Venture capital is a long investment cycle business, and never before has that been so clear as now in the face of the ongoing COVID pandemic. Even with the unprecedented public equity market volatility, venture investing into private biopharma companies appears to be continuing with conviction.

During March, when the public market was a rollercoaster, biopharma venture capital funding into private companies reached all-time-highs. Of the 19 “mega-rounds” bigger than $100M that closed in the first quarter of 2020, 10 of them closed in March amidst the craziness in the public equity markets.

Importantly, investors – at least as of now – have maintained their resolve. I’ve not heard of a single financing that has fallen apart in the private biotech ecosystem due to concerns about COVID. We’ve closed or will be closing over $350M in financings in March and April, and so far every investor is showing up and doing their part in the long term growth of these startups. Bob Nelsen of ARCH remarked with something similar on twitter (here, here).

Surprisingly, according to data cut from Pitchbook yesterday, the first quarter of 2020 was the single largest quarter ever for biopharma venture funding in the U.S., topping in at $5.5B in aggregate funding across 171 financings. The average funding size per round was also the largest ever: $32M per round.

Biotech has always been an odd part of the venture ecosystem. As stated in a prior blog on Strategic Planning during COVID, data is the ultimate currency of progress and value in early stage biotech, rather than “normal” business metrics (e.g., MRR, CAC, etc…). While typical industries are often affected by acute changes in consumer demand (and spikes in unemployment), this isn’t really the case with biopharma: there are plenty of unmet needs of patients where innovative new therapeutics can have a meaningful impact. Loss-making biopharma is where many of these new drugs are discovered and/or developed today: companies that get funded, and valued, based on data which accrues over years, not weeks and months.

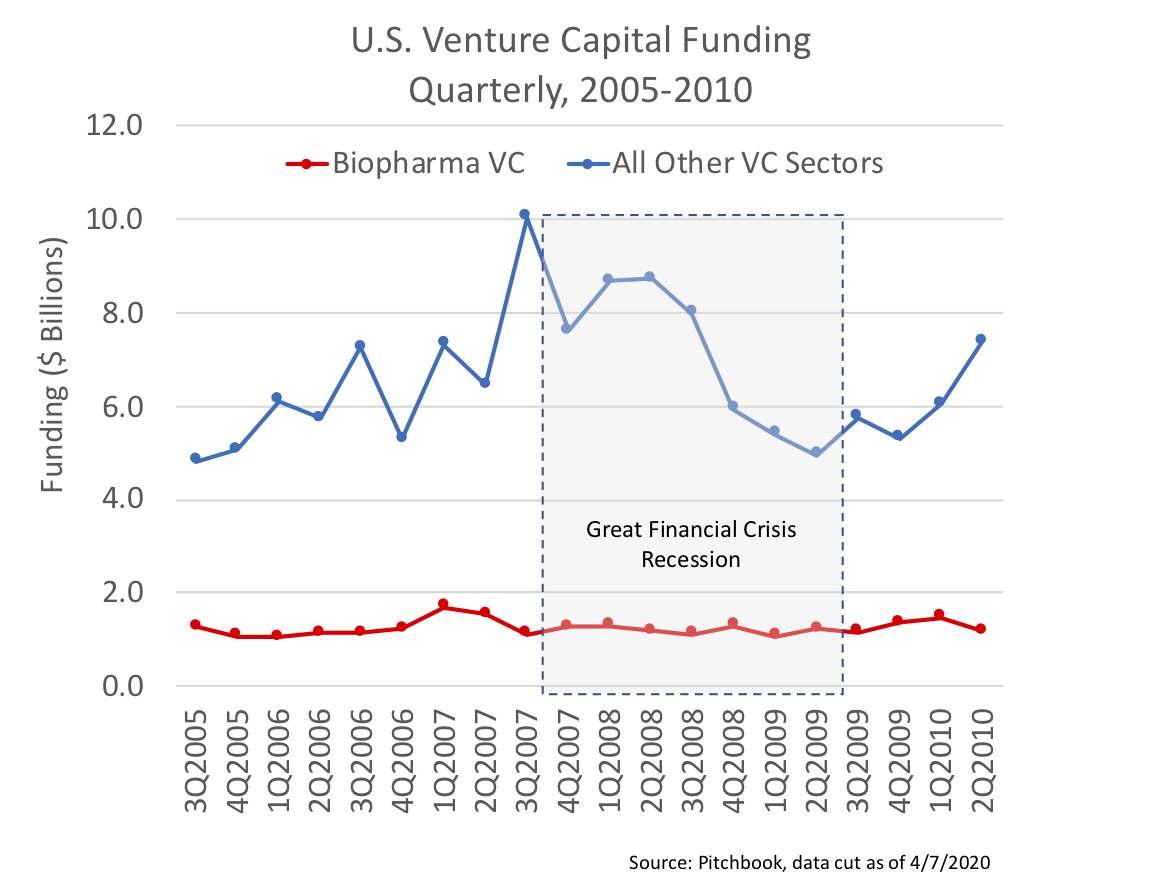

That disconnect from conventional economic cycles is one of the reasons why biopharma tends to outperform other sectors during financial recessions (here).

Furthermore, while the tech VC financing market experienced a massive 50% contraction during the 2008 financial crisis (from peak in 2007 to bottom in 2009) as banks and consumers pulled back, biopharma VC was incredibly steady during that period – averaging $1.2B per quarter steadily. Cautious sentiment and concern was voiced about how tight the biotech funding environment was, but in reality the funding levels were remarkably consistent through the period.

