A biotech’s Board often plays important roles in shaping the company’s success or failure: contributing strategic guidance, providing proper governance, stewarding fiduciary responsibilities, raising a startups’ profile, aiding business development, to name a few.

Over the life of a biotech, the role and contributions of the Board of Directors, and in particular the independent Board members, change. As drug discovery startups, often having research expertise from veterans that have served tours of duty in R&D can be helpful. Moving towards and into development, translational and clinical experience can be important value-add. Entering the public markets requires more financial expertise. And all companies can benefit from good perspectives on operations and strategy. Having great independent directors across the biotech lifecycle is one of the keys to highly functioning biotech boards (see post here).

Importantly, a big period of evolution for biotech boards occurs after they’ve gone public. As emerging public companies, the process of transitioning their boards from venture-backed to publicly-traded occurs. It doesn’t happen overnight, but over the few years following an initial public offering.

With the wave of biotech IPOs, we’re in the midst of one of the most prolific Board transition periods the industry has ever faced.

Back in late 2014, in collaboration with executive search firm Catalyst Advisors, the turnover of Boards from the 2011-2014 IPO period, representing some ~100 IPOs, was examined here. Two conclusions came out of this work: first, the “half-life” of the typical biotech Director post-IPO is about four years; and second, as the bolus of 2013 and 2014 IPOs moves through the system, the industry would face a huge number of Board replacements. Using that turnover rate, I estimated the sector would need 280 new Board members.

Two years on, we have recently revisited this analysis. Working again with John Archer (and Todd Aghazadeh) of Catalyst Advisors, we extended the analysis for IPOs occurring through the summer of 2016. From 2013-2016, it includes over 140 offerings with full data around their Board transitions – representing almost 1000 board seats in that time window.

Almost surprisingly close to the prediction of 280 new Board members in the original blog post, the 2013-2014 cohort has had 272 Board seats transition, with 248 new Board additions, in the past few years.

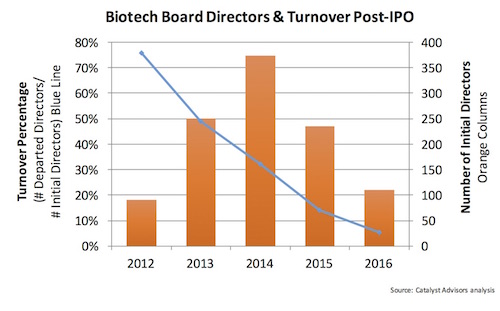

Broadening the analysis to include the 2015 and 2016 cohort, the chart below captures the updated data: plotting the turnover rate (percentage of initial “at IPO” directors that have since departed; line, left axis) and the number of initial Directors across five annual cohorts (columns, right axis).

Two observations of these data, similar to those in 2014:

- Half-life of a Board Director post-IPO is 3-4 years. This rate of board turnover/transition is only slightly faster than the 4-5 years found in the prior 2010-2014 dataset: roughly 25% turnover in 1.5-2 years and 50% turnover of the Board after 3-4 years. Much of this involves the transition of venture-affiliated board members off of these boards as public companies.

- We should expect to see huge demand for new Board positions over next couple years. Like a pig moving through a snake, the big wave of IPOs in 2014 has to make its way through the Board transition cycle. Based on these calculations, more than 340 Board positions are likely to transition over the next few years.

The math around Board demand is staggeringly large. As a sector, biotech just replaced nearly 250 over the past few years as noted above. Now we need to replace another 340 positions. On top of this, we have to add on all the board requirements for private biotech companies: with 100 new startups a year, and 1-2 independents per startup board, that’s another 100-200 Directors. Plus the pre-IPO companies that are maturing: with 400 or so biotechs receiving follow-on financings per year, there’s a big pool of these companies. Based on all this, a reasonable estimate of aggregate demand for talent is that at least 600 biotech Board Director spots will need to be filled over the next few years.

Where are these all likely to come from?

