While all eyes have been on the raging IPO market in biotech over the past year, the private biotech M&A market has continued its fourth straight year of impressive results.

Yesterday, HBM Partners released their always-excellent annual report (here) on biotech M&A, and I’ve pulled out a few salient venture-related highlights:

- The number of VC-backed exits with values >$100M, with 14 in 2013, is the highest number in a decade

- The average VC-backed deal exit in 2013 was $372M, also the highest in a decade, though the average upfront alone value of $176M was beaten by a single year, 2011 ($192M)

- With average VC investments of ~$55M, these deals offer very interesting return multiples. For the first time ever in the HBM analysis (2005-2013), both median and average value-to-invested-capital ratios on the upfront payment alone were estimated above 3x (3.1 and 3.2x respectively), with upwards of 7-8x inclusive of milestones.

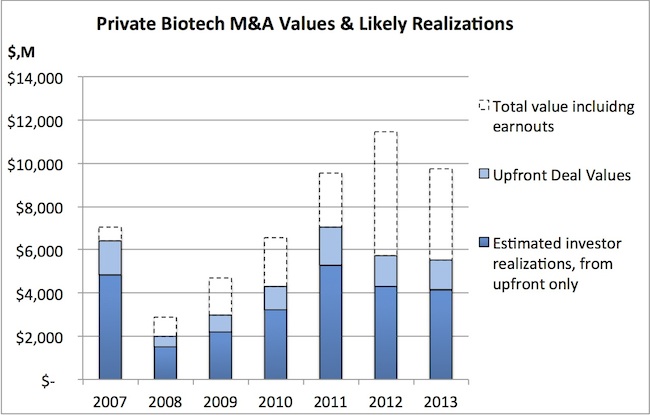

I’ve also taken the opportunity to revisit a blog post from January 2012 (here) that looked at the estimated distributions from 2011 M&A relative to other fund flows – and it’s a continuation of the theme that private biotech returns – estimated realized distributions – are considerable.

In that post, I called 2011 “a banner year for private company M&A”. It certainly was. But 2012 and 2013 were also quite stellar. If you include the upfront and earnout payments, both 2012 and 2013 were bigger than 2011 (dotted lines below); on upfronts alone, 2011 stands out as a distinctive year.

For the specifics in 2013, based on BioCentury data on private biotech M&A, here are some datapoints:

- 49 private company acquisitions, representing $18B in proceeds (including upfronts and earnouts). This includes deals like Aragon, Pearl, Amplimmune, Okairos, Ceptaris, EOS, and Incline, among others.

- Valeant acquired Bausch & Lomb for $8.7B, which was clearly not a typical venture deal; taking that out leaves $9.7B in total.

- Many of the 39 deals that have disclosed financials included big contingent earnout payments; just looking at the upfronts alone represents $5.5B in deals ($4.2B in earnouts).

- If we use the assumption that investors owned, on average, 75% of these exits, then an estimated $4.1B was realized last year on the upfront payouts alone, and up to $7.3B could be realized if the milestones pay out.

- By comparison, in 2013, the 46 biotech firms that got public (according to Burrill & Co) raised a whopping $3.55B – which is only ~60% of the amount paid out in M&A upfronts alone. Helps to put the scale of the fund flows in perspective.

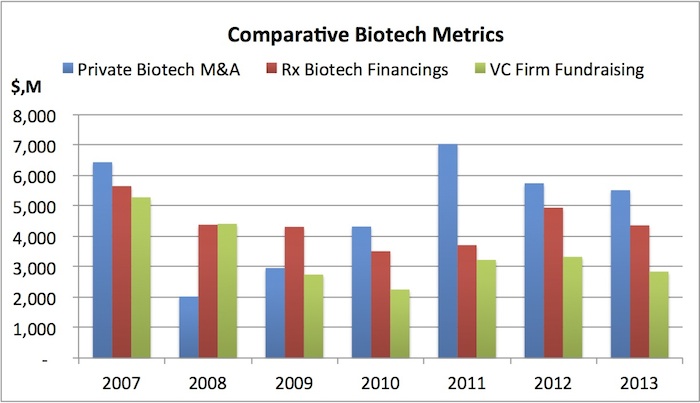

Comparing the private M&A activity to other key financial metrics also affirms the significance of their scale. As depicted in the chart below, private biotech M&A has outpaced new biotech therapeutics financings (BioCentury data) as well as estimated venture firm fundraising likely to be allocated to biotech (17% historically) for the past few years.

As I noted back in 2012, the fact that M&A values alone are generating realizations that significantly outstrip fundraising is very good thing for the sector. Further, when the distributed realizations start to come in from the ongoing biotech IPO boom, the aggregate returns in biotech venture should significantly uptick over the coming quarters – combining solid M&A performance with attractive public capital market stock appreciation.

Improving returns should ensure that adequate fund flows are being directed into new innovative therapies – great news for the sector and even greater news for patients.

Special thanks to our friends at BioCentury (Walter Yang in particular!) for the data supporting this analysis