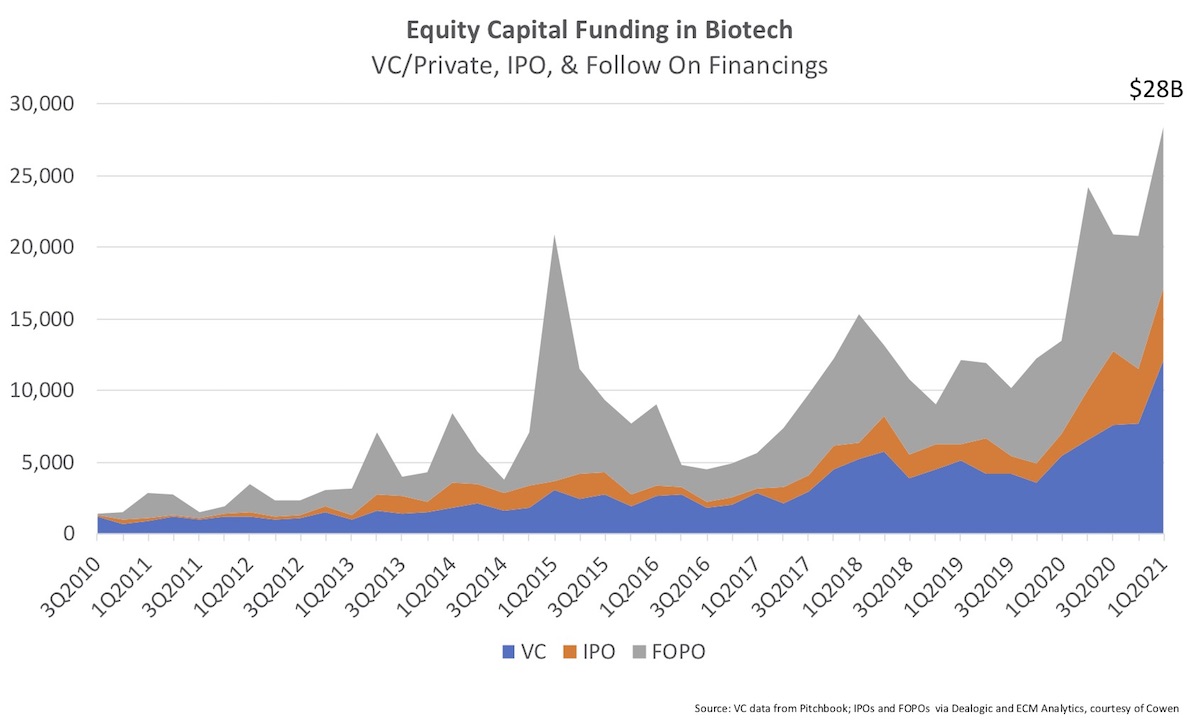

Another quarter, another set of all-time highs for biotech funding – and this surfeit of capital continues raises possible concerns about its disciplined deployment.

Back in January, when reflecting on the strange paradox of 2020, all-time-highs were across the board: private venture funding, IPOs, follow-on’s, valuations, and equity indices. While the biotech stock market has softened overall in the past couple months (e.g., $XBI is down ~6% year to date as of today, and down ~25% off of the Feb 8, 2021 all-time high), the financing environment has largely continued its record-breaking strength.

Venture funding for US-based biopharma companies in 1Q 2021 topped the charts above $12B for the first time ever according to Pitchbook; amazingly, we’ve had 4 straight chart-topping quarters in a row.

IPOs raised over $5B, making it one of the strongest quarters ever (#2 behind 3Q 2020). And public follow-on financings topped $11B, again one of the best quarters ever, behind 2Q 2020 and 1Q 2015. On average, there was almost one follow-on financing per day of greater than $20M in the first quarter. It’s worth noting, though, that since the mid-February peak in the stock markets, while privates and IPOs have continued apace, discounts on follow-on financings appear to have widened – in line with some softening of the overall market.

Overall, we saw an eye-popping $28B in equity capital financings in the first quarter across venture, IPO, and follow-ons – the biggest ever.

Much of these data, and others like it, reflect the strength of the current financing market for aspiring biotechs – and this a very good thing to see. Assuming its being used to advance meaningfully impactful new medicines, this is great news.

But, as I’ve opined many times before (here, here), as the cost of capital goes down, the risks to the discipline of deploying it go up. The average health of the herd goes down with an over-abundance of food sources.

