Just in time for the annual ASCO cancer circus, PhRMA released a new report listing the nearly 1000 projects in the industry’s pipeline for oncology – it’s an impressively long list against a whole range of cancers. And this should be celebrated: we’re working on big problems and throwing lots of drug candidates, time, and money after solving them.

But the lemming behavior revealed by this list is frightening: a significant percentage of these programs are chasing the same targets.

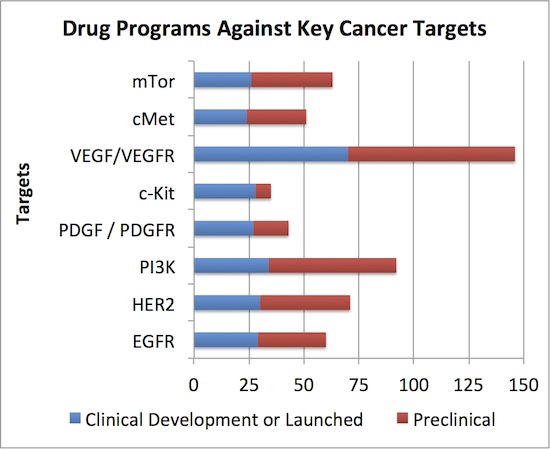

We used a different database than the PhRMA report (Thomson Pipeline vs ADIS Insights) but count roughly the same number of active programs in oncology (990 vs ~981)*. Of those, the concentration of clinical development effort around a handful of targets is staggering: 8 targets are addressed by >20% of the projects, each of which has more than 24 projects in clinical development. Clinical projects that target VEGF lead the charge at an amazing 70 – and this only includes the one’s addressing oncology. Here’s the stack below:

Does the industry really need 25+ clinical or commercial stage programs against each of these targets to exploit the full anti-cancer potential of those mechanisms? Even more puzzling than the clinical development congestion on these targets, what about the huge numbers of preclinical projects addressing these targets (in red above)? Some may be unique angles (e.g., receptor mutant-selective inhibitors that spare wildtype), but most are probably not.

A quick back of the envelope suggest there’s a ton of wasted industry resource across these programs. Assume every clinical program has cumulatively spent $20M, and the preclinical ones at $5M (both conservative estimates), this implies well north of $5B+ in R&D dollars has been tossed at this set of programs over the past few years.

How many winners are likely to emerge from this? Maybe a small handful per target, at most. That implies lots of zombie programs being funded by budgets and investors that will never be of value. This is of course always the case in R&D: programs more often than not fail. But the concentration of industry activity on these privileged targets feels way outside the norm, and in aggregate represents a lot of wasted energy. Beyond money and time, it also is a waste for patients. Clinical trial recruitment is hard enough for exciting programs, but doing work on all these unlikely-to-matter programs on crowded targets seems borderline unethical frankly.

All that said, there is some merit to the principle that we should aggressively attack mechanisms that work in order to fully exploit them. The arguments for this type of pipeline/program concentration are that: (a) smarter follow-on molecules may dial out some of the liabilities of the pioneer molecules through better selectivity, pharmacokinetics, etc… that make for better patient outcomes (after all, Lipitor was 5th to market after all, Humira was 3rd, etc…) – and this may be particularly relevant in unique “mixed” or dirty cancer agents; (b) different chemotypes could be terminated for tox liabilities so its good to have multiple shots on goal for high value targets; (c) different chemotypes will lead to differential responses by different patients for genetic/epigenetic reasons – and so personalized medicine requires a bigger arsenal of programs. And much of the above logic is probably true to an extent. But do they warrant, for instance, having 29 clinical and 31 preclinical programs against EGFR, many years after Tarceva and Erbitux were approved?

The real reason for this concentration isn’t about the arguments above – it’s fundamentally a reflection of our industry’s collective risk avoidance, as well as a misperception of aggregate risk.

Portfolio decision-making in large and small companies leads to an overwhelming bias towards precedented mechanisms as a means to reduce biologic risk. No head of discovery ever got fired for producing too many Development Candidates, and the lowest risk way of doing that is through “fast follower” (and even slow “fast follower”) incremental improvements. In the shot on goal mentality of R&D, more of these shots are better. Most R&D portfolio prioritizations punish novel target programs as low “confidence in mechanism”, and therefore riskier than precedented targets. The math from these models is hard to challenge, having made some of those models in a prior life.