In light of this, and to risk some crystal ball gazing, I believe private biopharma venture funding levels will likely stay healthy over the coming quarters. While they will almost certainly come down significantly from their all-time-high of $5.5B this quarter, we should expect to see $3.5-4.5B per quarter in biopharma funding on average over the next 1-2 years – in line with the median quarterly rate over the past three years. The 2Q 2020 may also be lighter due to the social distancing practices that will likely be in effect for much of the quarter, but I think the fundamentals for biopharma venture investing remain strong. And companies need more rather than less capital now (in light of COVID delays) to make it through the typical R&D gauntlet.

This venture funding forecast is further supported by the fact that lots of “dry powder” for biopharma has been raised recently (here). By my quick estimate, more than $5B has been committed to new VC funds focused on biopharma in just the first quarter of 2020 alone, including strong firms like Deerfield, Flagship, Frazier, VenBio, and NEA (part of which is healthcare focused). This is a considerable amount of capital ready to be deployed over the next few years, complemented by the large private funding flows from crossover public funds, sovereign wealth vehicles, and global asset managers that have come into the space.

In addition to the strong venture fundraising market, we’ve seen a steady pace of partnerships between Big Pharma and biotech since the start of the year. As an example, take Arrakis’ huge new deal with Roche announced this morning. Via Endpoints, Chris Dokomajilar at DealForma highlighted nearly 100 partnerships in 1Q 2020, about a quarter of which were COVID-related (here). I expect we’ll continue to see a strong showing for collaborations, even if the M&A market has cooled amidst the market turmoil.

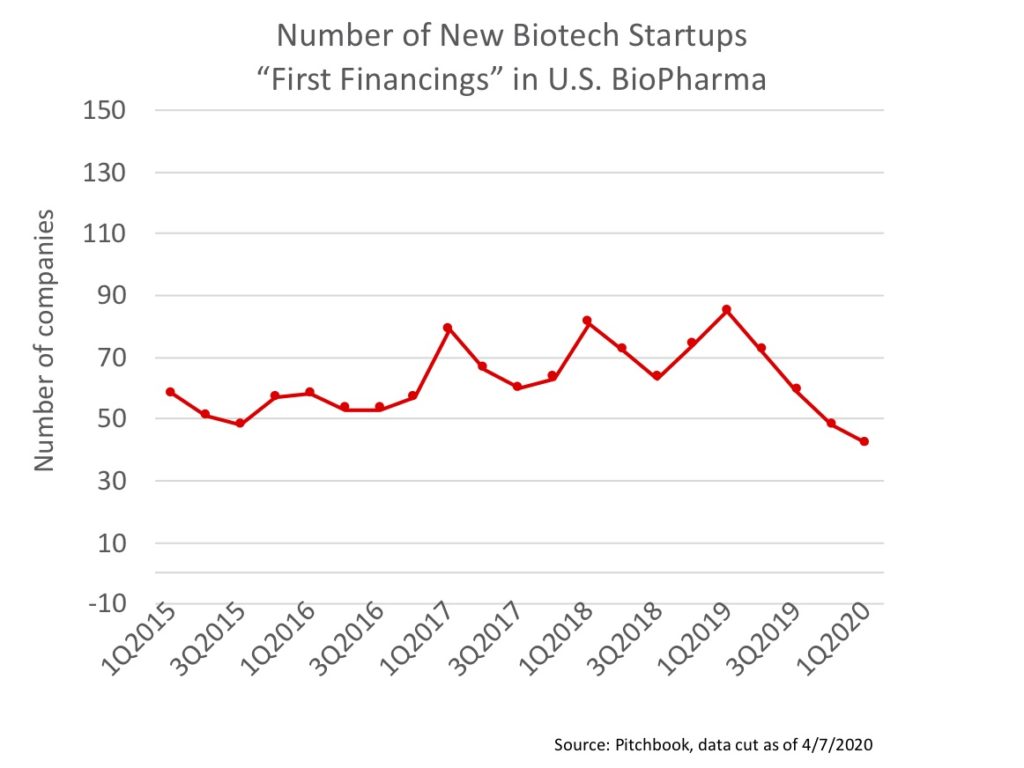

But all wasn’t rosy in the 1Q 2020’s blow-away funding numbers: a metric that I like to follow in the early stage world is how many “first financings” occurred – essentially a proxy for the number of new startups getting created and funded. This is the “substrate” that later stage investors back (and public markets welcome as IPOs) in the next few years. Earlier this year, in “Wither New Biotech Startups”, I shared data from 2019 and reflected on the shrinking number of new startups. Sadly, 1Q 2020 continued that negative trendline, falling to the lowest number in over five years.

This trendline was of course in place longer than COVID, perhaps due to drug pricing concerns or indigestion from a lengthy bull cycle, but it will almost certainly be impacted by the social distancing practices in place today over the coming quarter(s). Pulling together a new startup is more of a “roll-up-your-sleeves” endeavor – bringing people and science together at the inception – which is harder to do with Zoom. Hopefully new venture creation doesn’t stall out in the near term as folks pull back from startup formation. We certainly will do our part: the Atlas Venture partnership continues to work (remotely) on starting the next batch of innovative companies.

There are many concerns right now on the minds of biotech executives and investors, especially around R&D execution and delivery of data flow (here). But given the progress of innovation and dry powder available in the private market, I’m confident we’ll make it through the pandemic impact with a robust ecosystem of VC-backed biotech companies. Hopefully we can also reinvigorate the number of newly hatched startups in order to feed the pipeline of new therapies. Time to get back to work.