No investor ever really thinks they are being undisciplined in how they invest. Most early stage “patient” investors still have their eye focused on the long-term, hoping to advance medicines to patients, as the latter is the key to sustainable value creation in our sector. But obviously not all investors’ actions match that long term view, especially amidst the rising tsunami of funding activity. Some know, and may even openly acknowledge, they are backing pure “momentum” plays in a frothy bull cycle. They might be hoping to cash in before challenging reality of drug R&D meets up with the often over-promotional hype of the latest modality or “transformative” discovery approach. But many investors are clearly caught up in the excitement and willing to suspend judgement while the markets are working. In the words of Citibank’s Chuck Prince in 2007, “… as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Further, no credible biotech ever really thinks they are being undisciplined either. It just creeps quietly into the model, finding its way into the discourse of the management team and Board. “XYZ raised this much, we should raise more… They upsized, so should we… Those guys are hiring fast, we should hire faster… We have enough chemists on that project, but we should put 3x more since we have the funding… We need more programs to work on, this one looks good enough… Rents are high, but we’re going to need the more space so let’s lock it in now…”

We’ve all heard versions of these kind of discussions amongst teams, Boards, and investors – and often without calibration to the intrinsic risks of advancing novel drugs against challenging targets often with new modalities. Resource allocation is often disconnected from risk management in these discussions.

The end result is we have biotechs that are booming – with bigger space, bigger teams, bigger portfolios – which is great for everyone when the music keeps playing. But irrespective of whether their drugs reveal themselves to work, pre-revenue biotech still has to feed all the costs of the growing beast with frequent equity financings.

In addition, the feed-forward flywheel of biotech financing psychology also happens. It goes like this: successful and/or lucky biotech firms are able raise large amounts of cash onto their balance sheets through both financings and deals. Initially, their plan was to do X, advancing new medicine(s) down the road towards patients. But in the presence of an abundance of cash, they often expand their goals to not only do X, but also Y and Z. Rather than have, say, 4-5 years of cash runway, the influx of capital changes the pace and nature of their “use of proceeds” – such that now its “just” 2-3 years of runway. Their focus gets spread over more things, and both “strategic complexity” and its distracting cousin “organizational entropy” increase. Management teams are challenged to address more things, more frequently. New eager investors encourage them to raise even more money so they can have a stake in the story. In short, the presence of more cash often makes burn rates go even higher, re-tightening runways, and requiring more follow-on financings.

I’d argue this is actually pretty normal in the corporate lifecycle; it’s human nature, after all. More resources to deploy often changes one’s appetite for things. Further, for emerging companies, in a bull market it’s often smart to take advantage of the availability of cheaper capital to strengthen balance sheets and strategically expand one’s scope. But, importantly, it’s not always the prudent thing to do, and the best management team knows how to dial in the right levels of resource allocation linked to risk mitigation. Sadly, I’d argue that historically many biotechs haven’t done this judiciously.

In light of these dynamics, there’s a real risk today that many companies, and indeed the sector as a whole, are becoming addicted to these copious injections of capital.

What happens when things tighten up?

The dispersion between winners and losers will get much wider. Those who have discovered and developed solid drug programs and are fortunate enough to generate compelling data won’t have a problem under most scenarios – there is almost certainly going to be plenty of appetite for innovative new medicines over the next decade.

But for those that struggle to generate compelling data, either because of program failures or simply delays of good programs, the cost of capital could increase dramatically. Burn rates will have to be cut (with the cultural and emotional damage that occurs with those cutbacks), as raising capital will get harder.

Importantly, this isn’t an “if” question in my mind. It’s a “when” question, because cycles are intrinsic to the way the equity markets work. Bulls and bears are constantly battling each other, and bulls have largely been winning for most of the last decade.

Companies would be smart to plan for various bull and bear scenarios for the future… if our data are great, and the markets are strong… if our data are great but the markets are weak… if our data are weak but the markets are frothy… Many permutations exist that are worth thinking through.

These cycles can see the cost of capital swing by 30-50%, and we will continue to see these happen. As a reminder, we saw temporary bear “corrections” in 2H 2015 and again in 4Q 2018, in the range of 45% and 30%, respectively. We’ve already seen a 25% softening in the $XBI since peaking in Feb 2021. Torreya Partners in their mid-April weekly report said “The Biotech Party is Over” – which could be prescient or premature, only time will tell.

Importantly, it’s totally normal for the R&D-stage biotech markets to move with this type of volatility, as its driven more by sentiment and data than by financial metrics like earnings multiples. Warren Buffet’s words couldn’t fit biotech more: “Remember that the stock market is a manic depressive.” Cycles like this will continue to happen, even if we’re very optimistic about the longer term prospects for the sector.

This isn’t meant to be fear-mongering about the state of the markets and burn rates, just a gentle reminder that both investing discipline and spending discipline matter.

For the time being, we remain in a long horizon bull cycle with a historically low cost of capital – which means companies should be opportunistically raising capital from long term investors to strengthen their balance sheets while diligently trying their best to maintain discipline on its deployment.