent Biotechnologia meeting in Greece. I finally got around to looking at the data myself and he couldn’t be more right.

The strategic push to become more biotech-like is an industry-wide phenomenon, and the corporate boards of these companies need to change as they aspire to change their corporate cultures.