Biotech is booming, with eye-popping new financings seemingly announced daily. The sector is having an epic year for startup fundraising, breaking records for what will end up as the most active private biotech financing year ever.

Although overall sentiment in the VC-backed biotech ecosystem is hard to explicitly measure (i.e. there’s no “index” traded daily), its clearly a very bullish period in the investment cycle. Some of this excitement is clearly warranted – lots of great new therapeutics are addressing the needs of patients, as science is maturing into medicine at an incredible pace. That said, as some pundits have noted, some of this is also more about “hypelines” than pipelines, where investors may be exposed to the over-promising, under-delivering behavior exhibited by some biotechs.

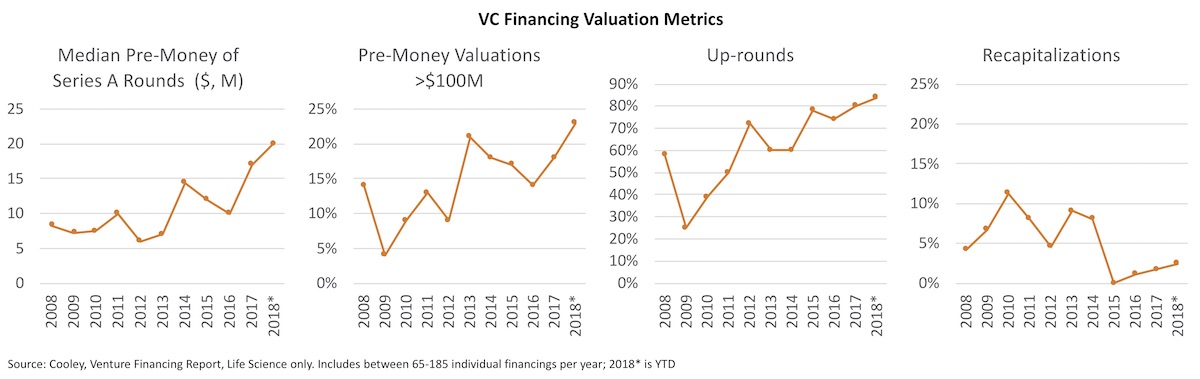

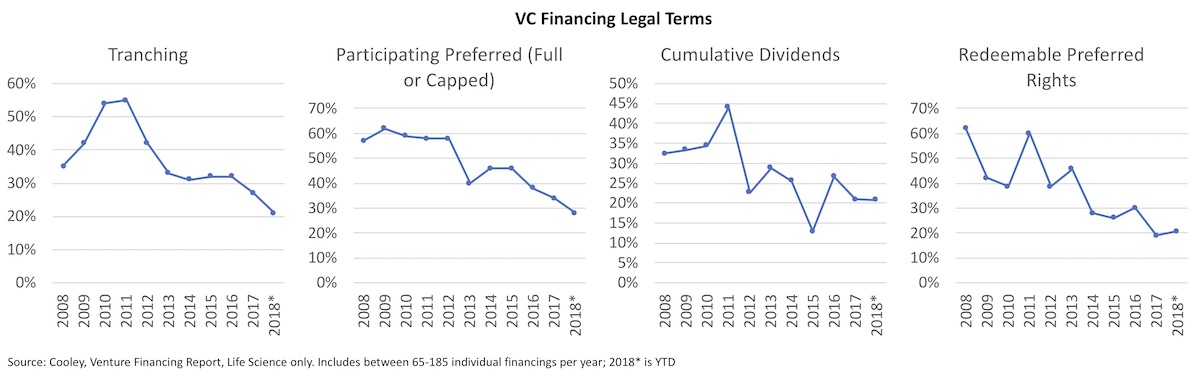

To frame up one perspective on how the current private capital market compares to the past, our friends at the law firm Cooley LLP were willing to share some of their Venture Financing Report data over the past decade to track the historic trends around key financings terms.

The quick takeaway is as you might expect: money is flowing, valuations are up across the board, and deal terms are “looser” than they’ve ever been.

For some background, Cooley keeps a dataset of all the deal terms associated with financings that it participates in – which has ranged from 65 to 185 financings per year since 2008. So it’s a rather large dataset of financing terms. They cut the data just for life sciences, and here are a few observations.

Valuation Metrics.

As is certainly expected, pre-money valuations are up throughout all rounds of financings. Series A rounds, as an example, which represent roughly 35-40% of financings, have seen their pre-money valuations more than triple over the past few years, from $6M or so in 2012 to over $20M today.

Of all rounds, pre-money valuations north of $100M were infrequent a few years ago, less than 1 out of 10 or 20 financings through much of 2009-2012. Today these robustly valued private deals are more than 1 out of 5 financings.

And down or flat rounds just aren’t happening very much: 83% of financings this year have been up-rounds. Must be that all the science in these companies is working great. Or that there’s lots of bullish investors around. For comparison, in 2009 when everyone was hiding out in bunkers, only 25% of rounds were up-rounds – clearly the pendulum has swung to be much more favorable. A related metric, the share of financings that are recaps, conveys the same: after running 5-10% for many years, the rate of recaps in the recent years has been 1-3%, a small fraction of what it was.

Structure and Deal Terms.

The use of tranches to dollop out a larger financing into bite-sized pieces, usually contingent on forward progress, has been a common tool used by investors to manage risk and burn rate. Tranching has gone from a majority of biotech financings a few years ago down to only 20% this year. With financing round sizes up, and robust investor demand, startups are able to push to have all the capital injected at once rather than in tranches. This reflects a combination of less discipline around capital flows and more competition to put funds to work by later stage investors.

I think this trend toward less tranching is particularly true for post-Series-A stage rounds, where enough “story risk” has been wrung out to know there’s a company to be built and hence the bigger, one-and-done financings. From our vantage point, as venture creation focused investors, we still see tranching in almost all of our seed/Series A rounds.

“Participating” preferred stock offerings are also trending downwards: from being a market-rate term in the majority of biotech financings for years, it’s now less than 30%. This “participation” feature, which allows an investor to get their principal paid and participate on an as converted basis thereafter (hence why it’s sometimes called “double dip” preferred), has been the subject of discussion here in the past.

Lastly, two other terms tracked by Cooley, notably the use of cumulative dividends and redeemable provisions (both ways investors can try to juice their returns or protect themselves on the downside), are trending in a company-friendly rather than investor-friendly manner. These two terms, more commonly tools of later-stage investors in tougher financing environments, are becoming less common in biotech financings. Frankly, and very practically, I’ve never really seen these terms exercised.

Taken in aggregate, all of these eight metrics are trending in line with the overall bullish sentiment of an accommodative private capital market environment. The supply and demand balance has shifted towards suppliers of innovation (and thus issuers of equity) in the face of robust capital flows.

Thanks to Cooley for sharing these data.