As a biotech investor, it’s been fascinating to watch the Snapchat IPO and the fanfare around this $25B sensation following its offering as a “camera” company. As one of the big tech unicorns, it’s justifiably gotten considerable attention in the media and tech community. Despite the pullback in value since the offering, it remains a monster win. Kudos to Lightspeed and Benchmark, who have generated returns in the billions.

Of the 3000+ tech startups that got funded in 2012, Snapchat is almost certainly the most impressive lottery ticket of the group. This is what tech investing at its best looks like.

But it’s also reminded me of how different the basic dynamics of our respective venture sectors are. In many ways, we live on different planets in the venture universe.

One sector relies on stochastic 0.1%-type outliers as the driver of fund-level and even industry-level returns, the other offers a steadier path to 5-10x returns as a more frequent top decile outcome. When aggregated at the sector-level, the returns (multiples and IRRs) have been biased in favor of biopharma venture over the past few years (here, here).

Most readers will know that I’ve explored the “tale of two startup ecosystems” in biotech and tech venture several times over the past five years, in particular highlighting the different dynamics around venture creation. But in light of all of the changes in the past year, I thought it worth revisiting data on a couple points to see if there’s been a change in the startup environment.

Data revisited.

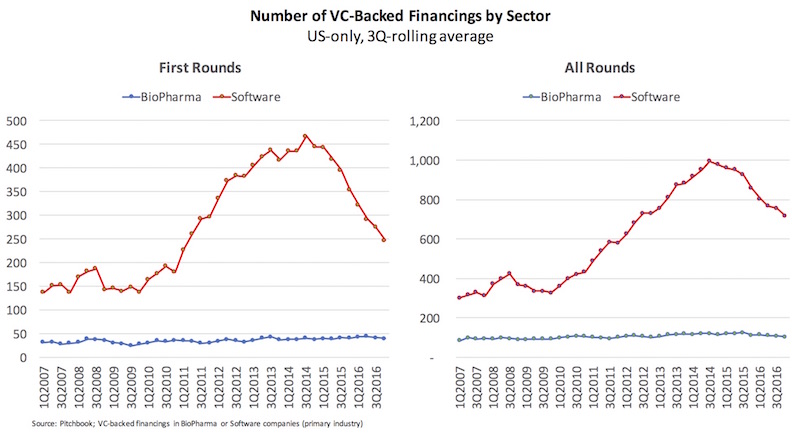

As I shared last week (here), the biotech financing market has been in remarkable equilibrium over much of the past decade. According to data from Pitchbook, the pace of startup creation has been relatively constant, as has the overall pool of biotech companies getting financed – driven by a stable number of active investors.

This couldn’t be more different in the tech space, especially looking at the software sector. While the pace of venture creation is off its peak of 2014, it remains significantly above the long-term average, cranking out ~250 new startups each quarter last year, a significant increase over the pace a decade ago. This rapid increase in startup formation has led to a huge tidal wave of financings in the tech sector – backing 200-300% more tech startups than just a few years ago (versus a ~3% increase in BioPharma).

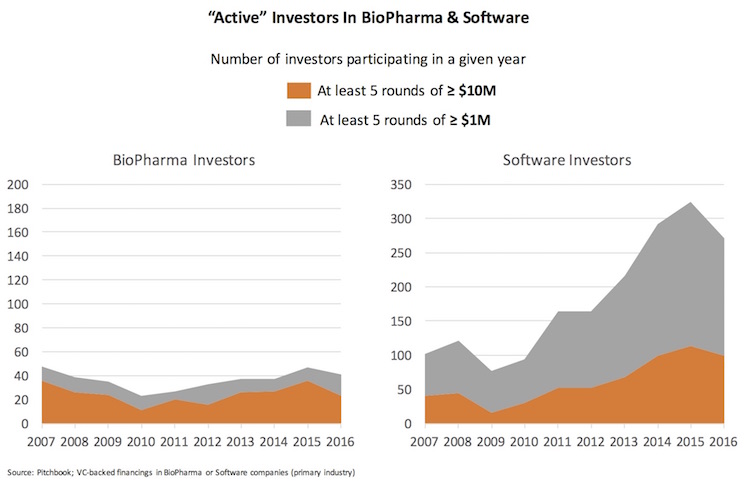

As you might expect, the number of startups in a sector is directly related to the number of active investors. By defining an active investor as a firm that invests in at least five financing rounds per year, we can get a sense of the number of institutional investors participating at scale in a sector, again leveraging the dataset at Pitchbook. Broken out below are two cuts of the data: those that participate at least 5 rounds of $1M or greater (capturing bigger seed investors or micro-VCs), and those investing in five or more larger rounds of at least $10M (note y-axis scale is different).

While the biotech sector’s investor universe has been relatively tight, the software investing world has exploded with participants at both ends of the scale – small and large rounds. The growth rate in participating investors roughly mirrors the growth rate in number of companies getting financed, as you’d expect.

These two data points are reflective of vastly different structural forces at work in these two ecosystems: biopharma and tech venture capital are two different beasts.

Reflections on Sector Dynamics.

To put a finer point on the differences, it’s worth highlighting a few key industry structure aspects.

