Heading into the winter holidays always brings out festive reflections of the past year. Twelve months ago, we were thrilled to say goodbye to 2016 and excited to embrace 2017’s promise. And in large part, the past year has delivered nicely, with more than a few things to celebrate: the NASDAQ Biotech Index is up nearly 20%, Kite got bought for $12B by Gilead, Denali went public in the stratosphere, and investors have filled their warchests with plenty of new funds.

Back in January 2017, I kicked off the year with a set of predictions, in a piece titled “Crystal Ball Gazing: Biotech Predictions for 2017.”

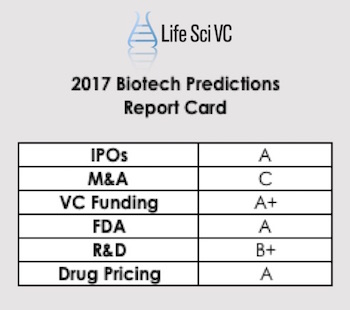

Today I’m holding myself accountable and providing a (self-graded) report card of how right those gazes into the future were.

Behind each of these six areas, I offered up a number of specific predictions about the year. Here’s a summary, with grades for the accuracy of my predictions (not grades for industry performance).

IPOs/Public Markets. Grade: A

We’ve witnessed over 37 VC-backed Biotech IPOs in 2017, nailing my prediction that we’ll see “more than 30 life science IPOs”. The markets were clearly very receptive to emerging biotech stories, and 2017 ranks in the top quartile by IPO volume over the 40-year history of the biotech industry. Intarcia and Moderna, two of biotech’s private unicorns, didn’t go public in 2017, which I thought might occur; but we did see another unicorn, Denali, explode onto the markets with a near $2B valuation.

We have continued to see dispersion in the post-offering performance in biotech: as of yesterday morning, only 40.9% of the ~200 biotech IPOs between 2013-2016 remained above their offer price – in line with my prediction of ~40%. Unsurprisingly, this reflects the historic norms around the gravity of the small cap biotech markets: roughly three of five offerings go underwater in the years immediately following an IPO, with a small percentage of companies showing massive outperformance. Of the 2017 IPO class, still very young, 60% of the companies are still above their offer price, but I expect further dispersion in performance over the next few years: by 2019-2020, I’d be surprised if more than 40% of these new issuances were above their IPO marks. For more on the concept of dispersion, check out this 2016 post.

Reverse merger activity has been very strong: I predicted at least 10 reverse public offerings, and by my count we’ve seen over a dozen (here for more). In fact, we had two of our portfolio companies go public via reverses, including MiRagen (NASDAQ:MGEN) and Synlogic (NASDAQ:SYBX). These are likely to continue as more companies in the 2013-2016 IPO cohort face product failures and become “shells” available for reverses.

M&A. Grade: C

Biopharma M&A activity certainly wasn’t on fire this year, and far less active than I had predicted (and hoped). While Atlas was fortunate to have a few acquisitions in our portfolio (here, here), my statement that “M&A will continue to drive liquidity in biotech venture” didn’t really manifest into reality across the industry at large. Private VC-backed M&A likely fell well short of the $10B target I hoped for (more in the ~$8B or so range).

That said, inclusive of commercial-stage (non-VC) private biopharma acquisitions, the aggregate number is closer to $13B. And alternative cuts of the industry’s M&A data paint a less moribund picture: for instance, R&D-stage M&A of publics and privates wasn’t actually that bad in 2017 (in line with both 2016 and 2014), but nowhere near what it was in the boom year of 2015.

My crystal ball also predicted a pending flurry of public acquisitions, thinking that at least five M&A deals would ring the bell above $5B. I even listed possible targets like Incyte, Alexion, BioMarin, Tesaro, and Clovis. Unfortunately for my report card, all of those remain independent, and to my knowledge there were only three acquisitions greater than $5B: Ariad, Actelion, and Kite. Hopefully this will change in 2018 and build off the momentum of this morning’s acquisition of Ignyta by Roche for $1.7B.

But in summary, I largely missed on these M&A predictions. With grade inflation, and alternative ways of cutting the data, I gave myself a “C” on M&A.

