Every week it feels like there’s yet another big event happening in the engineered T-cell therapy space. Recently it’s been biotech-pharma partnering (link). Before that it was the biggest biotech IPO of the year (link). And before that, it was a parade of positive clinical data at ASH (link). It’s as relentless as the blizzards pummeling Boston this winter. As CEO of Unum Therapeutics, a next-generation T-cell therapy company, I find myself sitting in the middle of the action and so I thought that it might be a good topic to talk about for my first “From the trenches” contribution.

First, let me tell you how I got to be here. A little over a year ago, I was leading the partnering group at Novartis, responsible for deals impacting discovery up through clinical proof-of-concept. In my six previous years at Novartis we had put in place many exciting partnerships covering everything from small molecule discovery technology to gene therapy products, working with a mix of academics, biotechs, and other large Pharma. But without question, the most exciting opportunity I worked on during that time was the collaboration with Dr. Carl June’s CAR-T group at the University of Pennsylvania. In my entire career, I had never seen such dramatic success in end stage cancer patients as June’s initial published data in three patients with B-cell leukemias.

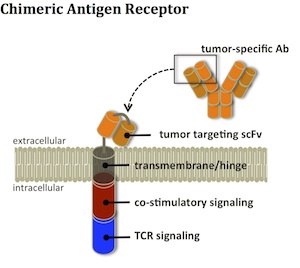

If you’ve already seen this work (which seems to have gotten equal coverage from Science Translational Medicine (link) and the New York Times (link)), feel free to skip to the next paragraph. If you haven’t, it is truly groundbreaking and worth the read. In brief, the UPenn investigators genetically modify a patient’s own T cells to endow those cells with the ability to recognize CD19, a marker on the patient’s cancer cells, using what’s known as a Chimeric Antigen Receptor (a ‘CAR’). The modified T cells are then re-administered to the patient. In an initial group of three patients treated at UPenn, the engineered T cells rapidly expanded and killed huge quantities of the patients’ leukemia cells, mediating impressive and durable clinical responses in patients with very advanced cancers.

That was 2011. In 2012, my team at Novartis executed the deal with Penn both to develop the CD19 CAR and to create a pipeline of additional CARs. The Penn group’s results and the ensuing deal with Novartis were game changing in two different ways. The patient data validated the approach and said that CAR-T could be a viable cancer therapy with curative potential. The Novartis deal signaled to the world that Pharma saw real value in cell therapies for cancer.

Researchers at a number of different institutions have also been working hard for nearly 25 years, and several CARs had been tested in the clinic over that time. In the three years following the publication of the Penn results, several other academic groups have reported similar clinical successes – all also targeting CD19. In parallel, several groups have developed affinity-enhanced T-cell receptors. Like CARs, these receptors can be inserted into a patient’s T-cells and be used to direct cell killing through recognition of cancer-specific peptides displayed by immune receptors on tumor cells.

From each of these academic efforts, new biotech companies and industry-partnered programs have spawned. Kite Pharma (partnered with Amgen), Juno Therapeutics, bluebird bio (partnered with Celgene), Cellectis (partnered with Pfizer and Servier), Bellicum, and Adaptimmune (partnered with GSK) are among the companies with engineered T cell therapy programs in development. Good news continues to stream from the clinic, as several programs have advanced into larger trials across a range of indications. These results are largely confirmative of the original Penn results – high to very high response rates and some long durable responses.

This field has been a bonanza for investors who have done well through the mezzanine financings, IPOs, and follow-ons that these companies have executed, especially in the last 12 months. While the current generation of engineered T-cell therapies has shown enormous potential, I think there are three ‘unknowns’ that still need to be considered and that each of these companies (as well as my own, Unum Therapeutics) are attempting to tackle. I’ll label them: (1) safety, (2) platform potential, and (3) economics. The rest of this blog will focus on each, describing the challenge and where I think the field will go as programs based on existing technologies develop further and as new technologies are brought to bear.

Safety. CAR and TCR therapies have shown that they are extremely potent therapies that can drive significant patient responses. At the same time, severe adverse effects, including a handful of patient deaths, have been reported. A small number of these reflect unfortunate target choices where the tumor antigen recognized by a therapy was also expressed on essential non-tumor cells. Most of the reported adverse effects, however, relate to a phenomenon known as cytokine release syndrome (CRS), which is a by-product of the powerful immune response triggered by the therapy. Potent cytokines released into the blood after T-cell activation can cause symptoms such as heart dysfunction, respiratory distress, and kidney and liver failure.

Physicians are developing a better sense of which patients are at risk for CRS and also how to manage it if and when it develops. Unless CRS can be engineered out of the therapy or we can continue to find better ways to prevent or mitigate it, it may limit the potential of the approach. Because of this, a number of groups are looking at ways to build safer T-cells.

One approach uses ‘suicide switches’ – additional genes engineered into the T-cells that enable their targeting and depletion in the event of severe toxicity. Bellicum, which uses an orally administered suicide induction approach, has shown that engineered T-cells can be largely cleared from a patient shortly after the suicide switch trigger is delivered. I imagine that this approach will be especially helpful in clinical development since it provides a backstop for new therapies whose safety profile has not yet been fully characterized. A second approach involves ‘combinatorial’ CARs – receptors whose activity requires simultaneous recognition of more than one tumor antigen. While there’s some elegant pre-clinical data showing that this can improve specificity for the tumor over healthy tissues, a lot of work needs to be done to understand how well these might work in the setting of a patient’s disease (where heterogeneity between patients and even between different tumor cells in a single given patient may subvert the approach). Finally, Unum is working on ways to functionally couple T-cells to a co-administered antibody. By adjusting antibody dose, T-cell activity can be turned up or down, hopefully to optimize the therapeutic benefit while minimizing toxicity to the patient.

