Fund flows between sectors are a critically important dynamic in the equity capital markets: when net fund flows are positive, more demand for equity exists and stock price movement bias upwards; conversely, when fund flows are negative, the selling pressure softens markets.

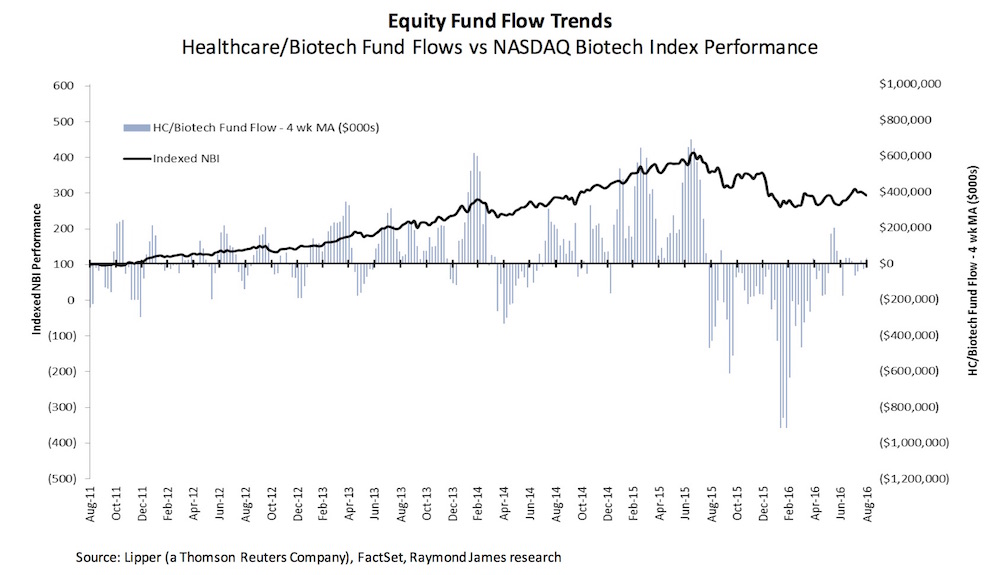

During the bull market of the last five years, these fund flow dynamics have indeed been major players. The chart below, shared kindly from Raymond James, captures five years of fund flows in/out of Healthcare/Biotech (in the columns) and compares it with the NASDAQ Biotech Index (NBI, the black line). As expected, periods when fund flows are strongly positive tend to correlate with upward movements in the NBI, and vice versa.

These data represent the flow of funds into or out of specialist healthcare/biotech investors, as reported by Lipper/AMG Data Services and shared by Raymond James; the data encompass 104 funds and about $50B in assets, so is a good measure of the directionality of fund flows in the sector.

From early 2013 through August 2015, about $16.4B has flowed into these sector-focused funds. Since August 2015, $11.9B has flow out of these same funds. These net flow changes obviously shape a portfolio managers’ overall allocation decisions. Net fund inflows need to be deployed into the markets (as many institutional managers need to be at or nearly “fully invested” and can’t sit on large amounts of cash); and, net fund outflows require cash so need to be funded via the sale of positions in the portfolio.

But are these specialist fund flows even important given how small they are relative to the trillions in assets under management sitting in generalist funds?

The downdraft in the NBI over the last year is frequently attributed to the flight of generalists out of the sector. As biotech went out of favor for a variety of macro reasons (like drug pricing), generalists cycled cash out of the sector and into other industries or the sidelines. And we won’t see a real bull market back in biotech until we get the generalists back – or so goes the oft-cited conventional market wisdom.

But this “blame the generalist” view of the sector’s performance is wrong, according to some intriguing new data from Peter Reikes, Vice Chairman if Stifel Nicolaus & Co, and his colleagues. Reikes et al published an outstanding guest commentary in BioCentury earlier this month titled “The Generalist Investor Blame Game.”