Sadly, the same biology risk avoidance holds for many venture capital investment decisions (“this is a risky target if no one else is working on it”… “we don’t do drug discovery unless its close to IND”). There’s a reason only a few VC firms do early stage innovation and venture creation like we do – many investors myopically focus on biology risk when other risk drivers are equally if not more important (which I’ve written on here).

In the end, all this leads to an industry pipeline – big and small companies alike – full of groupthink programs that follow the “hot” target trends like lemmings.

Beyond just the biology, I’d bet the industry pipeline’s chemistry concentration on these privileged targets is also high. With compound structures from the patent literature, simple analoguing strategies and scaffold hopping approaches can provide for a patentable chemistry around even widely-mined chemotypes. There’s a reason most kinase inhibitors are derivatives of only a handful of scaffolds. These chemistries are also perceived to be lower risk (“this series has been in the clinic” etc…), and maybe they are. But they don’t provide a lot of room for novel discoveries.

But while biologic and chemical risk is often lower for projects in these crowded classes, the differentiation risks skyrocket – including the downstream Phase 3 development risk (e.g., active comparator in your drug class; refractory patients), regulatory risks (e.g., higher bar for approval with other approved agents ahead), reimbursement risks (e.g., why should payors pay for your drug), and marketing risks (e.g., how do you get share of voice). How does one differentiate the 10th PI3K inhibitor to enter its Phase 2a program? Very challenging. Furthermore, if small biotechs are hoping to be acquired by Big Pharma, being in the first wave of innovative projects against a novel target is important – or certainly facilitates earlier interest. If a biotech has to do a Phase 3 program to show differentiation before it gets acquired, hope they have deep pockets. I can think of a few small cap examples of this today. And, lastly, the returns from spending all this may not be there in oncology especially: at what point does society stop paying $50-100K for a “doubling of survival” that adds only 3 more months of life? For all these reasons, the next decade will not be kind to incremental innovations against well-known, well-drugged targets, and the companies that have them.

Importantly, I’m not advocating for big programs against totally unvalidated targets that pop out of the Human Genome (the “Fruits of Genomics” described over a decade ago). That would be a huge waste of time and money. But the risks can be mitigated around novel first-in-class targets through many “confidence” building approaches and the tight titration of capital into them over time: (a) early validation of an intervention’s effectiveness in the best available animal models of disease (not predictive, but better than nothing); (b) identify the possible linkages to human genetic variation and if nature has validated the target already; (c) understand if pharmacology can phenocopy the transgenic knock-out or knock-down models; (d) show that multiple chemical series achieve the same outcome in preclinical models; (e) create translational strategies with appropriate PD markers of target engagement to bridge from animals to the clinic; and many, many other strategies. None of these are a panacea for risk – but they do help strengthen the spine for making a commitment against novel biology to move forward. Careful deployment of resources, and the weeding out of false positives with a fast-to-fail mentality, can help manage risk in these novel approaches (btw, its hard to fast-fail a precedented program because differentiation is largely untestable for oncology in preclinical models). And while the biology risk may remain higher than for more established targets, the downstream risks around differentiation are clearly reduced. I suspect the aggregate “net present risk profile” of a preclinically-validated but not yet to human Proof-of-Concept program is probably far less than a similar stage inhibitor of a well known target like EGFR, PI3K, or VEGF today.

I’m also all for advancements in oncology. Many cancers still have huge unmet medical needs that we should be aspiring to tackle. But in the mid-1990s, oncology was a far smaller percentage than the ~40% or so of the pipeline it occupies today. Is this the right allocation of resources? What about all those other fields (like the contrarian ones I highlighted last week)? It’s worth questioning at R&D strategy meetings around the industry.

When we see this kind of cancer pipeline concentration, its certainly hard to argue that we as a sector don’t need to make smarter bets about what diseases, what targets, and what approaches we put our scarce industry R&D capital into – both in Big Pharma/Big Biotech (90% of the spending) and in smaller biotech (90% of the companies).

We need to stop being target lemmings, or our group-think and risk avoidance will run our industry off a cliff.

* Analysis thanks to Michael Gladstone at Atlas Venture