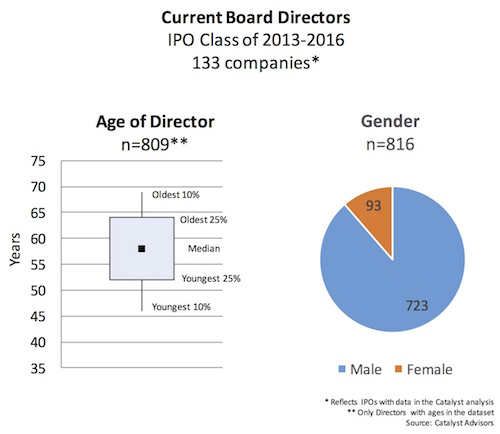

To frame that question, it’s worth examining the current Board member composition of the 2013-2016 IPO cohort. Based on the Catalyst’ dataset, there are 816 people that fill 985 seats on the Boards of these companies today (as of September 2016). Here’s a snapshot of the gender and age breakdown of these 816 individuals:

First, as the age graph on the left shows, Boards have a largely expected bias to “grey-haired” veterans who bring their biopharma field experience (a proxy for judgement) and industry connections into the boardroom. The median age of all Board Directors is 58 years old, with a reasonably tight distribution from the oldest quartile (64 years old) and youngest quartile (52 years old). I’m certain that if young VCs (like myself, of course!) and current company executives (e.g., CEOs who sit on their own Board) were eliminated from the analysis, and it just focused on “Independent” Directors, we’d see the age distribution in these data shift markedly older still. I just don’t have the time to walk through each individual name to do that analysis. But these data support the intuitive conclusion most of us would believe: Independent Directors are commonly pulled from the ranks of recently retired industry executives.

Second, as is screamingly obvious in the pie chart, female Board members are vastly under-represented on these emerging biotech Boards, with a participation rate of only 11%. I suspect, given the age distribution data, that this in large part reflects the impact of gender differences in leadership roles in the biopharma industry over the past few decades. Very few Pharma or Big Biotech companies were led by executive teams of women leaders a decade or more ago (such as Vicki Sato, head of R&D at Vertex, or Deborah Dunsire, CEO of Millennium); if we recruit board members predominantly from retired senior executives, we’re not sampling from a very diverse pool.

So back to the question then of where will the candidates for these 600+ Board spots come from. I’m sure many will continue to come from the ranks of recently retired biopharma executives – they often add a ton of value to a boardroom. But here are three (certainly overlapping) ideas that go beyond the tried-and-true pool of retired veterans:

- More female biopharma executives. We need more female executives to join biotech boards, and these most likely have to come from women who are active executives in the industry today rather than retired ones (given the disparity in leadership roles in the past mentioned above). Fundamentally, ignoring half the talent pool just isn’t bringing the “best and brightest” perspective into the Boardroom. The only way to change this is by influencing the decision-makers: existing boards and their nominating committees, their investors, CEOs, and executive search firms. This blog has covered this topic in the past (here, here). We’re making strides, albeit slowly: Atlas’ portfolio has recruited a number of female independent directors in the last year or so (e.g., Adelene Perkins at Padlock, Samantha Singer and Samantha Budd-Haeberlein at Rodin, Caroline Dorsa at Intellia, Christiana Stamoulis at Kyn).

- Cross-pollination from other biotechs. Fellow biotech executives (CEOs, CSOs, CMOs) that are working in the startup trenches often make great independent directors, and the experience typically makes them better executives as well. Seeing executives wrestle down similar issues but from a different vantage point is very helpful. Win-win relationships like this should be fostered. The additional time commitments don’t work for everyone, and a sitting executive can’t do too many of these, but a couple Board roles outside one’s “day job” is a useful thing to consider. A number of our biotech executives serve on other boards in our portfolio and elsewhere.

- Current and “up and coming” Big BioPharma leaders. I think Big Biopharma companies are largely under-leveraging a great career development asset: encouraging their current senior executives to sit on the boards of startup biotech companies. A few Big Biopharma exec’s already serve on boards outside their “day job” or corporate focus areas: George Golumbeski of Celgene serves on Enanta’s board, Phil Vickers of Shire serves on Revance’s board, to name just two. But this practice could be much more widespread and helpful to both large and small companies alike. What if a Pharma company decided that every xVP-level executive in R&D and BD should serve (or try to serve) as an independent Director on at least one external biotech board as part of their career development plan? It would bring a few hundred executives into roles they’d never seen before (including many more female executives). It would add a lot of orthogonal insight and talent into biotech boardrooms, and I suspect it would be welcomed by most venture investors. And the perspective on entrepreneurship and organizational agility would be brought back into the Pharma company where it could help catalyze change. Seems like a great thing to do all around.

Talent is the #1 constraint in biopharma today. Whether it’s about creating new startups, advancing translational medicine, or scaling biotech companies, an enormous number of talented executives and entrepreneurs are needed. And this talent demand also exists in the boardrooms of those biotechs. Fundamentally, the difference between success and failure often comes down to talent throughout the organization – and the war for talent never ends.