The biotech sector is unique relative to the rest of the stock market in many ways, but one that is often overlooked: its expansionary public equity market footprint.

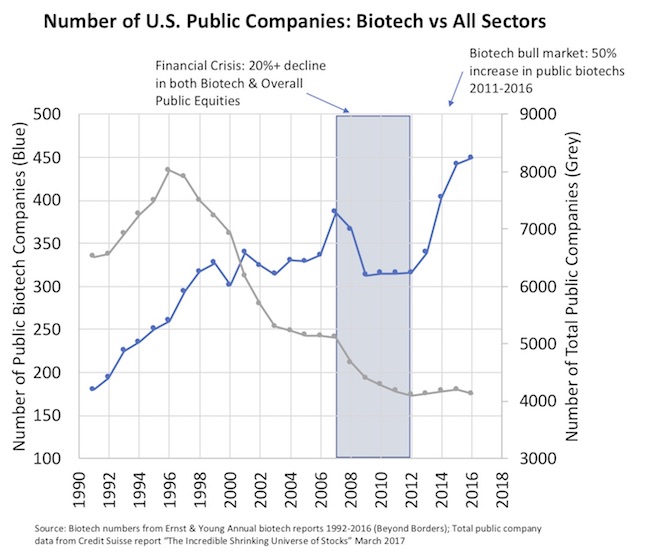

It’s been well appreciated by market analysts that the universe of U.S. public equities has shrunk remarkably over the past 20 years, from nearly 8000 listed companies in 1996 to just over 4000 today. A combination of fewer gains (new listings like IPOs) and more listing losses (from M&A and delistings) has dramatically reduced the pool of public stocks investors can trade by almost 50% over two decades. This has led to the observation that the typical listed stock is now a much more mature company than it was 20 years ago.

Credit Suisse put out a fascinating report titled “The Incredible Shrinking Universe of Stocks” last year that covers the topic in depth, highlighting how the benefits of being a listed company have dwindled and regulation has increased (Sarbanes-Oxley).

Back in 2011, the biotech sector essentially shared those traits.

