2018 was a incredible boom year in the number of new biotech offerings, with 60 IPOs on US exchanges. But as we’re all painfully aware, after the overall biotech market ($XBI) touched its all-time high in August, the last third of the year was challenging – indices plummeting over 25% in four months.

As both an active participant and market observer, it felt like we were watching the nearly complete capitulation of the markets: there were just no buyers around to support many of these newly-minted public companies, so even small selling volumes would pressure stocks and driving large price declines.

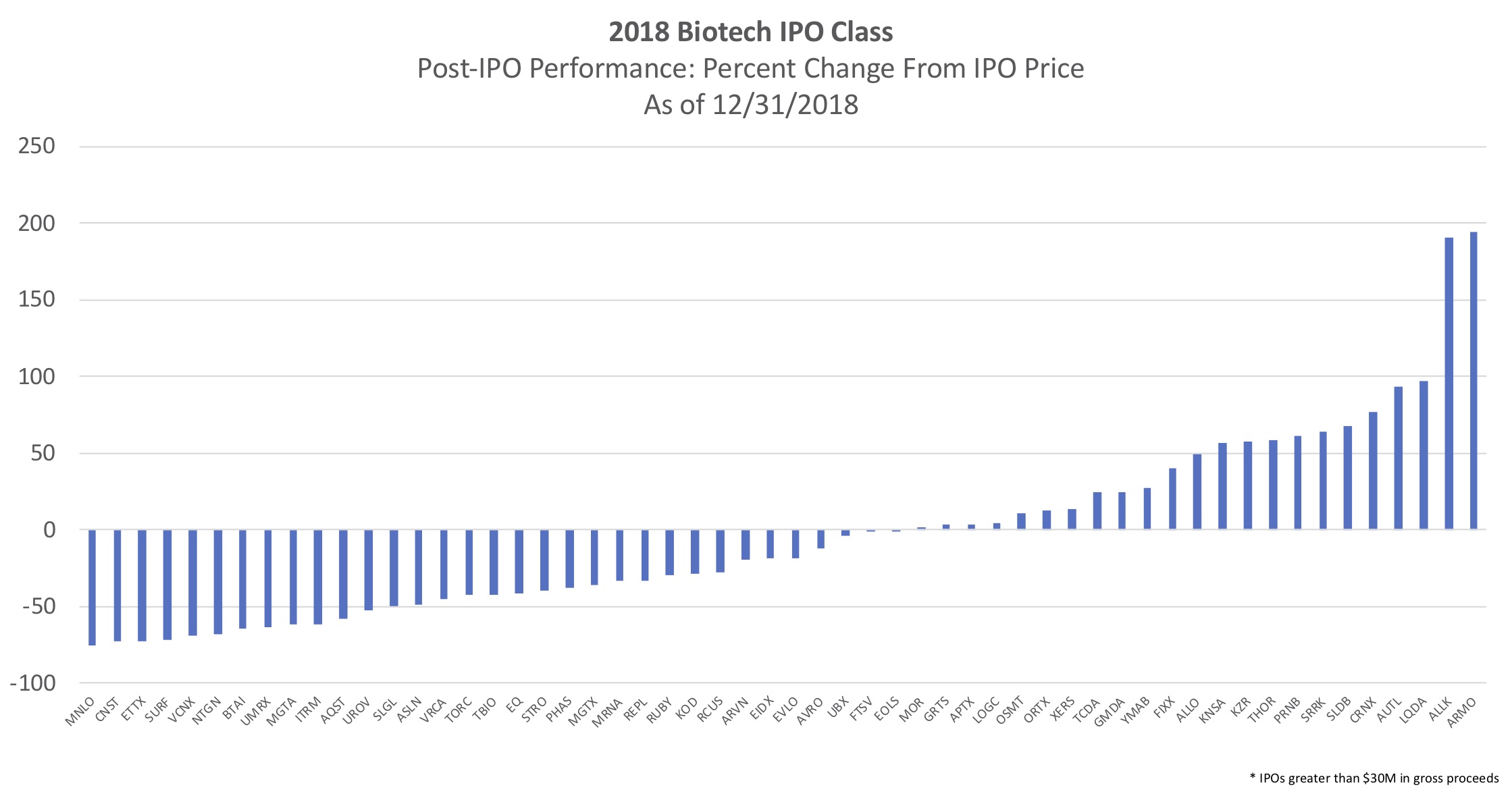

To set the baseline for where things are as we start 2019, it’s worth reviewing the 2018 IPO Class and its year-end performance. Numbers below are courtesy of friends at Cowen and BMO Capital.

A few quick and sobering stats:

- 56 offerings of over $30M in gross proceeds (60 offerings of $20M or more)

- These 56 raised $7B, adding to their $5B of existing cash balances, bringing their total cash reserves at IPO to nearly $12B. Will be interesting to see how quickly these players need to come back to market with cash hordes of this magnitude.

- 41% of these offerings ended the year above their IPO price. The vast majority of IPOs broke issue price at some point in the year following their IPOs.

- There was a wide dispersion of outcomes: roughly 20% of the offerings lost (or gained) more than 50% of their value (tails representing 40% in total)

- Median and mean post-market performance was -19% and -3%

Here’s a chart reflecting the dispersion of post-IPO performance outcomes by company.

While percent change is the common way investors tend to look at, it’s also worth exploring the absolute value creation/destruction in the ecosystem.

While percent change is the common way investors tend to look at, it’s also worth exploring the absolute value creation/destruction in the ecosystem.

- Of the offerings that lost value, $8.3B was lost in post-IPO market depreciation.

- Of those that gained, $7.6B of value was created in market appreciation

- Net loss of value, therefore, was “only” $700M at year-end. That’s not chump change, but it’s surprisingly little relative to what the market felt like at year end.

Allakos, Allogene, and Armo all had greater than $1B in value appreciation during 2018, nearly 50% of the total value gains of the 2018 IPO class. On the flip side, Moderna, given its large valuation at offering, had $2.6B in losses, representing 33% of the total losses of the 2018 IPO class. Rubius’ comes in 2nd with $600M or 7% of the total losses.

Most of 2018 IPO Class’ losses happened in the 4th quarter on both a percentage and absolute basis, as one might expect with the meltdown in the markets.

With a large backlog of potential 2019 biotech IPOs, all eyes at #JPM19 will be on the institutional investor community and whether any of them will step up as anchor orders in these early offerings. This will have a big impact on IPO market sentiment heading into the rest of the year.

While 2018 was a prolific year for IPOs – one of the best ever – the last few months of stock declines did little to support the celebration. Hopefully 2019 will be different on that latter dimension.