This blog was written by Chuck Wilson, CEO of Unum Therapeutics, as part of the “From the Trenches” feature of LifeSciVC.

This is an ongoing saga about finding a new home for my company, Unum Therapeutics. Google tells me that there are 14 million web pages containing that over-quoted saying “location, location, location” – presumably everyone understands that location is important when picking real estate. But what is it really worth when you’re trying to get a startup off the ground? And what compromises should one make to get it? These days, I’m leaning more towards “location – shmocation, just get me some lab space!”

For background, things here at Unum are going great… Since closing our series A financing in October last year, we’ve grown to a dozen people, we’ve started our first clinical trial, and we’re on track for several other newsworthy events in the near future that I’ll avoid mentioning so I don’t jinx myself. All of this has us thinking hard about moving out of our current digs into larger space. We’re currently located in LabCentral, an innovative biotech incubator that sits in the middle of Cambridge next to the newly built research campuses of Novartis and Pfizer. LabCentral has been a godsend – we’ve been able to get off the ground quickly without having to invest in infrastructure or significant capital equipment. The only limitation is size – we’re bulging at the seams and if we don’t move soon, we will have to cap our future growth. For many reasons, our preference is to stay in Cambridge but the realities of the market are making that a difficult choice.

Cambridge is a very special place. Unlike most other places with a biotech presence, it’s an urban environment. A good fraction of the people here gets to work by subway, bus, or (believe it or not, Californians) walking. This lack of reliance on cars has yielded a geographically compact community – a two-mile stretch along the Charles River is now home to dozens of biotech and Pharma companies. And this compactness creates all sorts of synergies that come from putting stakeholders with common interests in close proximity. At Unum we’ve benefited, for example, from the fact that our labs lay within a fifteen-minute walk from the offices of many leading biotech VCs (including the three firms that participated in our series A financing). Many large Pharma (i.e., potential partners) have located their research and business development functions here, so informal meetings happen all the time. Leading academic institutions that help to spawn many of the startups are only a few blocks away. Maybe most importantly, our biotech brethren surround us. This minimizes the barriers to networking with potential new employees, sharing useful experiences, and, when needed, growing into facilities that are already equipped for life science research.

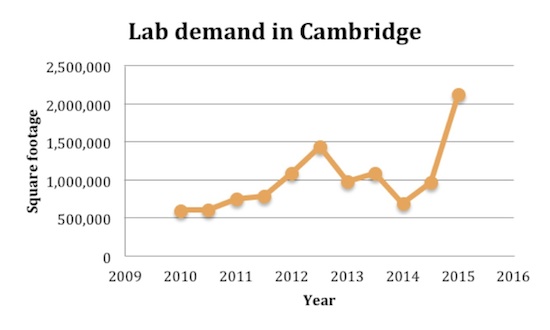

So what’s the problem, you ask? There’s a massive mismatch between supply and demand for biotech startup space. In the years leading up to and immediately following the 2008 crash, the pace of new building slowed. Since then, new construction has been unable to keep up with the relentless demand (charted below in data kindly provided by our friends at CBRE / New England). It’s not just the growth of biotech – it’s also the decision by many Pharma companies to re-locate to Cambridge to take advantage of the benefits that come from being part of the community. Each time someone takes a few hundred thousand square feet of space, it means the options for many other startups have instantly narrowed. (As a side note, one can ask if this trend risks destroying the very ecosystem that has attracted Pharma here in the first place. Maybe Pharmas should donate some of their space or subsidize the rent of promising, hungry biotechs to ensure their own sustainability! Just a selfless idea for consideration…)

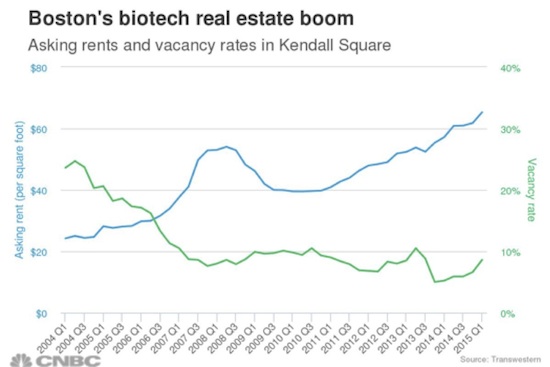

There are two obvious consequences that come from limited supply. First, rents are going through the roof. When we first started looking in Kendall Square a few months ago, we were a little shocked at the numbers – mid-to-high $60s per square foot per year – but we took some comfort knowing that rents dropped down into the $40s and $50s only a few blocks away. Now people are talking about rents approaching the $90s and there doesn’t seem to be any end to the rise.

The second consequence is that vacancy rates are dropping to zero, meaning that even if one is willing to pay the rent, there are simply very few viable options available. This is of particular concern for a company like Unum where we’re anticipating rapid growth and are looking for space to meet our needs for several years. In a normal market, one might expect to be able to take a small amount of space and to trade up as needs grow. With the current reality, however, that strategy creates significant risk. With little supply, expansion space may simply not be available when we need it.

All of this is pushing us to look more broadly and even (gasp!) contemplate a life outside Cambridge. Previous experience says that one can build great biotech companies in the communities surrounding Cambridge, including places like Watertown (e.g., Enanta, Forum, Tetraphase), Waltham (e.g., Praecis, Adnexus, Tesaro), and Bedford (e.g., Avila). The big question for us is what is the long-term impact – positive or negative – on Unum if we choose to pack up and move out to the ‘burbs. Will we compromise our culture (feeding off the perception that Cambridge provides a more risk-tolerant and dynamic employee base) or will we find that we’re suddenly able to bring on board experienced drug developers who are unwilling to put up with the hassles of the daily commute into Cambridge? Will we miss the impact of those daily incidental contacts with other companies, academics, and investors that we now take for granted? Or will we build tighter internal ties and develop a stronger sense of community within Unum when we’re not confronted by external distractions? If we do move out, will we ever be able to (or want to) move back in? I’d love to hear from other folks who have managed companies through this kind of decision. And if you just so happen to have a couple of thousand square feet of class A lab space to spare…