VC Funding/Startups. Grade: A+

2017 was a blowout year for venture capital funding into biopharma startups, with over $12B of private fundraising coming together, according to Pitchbook’s latest data. This performance certainly checks the box of my optimistic “over $7B” prediction.

As I’ve described before, this flow of funding isn’t about spreading the capital around to more startups though – about 450 companies were financed last year, largely in line with the long term averages (for more commentary see “boom or bubble”). Further, Boston and San Francisco continue to get the lion’s share of this capital, further consolidating around those two core clusters (here).

Pace of startup creation is still largely flat, as predicted. According to Pitchbook data, for the past five years, roughly 35-45 new startups get their “first financings” each quarter, and 2017 was no different. While numbers of financings were similar, there was a dramatic uptick in early stage financing dollars. Of note, this is increasing the capitalization per company, not dramatically changing the number of new startups: essentially more funding into a limited number of players.

FDA. Grade: A

As was widely lamented, 2016 was a light year for new drug approvals. Back in January 2017, I predicted that this “macro biomarker” of the industry would rebound with a “sizeable uptick” and we’d see “more than 30 new medicines”. That has for sure been the case: the FDA’s CDER division has approved 45 new drugs as of today, and CBER also approved several highly innovative new cell and gene therapies, including Kymriah, Yescarta, and Luxturna. It does appear, however, that more FDA approvals this year were to “precedented” drug targets rather than addressing first-in-class new mechanisms (here), reflecting the increasingly competitive nature of the industry against proven targets.

Fortunately, the FDA has also not dropped its standards on efficacy, which was a legitimate worry given some of the rumblings from the Trump administration early in 2017 (here, here, here). Scott Gottlieb’s appointment and subsequent leadership has been a resounding positive for the agency.

Industry R&D. Grade: B+

I had several predictions for industry R&D activity last year but only got the last one partially right.

Drug R&D has, of course, remained hard and there’s been no lack of unexpected clinical blow-ups (1H2017’s failures covered here): for example, Celgene’s Phase III failure of mongerson, Axovant’s Alzheimer’s miss (specifically called out in Jan 2017), the Mystic whiff from AstraZeneca, Otonomy’s hearing failure, Inotek’s tradbodenoson, Dimension’s hemophilia B gene therapy, Ophthotech’s Fovista’s third blowup, Cempra’s antibiotic disaster, and many others. Lots of shareholder value was destroyed by these blow-ups. These negative clinical surprises are the norm in our industry, much in the same way as positive data surprises.

I also discussed the I/O explosion that’s continuing to consume the industry, expecting more than 1000 trials to be open related to the PD1-axis in 2017, which is indeed the case (up 20% or so from 2016). This was undoubtedly a sandbagger’s prediction reading it in hindsight – the world would have had to flip on its head for this trial explosion not to occur in 2017.

But I also speculated that there’d be more creative deal-making between the PD “have’s” and the “have-not’s” – and this hasn’t really happened with the expected enthusiasm. Where are the consortia and low-cost PD1 approaches that would change the playing field, directing value to the combination products rather than PD1 foundation? Everyone continues to think they need their own PD1 agent, which is unfortunate – and for this reason I give myself a B+ for failing to appreciate the never-ending power of the status quo as a force of inertia.

Drug Pricing. Grade: A

While the drug pricing issue was expected to be a source of continued volatility in the sector, I rightly predicted that “nothing dramatic is likely to come out of Washington in 2017 on the topic.” Despite intermittent tweets and such, no legislation regarding the pricing of innovator drugs made traction. Beyond this topic, the noise out of Washington regarding the pharma business was largely positive throughout the year: for instance, Gottlieb’s support for more generic manufacturers helps on the competitive issue around irresponsible pricing increases of old drugs. In addition, the recently passed corporate tax reform should benefit the broader Pharma industry as offshore cash and profit repatriation has been an important issue.

That’s my Report Card on the 2017 predictions. Other than missing on M&A, largely “on the money” with regards to the major trends in the industry this past year.

So what are my thoughts for 2018? Well, let’s leave that for next year, and turn off for the holidays. Best wishes to all.