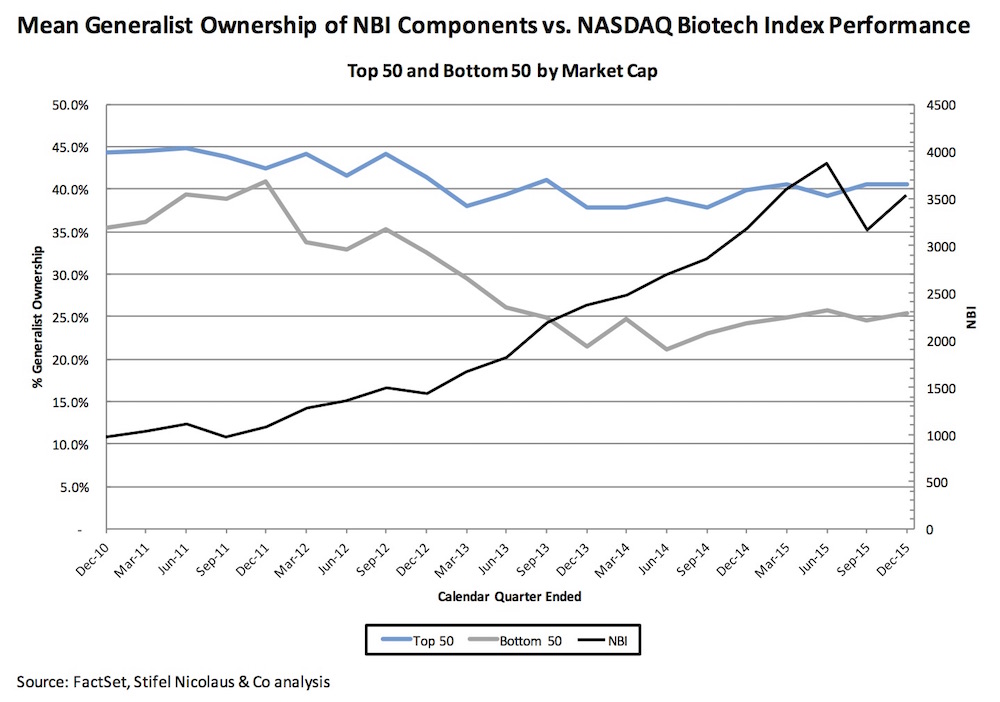

Here’s the essence of their analysis: if generalist flows into the sector were the big driver, we’d see the share of the top holders in biotech stocks that were generalists go up during bull markets and down in bears. So they constructed a huge dataset to test this hypothesis. They looked at the top 20 institutional holders of the largest 50 and smallest 50 biopharma companies in the NBI over 21 quarters through December 2015 – this amounts to 42K data points.

The percentage of generalist investors in the top 20 holders of these biotech stocks went flat or down during the bull market, not up as you’d expect if the conventional wisdom was true.

As you might intuitively guess, the largest companies in the NBI had higher levels of generalist investors (40% at end of 2015), which was largely unchanged during this period – despite the stock appreciation and significant P/E expansion of these large cap names.

Very surprisingly, the smallest 50 companies in the NBI saw their generalist investor contribution shrinking by 40% or more (from 35%-40% to 20-25% over the period) – directly the opposite of what the “blame the generalists” thesis would suggest. For the deeper analysis of the data, I’d encourage readers to check out the commentary.

The reality is specialist healthcare investors remain the dominant players in our space, and are critically important in driving demand for biotech stocks. Coming full circle, it’s also why fund flows in/out of these specialist funds is such an important element to watch.

But fund flows aren’t everything, obviously. Another important element in shaping equity demand in biotech is M&A. In fact, biotech acquisitions can be a double accelerator of demand. First, big deals drive positive sentiment changes. Allergan’s recent purchases got everyone speculating about who was the next to be bought and how big would the premium be. With Medivation’s purchase by Pfizer, there was rampant speculation about whether other PARPs would drive further big deals. Similar speculation circled around Receptos, Synageva, StemCentryx, and other large purchases. Sentiment changes can often have high impact on the investing herd. Second, beyond just sentiment, M&A also sends cash back to institutional investors, which has to get redeployed. It’s often redeployed back into stories that look like their last winners, especially for specialist funds (who are often the vast majority of the top 20 holders). For comparison, all the IPOs since Oct 2013 (3 years ago) raised gross proceeds (~$13B) that are less than the Medivation acquisition value ($14B) alone. It’s also much bigger than the aggregate fund flows in the first chart. A few large acquisitions can swamp other impacts – as M&A cash recycling can be a significant positive driver even with neutral aggregate fund flows.