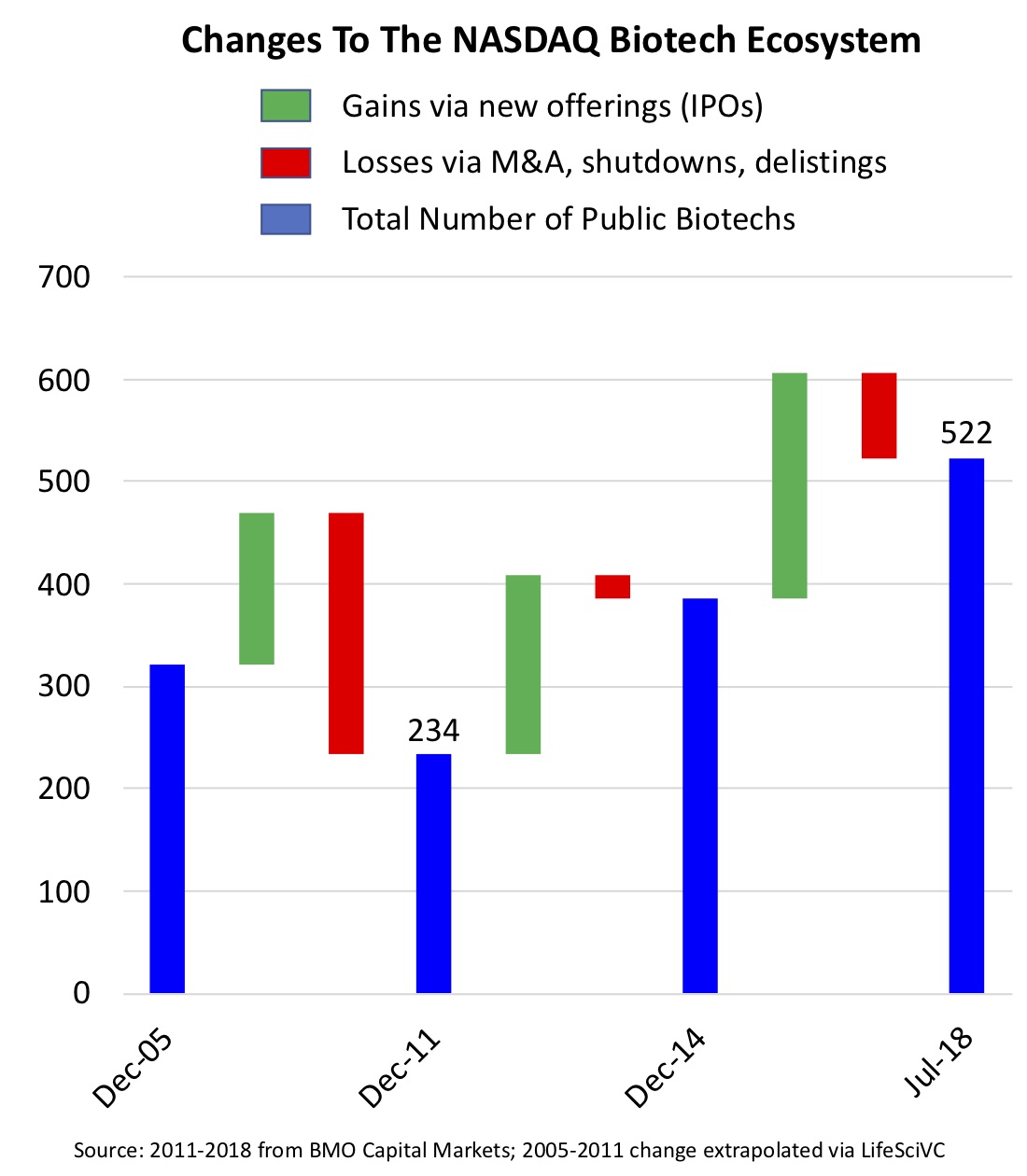

As I wrote in a blog post, “Our Shrinking Biopharma Ecosystem”, the number of publicly-traded biotechs in the US had dropped by over 25% from 2005 through 2011. I summarized the driver behind this contraction as:

…there’s really not an open, viable path for biopharma “maturation” today. In order to have a sustainable, stable-or-growing pool of emerging biotechs we need to have a functioning IPO market for biopharma today that can provide low cost-of-capital growth funding for aspiring companies…

How the world changes in seven years.

Today we are five years into a sustained, open, and accommodative IPO market, the most prolific for new offerings in biotech history. Since 2011, we’ve seen over a 50% increase in the number of publicly-traded biotech companies.

The chart below captures the trend in U.S. public biotech numbers (left axis, blue), courtesy of E&Y’s excellent annual biotech reports since the early 1990s, compared to the overall number of public equities (right axis, grey). The contrast is striking, especially in the past five years.

Annette Grimaldi and her team at BMO Capital Markets recently shared a detailed analysis of how the universe of NASDAQ biotech equities has changed over the past few years, examining the puts (IPOs) and takes (M&A/delisting). The chart below combines my prior analysis of the 2005-2011 period with their more recent update. It’s very clear that new offerings, and relatively low levels of listing losses, has contributed to a huge increase in the equity pool.

