Three late stage oncology deals have made it through the IPO gauntlet in the past six months: Clovis Oncology in November 2011, Merrimack in March 2012, and just yesterday Tesaro. Almost all came out of their offerings unscathed, unlike most biotech IPOs of late, having raised a significant amount of capital at fairly robust valuations. This is great news for them and good news for all of us in biotech venture.

The similarities of these three, and in particular between Tesaro and Clovis, are obvious: great and experienced management teams, Phase 3 oncology programs, well capitalized balance sheets, etc… The one major difference is that Merrimack is a full-fledged R&D shop, whereas the other two are primarily “search & development” organizations today. One could fill up a blog post discussing the nature of their late stage programs (i.e., none are first-in-class agents against novel targets, but all have potential in varying degrees to be beneficial additions to the armamentarium in cancer), but I’ll leave commentary on that to others.

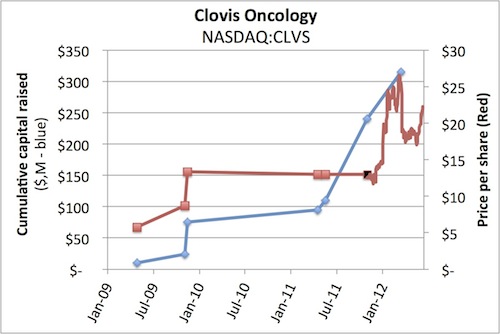

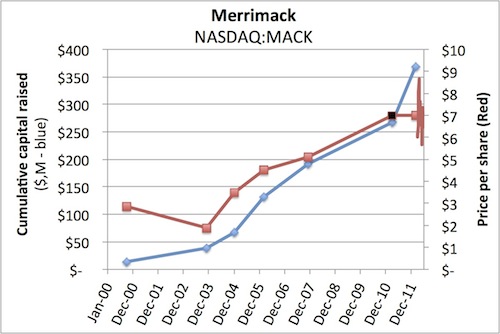

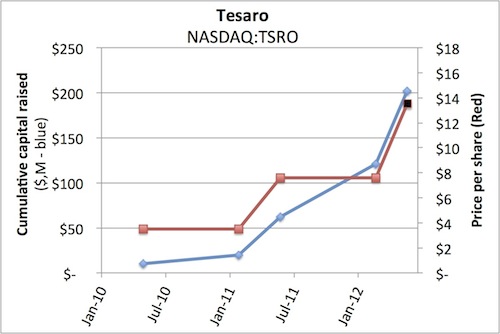

As an investor, I’m particularly intrigued at understanding the capitalization history, valuations, and returns from these deals. Attached below are the graphs of their cumulative capital raised (left axis, blue lines) and price per share (right axis, red lines). Caveat emptor: all these numbers are derived by me from their S1s, so while directionally correct may suffer poor calculus on my part.

Here are a few observations:

- All raised a significant amount of capital from the private markets: $110M for Clovis, $120M for Tesaro, and $268M for Merrmack. Including their public offerings, they’ve raised nearly $900M between the three of them: $316M, $202M, and $368M respectively. This late stage oncology game is only for those very deep pockets.

- As private companies, all achieved some sort of step-up in value from their earliest rounds into their late stage rounds. Series A to IPO multiples of 2.2-3.9x across the group. But unfortunately for returns, most of the capital came in the later rounds so the participating insider shareholders’ dollar cost average per share went up considerably over time.

- Their valuations today (and at their IPOs) are considerable – collectively worth $1.6B: Clovis is valued at $550M, Tesaro at $360M, and Merrimack at $650M. These are three of the largest post-IPO biotechs of the past five years.

- At current prices, the returns for the average private investor in all three are in the modest 1.4-1.8x range. Clovis’ investors had a weighted average private price per share near $12 and is now $20, Tesaro was near $8 and IPO’d at $13.50, and Merrimack was near $5 and is now $7 (if my calculations from the SEC filings are right). These current return multiples are remarkably comparable, although the IRR on the two new companies, Tesaro and Clovis, is obviously much more attractive than 12-year old Merrimack.

What’s interesting and sobering to note is that we’ve got three very successful, public late stage oncology companies with aggregate valuations of $1.6B that have raised $900M – this is less than a 1.8x multiple on invested capital in aggregate, despite the lofty valuation number. That’s a snapshot of how suboptimal the markets are today: Phase 3 programs led by great teams should be able to generate better returns at their IPOs than modest 1.4-.1.8x-ish metrics.

Its fair to say that all of these oncology plays are clearly longer term growth stories attempting to break out over the next 3-5 years, and its doubtful any of their investors have sold any shares to date. Their IPOs were geared to access larger pools of capital to build bigger businesses. Many of their private investors were and are probably buyers in current and future offerings– betting these management teams can create magic like they have in the past.

But what will it take for these stories to become high-returning deals? Over the past few decades, a 3x venture return is typically a top quartile deal, so lets assume that’s the threshold. In light of their valuations today and the amount they’ve raised, hitting a 3x will require them all to break out to much higher values. Assuming they don’t raise any more equity money (which is purely theoretical given their burn rates), here’s what it would take in terms of market capitalization: Clovis at $950M, Tesaro at $600M, and Merrimack at $1.4B. Hitting these heights would require around 100% appreciations in those stocks. All three would need to rank amongst the handful of post-IPO performers of the past decade for this to happen. While this is quite possible with these management teams, its certainly not easy. And statistically its unlikely to happen to all three.

Looking forward to watching them over the next few years.