Platform potential. All of the glowingly positive clinical data with current generation CAR constructs comes from targeting CD19. Similarly, the buzz around high affinity TCRs comes largely from efforts against one target, NY-ESO-1. While CARs and TCRs can theoretically be made to target many other targets, their ability to work across a range of different cancer types still needs to be clinically validated. Limitations to engineered T cell therapy in other settings come in two different forms: (1) T-cells being too potent to go after certain targets because they may cause toxicity, and/or (2) T-cells being not potent enough in certain settings to bring about the type of deep and durable responses we are seeking.

CD19 is a great CAR-T target. It is highly expressed on most B cell leukemias and lymphomas, and even though it is also expressed on normal B cells, patients can live without these B cells. Thus, patients can survive if all CD19 cells in the body are eliminated. Unfortunately, many ‘tumor targets’ aren’t as well behaved – they tend to be expressed at low levels on normal tissues that cannot be safely eliminated. HER2, as an example, is a well-validated breast cancer target, as shown by the success of HER2-directed mAb therapies Herceptin, Perjeta, and Kadcyla. HER2 is also expressed, however, at lower levels in important non-tumor tissues like heart and lung. CAR-T cells are so powerful, it remains to be seen whether it is possible to make a HER2 CAR that can thread the needle of powerfully targeting the tumor but sparing the heart and lung.

A fundamental difference between the monoclonal antibodies mentioned above and the current generation of T-cell therapies is our ability to control dosing. One can generally set the level of antibody activity in the patient by controlling how much and how frequently it’s administered. Current CAR-T and TCR therapies are intrinsically different. Once an armed T-cell engages its target, it’s programmed to proliferate. This means that once the treatment gets going, the amount of engineered T-cells in a patient may increase rapidly and bear very little relationship to how many cells were first administered. As such, it may be much harder to use dosing to identify a therapeutic window for CAR-T and TCR therapies that recognize targets with off-tumor expression.

A second factor that makes CD19 a great target is its location in the body. It’s a blood borne disease and hence easily accessible to the therapy. In contrast, solid tumors are typically poorly perfused (limiting access to drugs). Additionally, many solid tumor cells secrete proteins that suppress immune cell activity. Both factors suggest that the results in hematological cancers may be different from what’s achievable in solid tumors. Having said all this, the emerging data generated by NY-ESO-1 TCRs in sarcoma and melanoma makes it clear that engineered T-cells can be active in some solid tumor settings. Looking to the future, one can conceive of a number of further T-cell modifications (e.g., using some of the new genome-editing technologies) that should allow T-cells to actively home into tumors and overcome the immunosuppressive environment. In the near-term, however, we’ll need to be thoughtful about target/patient selection and combos with other immune-modulating therapies to try to overcome these hurdles.

Economics. In closing, I’d like to briefly touch on manufacturing, pricing, and IP. CAR and TCR programs are advancing nicely in clinical development. However, given their early stage of development, the feasibility of large-scale manufacturing and the cost of goods for providing therapy to large numbers of patients remain unknown. Coming originally from academic settings, the processes for CARs development were not optimized for commercial use and scale. Several groups are actively re-inventing processes to address some of these challenges. A big open question concerns the extent to which T-cell manufacturing can be automated, given its intrinsic complexity.

Following the debacle around Gilead’s pricing of Sovaldi (a small molecule HCV drug), there’s been a lot of discussion about what price payors will bear for a novel therapy, even when it’s highly effective and health economics analysis supports a high price. Like Sovaldi, engineered T-cell therapies may be acute treatments that very effectively ‘cure’ chronic diseases in some patients. Pricing for CAR-T recently hit the news with a suggested cost of therapy ($150K) substantially less than what most analysts had built into their base case models ($300K+) (link). My perspective is that it’s premature to be talking about pricing given unknowns on both the cost and the benefit side, so I won’t speculate. I can say though, with near certainty, that thoughtful pricing/reimbursement strategies will be important for those companies who succeed in getting therapies to market!

A final factor impacting the economics for T-cell therapies relates to IP. Because it took a long time (about 25 years) to optimize the CAR approach, there are very few unexpired patents covering the basic technology. This in part explains why we now see four very similar CD19 CARs moving in parallel through clinical development. In a market with multiple potentially quasi-equivalent options and limited IP protection, one should expect price competition to come into play. How this impacts profitability for the different CD19 CAR developers may ultimately come down to the cost efficiency with which each is able to deliver therapy to patients.

In conclusion… As I look at it, the current generation of engineered T-cell therapies has shown enormous promise, enabling us to think about cancer as a potentially curable disease. The enthusiasm of cancer patients, oncologists, and cell therapy investors is all well placed. At the same time, there remain significant opportunities for advancing the state of the art and moving to even better therapies to address the needs of a wider range of patients. That’s what we’re aiming to do at Unum (link). But I’ll save the details of that story for my next blog…