The stock market has been a wild ride of late – big moves up and down, NYSE getting halted, Grexit, China – lots of reasons for added skittishness. The VIX index, which measures the volatility of the S&P500, has gone up more than 50% in the last twelve trading days, into the range seen only a handful of times since mid-2012.

But the VIX measures the bigger end of the stock market. Biotech is a high beta equity sector, meaning it has a tendency to swing more than other stocks in respond to market changes. Within the biotech sector, younger small cap stories are notoriously more volatile, but historically there’s been little aggregate data given how few biotech companies made it public. But that’s changed in the past two years, so it may be more useful to examine the ups and downs of these newly minted IPO stocks.

First, the dataset used here tracks 112 biotech’s that went public in the 24 months of 2013-2014, and are still trading today; for these stocks, the daily closing prices were compiled and day-to-day changes were analyzed. Here’s the summary of the findings.

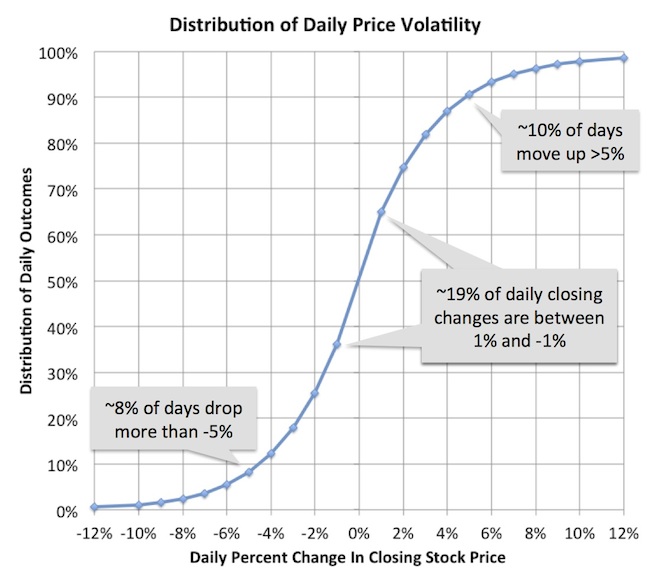

As a group, this cohort of young companies has rollercoaster volatility, as you might expect. On a typical day since start of trading this year (122 days through June 26), 43% of stocks in this group move down by more than 1% and 46% move up over 1% (meaning only 11% trade between 1% and -1%). Beyond that, the outliers are significant: 8% of the stocks in this group move down more than 5% on an average trading day, and 11% move up more than 5%.

Below is a chart that captures the cumulative distribution of daily stock changes. With 112 stocks coming into the markets over this period, this distribution represents over 37,000 daily closing prices.

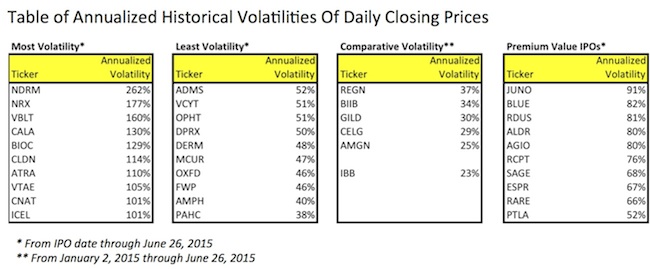

Digging into the individual stocks themselves, an annualized historic statistical volatility can be calculated (as described here). Here’s a table with the ten most and least volatile stock tickers, with a comparison to some large-cap biotechs and the NASDAQ Biotech Index (IBB). It also tracks some of the more high profile IPOs of the past couple years.

As expected, the volatilities of even the least volatile group of stocks are much higher than their large cap comparators, which range from 25-37% across names like Amgen, Gilead, Biogen, Regeneron, and Celgene.

High flying “premium” valuation stocks have also seen significant day-to-day volatility, with annualized rates in the high double digits: for example, Juno Therapeutics has shown annualized statistical volatility of 90% given the dynamic stock moves around news in the CAR-T field. Of the 129 trading days for Juno in this dataset, 16% were moves upward by over 5%, and 12% were moves downward greater than 5%. Another example is bluebird bio, which has an annualized volatility above 80%, reflecting the excitement in its programs and the gene therapy space; 15% of its~500 trading days have delivered stock movements greater than +/- 5%. Further, the most volatile stocks in this IPO cohort reflect crazy levels of stock volatility: Neuroderm, Nephrogenix, and Vascular Biogenics all have annualized statistical volatilities north of 150%.

It’s well understood by most investors that these stocks should be more volatile. They are by and large a thinly traded group, with small floats of outstanding stock and significant insider ownership. The prices of these stocks are therefore easily moved by modest changes in trading volume: in short, small orders can gyrate their pricing. Add this technical trading dynamic to the dynamic newsflow in these areas (e.g., CAR-Ts, gene therapy, orphan cancer drugs) and their specific R&D updates, and it’s a volatile mix.

It would be interesting to compare these “IPO cohort” volatilities with the stocks from past IPO windows (but I haven’t the data nor the time); its not likely that any of the technical fundamentals (like insider ownership, float, etc…) have changed significantly from past vintages, but the level of institutional specialist investing and long/short hedge fund activity in the space has almost certainly increased.

In light of the significant volatility, there are a few takeaways for those of us interested in long-term fundamental investing:

- Get a seatbelt and focus on the destination. Buckle into the stock as long as the investment thesis remains intact and the valuation has room to grow into that thesis. Expect lots of ups and downs between now and then. Reconsider as the thesis plays out.

- Don’t try to time the market; pick great stories, high impact medicines, and stick with them. Great companies are built over years and decades, not days and months.

- If you are an active trader, have fun with the volatility and have your Xanax ready. I have no stomach for that, and hence am in the most-illiquid, long-term part of the biotech sector.

- Big macro shocks are likely to further exacerbate these biotechs’ volatilities: although gene therapy has little to do with Grexit, traders correlate everything during market meltdowns. Given the macro issues today and on the horizon, expect things to stay exciting.

The capital markets in small-cap biotech are, as usual, awash in volatility. Accessing the public markets is essential for scaling new business and accessing the required capital, but it obviously come with expectation of potentially distracting and volatile stock movements. The key for management teams and their long-term investors is to not let daily or weekly or even monthly moves in your stock consume your attention. Build long-term value and the rest will come.

As many others have said, “the markets are a great servant but a bad (and volatile) master”.