Time and again, life sciences VC deals have been outscoring their better-capitalized, super-hyped and oft-praised colleagues who do deals in the tech side of the asset class.

– Jonathan Marino in a PE Hub Post titled “Quietly, VCs in Life Sci Made Biggest Hits“

It was nice to see Jonathan calling out some of the big 2011 Life Science exits. We may not have social media Insta-gratification deals like our Tech brethren, but 2011 was a solid year for Life Science M&A, as described in this Wilmer report and my January post on the subject.

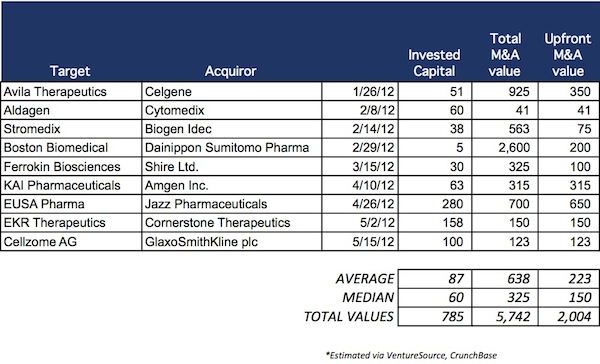

This prompted me to look at how we’re doing in 2012. By my count, there have been at least nine venture-backed therapeutic biotech M&A exits this year, and I’ve assembled them in a table below. If I’ve missed any, let me know.

With $2B in upfronts alone for the first five months of 2012, we’re on pace for a year like 2010 ($4-4.5B in upfront payments from M&A). Unfortunately this is lower than the very strong pace of 2011, but its still real points on the board. And this $2B number is probably higher than the amount invested into new venture rounds in biotech for the first half of 2012 – getting paid more than you are dispersing is clearly a good thing (as discussed here).

A few other observations:

- The median upfront deal size of $150M is right in line with the 10-year dataset in CapIQ of ~500 or so life science exits (see also Lalande’s analysis with a trimmed mean of $156M); a few of the bigger earnouts being met would obviously change this analysis favorably.

- Although a big distribution, theses exits have taken about $60M of equity capital to get to the goal-line (median). This is in line with the 10-year dataset described above (~$56M). Depending on your vantage point, that’s either a lot or a little. As an early stage investor, I tend to think the former, but its all a matter of perspective. History suggests that it’s hard to deliver healthy returns above this amount of capital. Boston Biomedical’s limited equity infusion and use of partner capital to fund its efforts certainly paid off handsomely in their returns.

- Seven of the nine deals were founded around early stage biotech research with a diverse mix of models (in line with lots of biotech worldviews working). Ferrokin and Stromedix were virtual asset-centric plays, with a half-a-dozen FTEs and a network of external CRO and consultant partners. Avila, Cellzome, Boston Biomed, Kai, and Aldagen were drug discovery platforms of various sorts (small molecules for first three, peptides for Kai, and cell therapies for Aldagen). The last two, EUSA and EKR, were spec pharma asset development and commercialization plays.

Who knows what the rest of the year will bring. With the U.S. elections, European dysfunction, and global economic concerns, sentiment may be biased towards taking risk off the table which could make buyers more cautious. But my guess is we’ll continue to see a steady pace of M&A even with those macro headwinds – and beating the 2010 M&A numbers is not an unlikely outcome. And lets hope for more than that.

Its worth noting that we’re very pleased to have been a part of three of these 2012 deals – Avila, Stromedix, and Cellzome were all Atlas deals. Both Avila and Stromedix were solid returns, and will be great deals should (when!) even a few of the earnouts be delivered. And while Cellzome wasn’t a great return, we’re very appreciative of the team there as they worked very hard to return capital: it was a genomics-bubble 2000-vintage biotech that managed to raise no additional equity since 2004 while building a solid epigenetics platform. A long road, but this successful exit certainly beats many less desirable outcomes.