Thinking about the performance of recent biotech IPOs reminds me of the Black Knight in Monty Python’s Holy Grail: not dead yet. But even if it’s not dead, its certainly been a very challenging few years for new offerings.

In fairness, there might be a few signs of life: Clovis and NewLink got out in the 4th quarter and several others are rumored to be expecting to get out early in 2012. But as the year ends, I thought revisiting the “IPO class” analysis of 2010 (and now 2011) would be worthwhile. While it doesn’t paint a great overall picture, there are actually some positive stories under the surface.

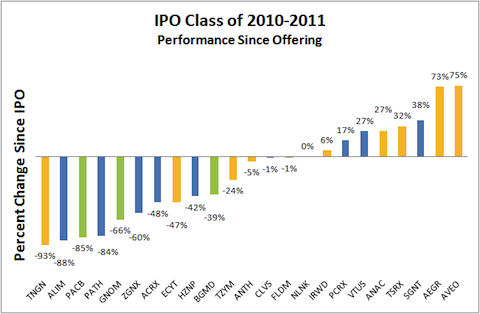

This group of 23 companies (US IPOs only) are down on average 17% since their offerings, with 14 of them (61%) below their IPO price. Interestingly, this is totally in line with IPOs in the hot social media space: according to analysts in the space, 60% of the Internet or social-media companies that completed U.S. IPOs since 2010 are trading below offer price as well. I’d suspect the valuations have been slightly different though.

A few more specific observations on the biotech performance:

1. As one might expect, although the average is negative, we’ve had a wide dispersion of outcomes. An additional sign of life is that we’ve had a few strong performers, like AVEO and Aegerion which remain up about 75% above their offer price. They were two of the three top performers back in April and have held their ground. But sadly we’ve also seen catastrophic performance with Tengion, Alimera, Pacific Biosciences, and NuPathe all off over 80%. Its worth noting that its tough to compare a recent offering like Clovis with only a few weeks of trading vs AVEO with almost two years, but such is the nature of these cohort analyses.

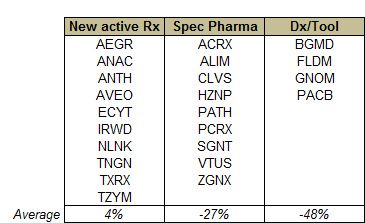

2. Companies working on innovative new molecular entities have in general outperformed those with late stage reformulation/low tech strategies. The colors in the above chart are my attempt at characterizing these companies, largely based on their lead programs: orange means their primary program is a new molecular entity or new active ingredient; blue are Specialty Pharma approaches (reformulations or new uses of known actives or generics); and green are Life Science tools and diagnostics. The table of this is below. While the sample size is clearly too small to draw strong conclusions, in this cohort of 23 IPOs, those companies working on innovative NMEs have gone up on average 4% vs. significant negative average performance of others. I’d like to believe this is because the markets are rewarding innovation, but I suspect the truth has less to do with that and more to do with the regulatory and market challenges of some of the Spec Pharma companies in this cohort (that I’ve discussed elsewhere).

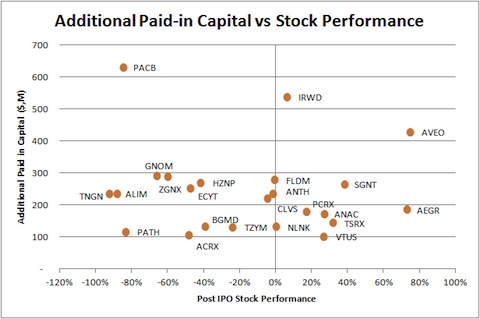

3. Being highly capitalized over time hasn’t correlated with post-IPO performance. Using “Additional Paid-In Capital” (APIC) as a proxy for total invested capital, I’ve plotted the performance relative to APIC. There’s no trend or correlation in this dataset. The three companies that have raised the most span the spectrum: Pacific Biosciences has raised over $600M and has suffered by >80%, Ironwood is near its IPO price after raising >$500M, and AVEO is up 75% on an invested capital base of >$400M.

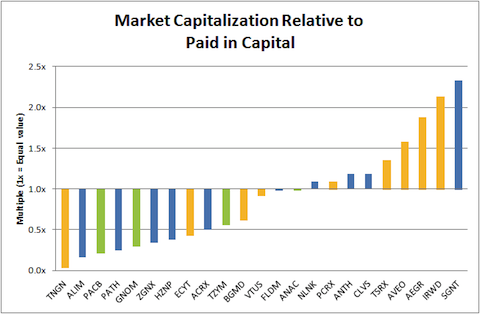

4. Even the top returning companies are barely above 2x on their total invested capital. The aggregate investor returns can be reasonably approximated by taking the APIC proxy for total invested capital and comparing it to the company’s current market capitalization. Just over half of the cohort have valuations below their paid-in capital levels. Adding them all up, this cohort has a combined APIC of $5.56B relative to a combined market cap of $5.2B. That’s an impressive amount of funding and an equally impressive under-performance, frankly. Even AVEO and Aegerion, despite great post-IPO performance, are below 2x in aggregate. The best two companies, Ironwood and Sagent, are just above 2x. Now I’m sure investors at different stages in these companies are sitting at different rates of return, but in aggregate these aren’t very attractive. These are nothing like the 23x ratio of value to APIC for the recent wonderstock Pharmasset (an IPO as recent as 2007, btw), but I guess there’s still plenty of time for that kind of outperformance.

So, in summary, the IPO Classes of 2010-2011 have seen mediocre to poor performance to date, although a couple of outliers have some promise. When compared to the very attractive performance of M&A deals with returns >4x in 2011 (e.g., Amira, Calistoga, BioVex, Plexxikon, Intellikine, etc…) and 2010 (e.g., Marcardia, Respivert, CGI Pharma, Arresto, etc…), its makes one wonder about why these companies go public at all (and why their shareholders support it). If they went public in hopes of being the next Vertex, that’s certainly an admirable goal; but to date, there’s little sign of significant outperformance in this cohort. Was it because they’d tapped the private markets to the limit, and had to move on to new funding sources? Probably. Or perhaps its because none of them could get acquired as private companies? Its worth speculating about whether IPOs today are negatively selected for (i.e., no buyers stepped up) unlike the “winners” that got public in the IPO vintages of the 1990s. I’m sure no generalized descriptor fits, but its an interesting question to ponder as we think about the line-up for IPOs in 2012.

Hopefully next time I update these statistics we’ll be in the midst of the great biotech bull market of 2012 and my optimism will spill over. But in the meantime, we’ll focus on finding attractive exits through tighter links and win-win deals with our Big Pharma/Big Biotech partners.