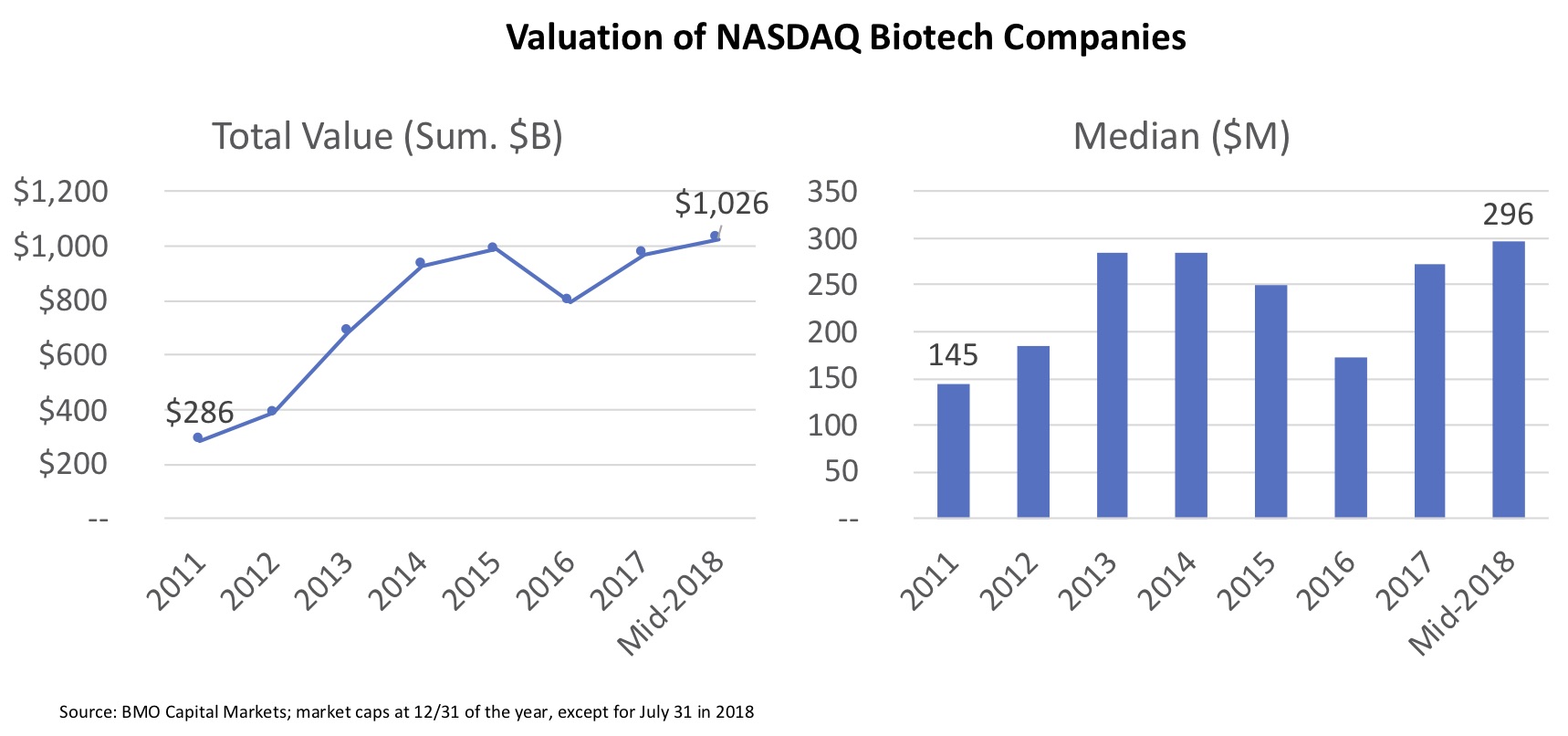

As you might expect, this has led to a dramatic increase in overall market capitalization in NASDAQ’s biotech equity sector, as well as in the median valuation of a NASDAQ-traded biotech company. Much of the former is driven by the large cap biotechs expanding valuations since 2011 – now above $1 Trillion as of July 2018. The blip at the end of 2016 on overall value and median value reflects the pullback in the NASDAQ Biotech Index from its peak in July 2015.

A few observations.

First, stating the obvious, biotech’s expansionary footprint in the public markets has largely been driven by strong new listings. IPOs have significantly outpaced listing losses over the last 5 years. While M&A was strong, it has cooled off recently – further accelerating the expansion in the number of biotechs. And the buoyancy of the public market has led to fewer delistings.

Second, while the IPO market has gotten tighter over the past two decades for technology stocks (requiring larger more seasoned software companies, for instance), demand for biotech IPOs and the opportunity to back new potential therapies has grown considerably vs in the past two decades. Biotech, and healthcare at large, have represented nearly two of every five IPOs, according to Renaissance Capital, over the past few years – 3-4x greater than biotech’s share of the private company universe. This reflects the deepening capital markets in the biotech sector and a significant expansion of “specialist” investors interested in finding the “next Gilead” across both long-only mutual and hedge funds. It’s also allowed younger biotech companies to go public – in contrast to the macro observation that the typical listed company is older and more mature.

Third, the benefits of going public are more clear for emerging biotech companies vs other sectors. In addition to almost always being loss-making, cash-burning stories when they enter the public markets, most biotechs are well recognized by investors as needing significant amounts of equity capital over the next 5-10 years for their pipelines to mature into real products. This is in striking contrast to the tech sector, where revenues and earnings are an important ingredient in creating IPO momentum.

Further, there remains very little “unicorn-stage” capital available in the biotech sector. While there are a few companies with multi-billion dollar private valuations, like Moderna and Samumed, it’s dwarfed by the quantity of tech companies in that part of the valuation stratosphere. The lack of late stage capital at this scale, willing to support another chapter as a highly valued private company, helps crystalize the IPO benefits to a biotech: it’s really the only way to access significant amounts of growth stage capital in the sector.

Stepping back to 60,000 feet, the expansion of the biotech public equity pool, in the face of a contraction in the rest of the equity markets, reflects a number of fundamental differences vs other sectors – part of the uniqueness of biotech ecosystem.