Here are four observations on the dynamics in the tech venture sector today:

- Hyper-competition amongst VCs. Being a tech VC in the software space is very hard today; chasing “hot” deals, submitting competing term sheets against other firms, elbowing your way into rounds, trying to carve out “proprietary” deal flow (which doesn’t really exist in tech venture). VCs that lead seed rounds often lose their A-round positions to new VCs with higher offers. Figuring out how to win (at least some of the time) in a hyper-competitive world is paramount.

- Like buying lots of lottery tickets, many Tech VCs embrace high velocity seed investing. At the extreme, some call it the “spray and pray” strategy. It’s the concept of backing as many entrepreneurs as possible as a path to try to secure a rare seat on the next Snapchat rocket ship. Selectivity is replaced in large part by portfolio breadth in a range of seed rounds; if you can preemptively jump on your seeds that are working, before others see the traction, that’s the trick. But since it’s hypercompetitive, losing your own seeds to other VCs happens a lot. Because winning in this environment is largely an unpredictable, stochastic outcome, you need lots of tickets – or so goes the logic.

- Entrepreneur-founders can have enormous leverage. Because of the competition for deals, tech founders can often get incredibly favorable terms, especially high pre-money valuations (reduced dilution and far higher ownership), fewer liquidation preferences, special classes of voting stock, etc. They also frequently “take money off the table” in subsequent financings (almost unheard of in biotech).

- Relative ease of starting companies leads to crowded spaces and challenging exit dynamics. The barriers to entry for starting new companies, especially in software and mobile/consumer apps, are incredibly low: 3-4 new startups in these spaces are backed by VCs for the first time each day in the US. Directly related to this low entry barrier is a nearly endless supply of entrepreneurs: unbridled, optimistic youth characterizes most tech startup founders, and there’s an almost infinite supply of college-age risk-takers with an idea and some code. It leads to a startup glut in certain areas, all chasing the same opportunities and downstream partners. This extends beyond just consumer apps; today there are hundreds of VC-backed security firms chasing the next vulnerability, for instance, but only a small fraction of those have ever scaled to more than $50M in revenues, like Veracode or Carbon Black.

In short, with low barriers to entry and hyper-competition amongst VCs, generating consistent outsized returns is incredibly hard for all but a few venture firms – and is especially challenging at the sector-level.

Biopharma is characterized by a very different set of dynamics, as evidenced by the striking contrast in the charts above:

- Investor scarcity is a major constraint, and investors rarely compete with each other. “Coopetition” – where competitor firms cooperate on a deal as co-lead syndicate partners – is much more common than competition among different VC firms. It’s very rare for an early stage company to have multiple term sheets for their first round of financing. Investor scarcity, especially amongst those with enough capital and experience to launch companies at scale, is a real constraint in biotech. I’d argue this is healthy at the sector-level in the long run: less capital chasing ideas means only the “better” ideas (on average) get funded, and returns will generally be attractive and more consistent.

- Biopharma entrepreneurs with deep R&D experience are also incredibly scarce. This is also a major constraint on the number of startups, as much or more important than the number of qualified active investors. BioPharma entrepreneurs tend to have 15-25 years of drug R&D and/or BD experience before starting or jumping into their first biotech NewCo. This is a highly regulated, science-heavy, esoteric asset class and success requires a deep set of experience and judgement.

- In-house venture creation brings investors and entrepreneurs onto the same side of the table. The increasing prevalence of startup formation within the close orbit of a venture firm is the reality of venture creation today (here). While our startup “founders” often lack the leverage that tech founders have, they also benefit from getting executive salaries and relatively little “career risk” when they work with a venture firm to start a company. By working with a group focused on venture creation, mature pharma executives are able to absorb the risk of jumping into startup through EIR roles and similar relationships. Alignment on valuation and future dilution can be created through shared founder common stock ownerships and the right incentive model.

- Building great biotech investments is about quality not volume. In direct contrast to seed-stage tech investing, being “selective and aggressive” is a much smarter strategy in early stage biotech. That’s not to say pouring large amounts of capital into a few early stage ideas is smart, as there’s still considerable risk in research-stage science. But these risks can be managed and mitigated through a targeted high-stringency seed-led strategy, whereby early hypotheses can be derisked through the deliberate titration of capital and go/no-go experimental strategies. By having seasoned EIRs in house (above), rigorous “truth-seeking” rather than “project-survival” behaviors are rewarded, and these help weed out false positives early. Once proven to be a scientific vein worth mining, more aggressive deployment of capital can drive upside and returns in a more predictable manner. This is especially true in an ecosystem where downstream demand for innovation from Big Pharma is a strong structural, secular force that is unlikely to abate. And with the positive overhang of this “Pfizer Put”, stock prices of both public and private innovative biotech companies are likely to remain buoyant.

For biotech, qualified investor and experienced entrepreneur scarcity are major constraints on the number of new startups and help keep the supply of innovation tight and of reasonable quality. This is a healthy dynamic at the sector-level, and helps to create an environment where quality early stage biotech investments can generate outsized returns consistently – as evidenced by the attractive aggregate returns data of biotech venture capital relative to other sectors (here, here, here, here).

The tale of two very different ecosystems is still a very real narrative.