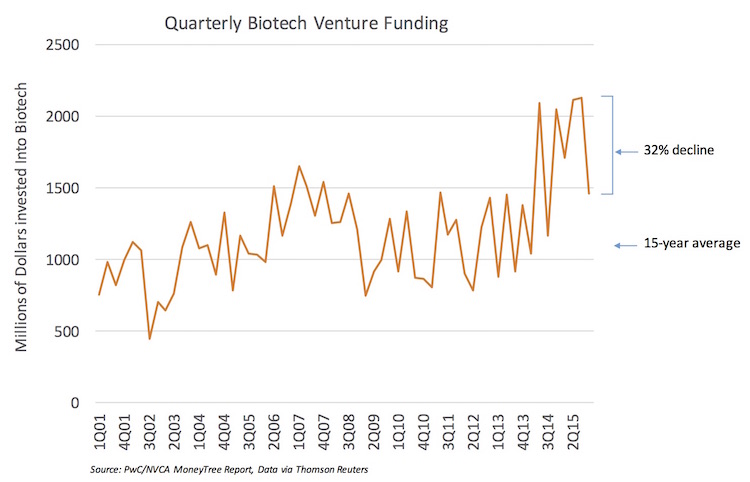

2015 was the biggest year ever for venture capital funding into the biotech sector. According to the latest MoneyTree Report from PricewaterhouseCoopers (PwC) and the National Venture Capital Association (NVCA), with data from Thomson Reuters, over $7.4B was invested during the year. Lots of private companies are well financed to advance their programs and weather the ups-and-downs of the capital markets (more downs so far in 2016 than ups).

Digging into the recent numbers, I’d like to highlight three observations – none of which are surprising for those tracking the space.

Guess who didn’t show up in 4Q 2015? Crossover investors pulled a Houdini. As the markets got jittery in in the 3Q, it clearly spooked a number of these traditionally public investors, who disappeared from many syndicates (as described here). The quarter witnessed a 32% drop in “venture” funding in these data. That amounts to nearly $700M less than in the second and third quarters of the year – in line with estimates of what the crossovers were contributing (here). This crossover phenom was driving much of the IPO market, and certainly many of the top performers (here); with this cooling off, it may suggest that quarterly venture funding will return to its longer-term historic range of $1-1.5B per quarter in 2016.

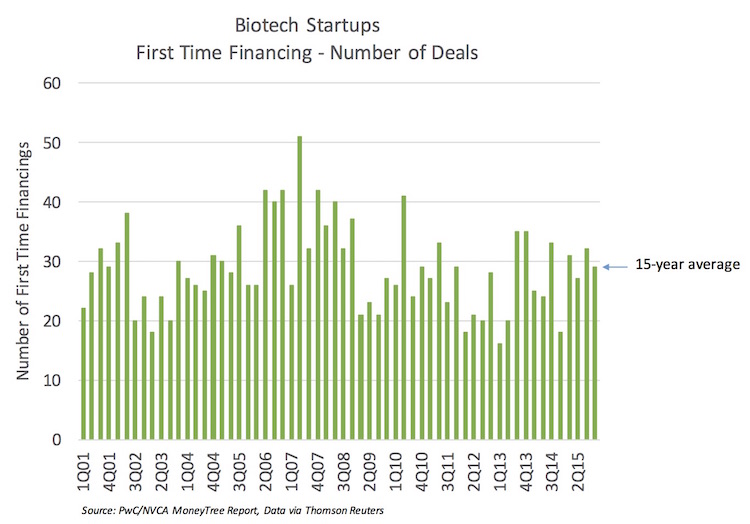

Startup formation remains as constrained as ever. Unsurprisingly, the number of new startups continues in line with historic rates (29 startups per quarter in 4Q 2015, exactly at the 15-year average), as I’ve described many times previously (here, here). The data just don’t seem to budge. This may be due to new structural dynamics around venture formation vs a decade ago (described here), and some of the inherent challenges and barriers to entry of launching a new company. With the migration of 150+ companies into the public markets, and another multiple of that taken out via M&A or option deals, the universe of innovative VC-backed biotech companies is very tight – and this scarcity bodes well for “suppliers” of these companies.

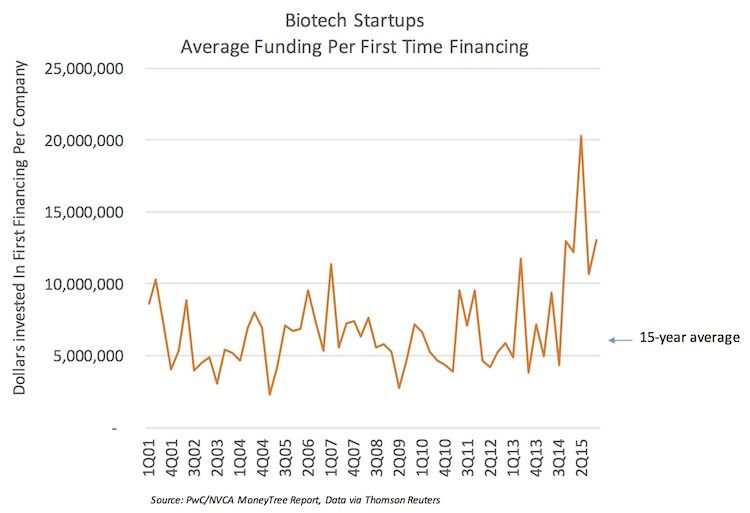

But new startups are launching with bigger bankrolls. The average funding per new startup in all four quarters of 2015 was at all-time highs, ranging from 2- to 3-times higher than the 15-year historic average. These numbers are of course skewed somewhat by a number of monster-seized first financings (Denali to name one), but it appears to be a widespread uptick. Interestingly, even the 4Q numbers continue to be robust; this is likely because (a) crossovers don’t typically engage in first financings so their flight from the funding world didn’t impact these numbers; and (b) most launches of VC-backed companies take 6-12 months to pull together – so many of these were already “baked”.

Given the volatility in the public equity markets right now, both in biotech and more generally, it will be very interesting to see how these numbers evolve in 2016.

On the venture side (the private company universe, that is), there are a number of VC firms that have reloaded with new funds in the past couple years that are well equipped to continue funding innovation, and I know of a few additional funds being raised. These funds bode well for venture disbursements into biotech during 2016-2017 as their new investment periods are typically only 2-4 years. Further, theses funds may become helpful to support the financing needs of young but recently public biotech companies should the public markets continue their risk-off bias.

Back to work, hopefully we can do our part to increase the first financings data in 2016.