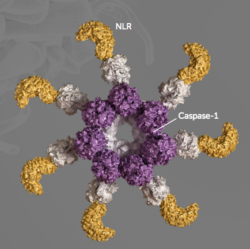

Today Novartis announced the acquisition of IFM Therapeutics’ portfolio of NLRP3 antagonists, via the purchase of IFM Tre, a subsidiary of IFM (here, here). These immunomodulatory medicines target the inflammasome, a key innate immune node whose pathologic chronic activation is associated with several metabolic, fibrotic, autoimmune, and neurological diseases.

Under the terms of the agreement, IFM will receive $310 million in upfront payments and will be eligible for up to $1.265 billion in milestone payments, for a total of $1.575 billion in total consideration.

IFM’s programs complement the existing Novartis pipeline of anti-inflammatory medicines, and build off of the strong clinical validation around the role of IL-1 signaling in a broad range of inflammatory disorders established by the CANTOS trial, among others. The three assets Novartis will be acquiring include IFM-2427, a clinical-stage systemic NLRP3 inhibitor for an array of chronic inflammatory disorders (e.g., gout, atherosclerosis and NASH); a preclinical gut-directed molecule for the treatment of inflammatory bowel disease; and, a preclinical CNS-penetrant molecule to address neuroinflammation.

Remarkably, this is the second transformative deal struck by IFM around its innate immune portfolio in less than 2 years. Back in August 2017, BMS acquired IFM’s preclinical STING and NLRP3 agonist programs aimed at enhancing the innate immune response in cancer, for $300M upfront and up to $2B in milestones. At that time, the team and non-oncology assets were spun out as IFM Therapeutics LLC , a holding company somewhat akin to the Nimbus Therapeutics LLC model. Since then, two mechanism-focused subsidiaries were launched: IFM Tre (housing the NLRP3 antagonist portfolio acquired by Novartis today) and IFM Due (focusing on cGAS/STING antagonists for serious inflammatory and autoimmune diseases). With IFM Tre’s acquisition, this is now another example of an acquisition-spinout-acquisition, a phenomenon discussed previously.

As in the past, here are a few reflections on the deal

- Team. Team. Team. Backing great teams has been a key to Atlas’ success, and IFM under Gary Glick’s leadership is a great example of this. As a group, they’ve been involved in dozens of startups. And together, at IFM, they’ve now delivered exciting new medicines into the hands of top tier pharma partners twice. Successful serial entrepreneurs with a real nose for drug discovery, who can integrate biology, chemistry, biophysics, and pharmacology into a high momentum biotech program(s), are incredibly valuable in our business. As noted back in 2017, Gary has done a great job in building the IFM story by assembling an all-star roster (e.g., Martin Seidel, Dennis Dean, Bill Roush, etc). Atlas partner and IFM Chair Jean-François Formela, as well as Atlas’ Michael Gladstone, were also both integral members of this broader IFM team since the company’s inception. In addition to this crew, I’d call out the inflammasome-related contributions of the academic partners of IFM – in particular Eicke Latz and Matthias Geyer at the Institute of Innate Immunity at the University of Bonn, who have been superb advisors for IFM. Getting some of the best and most knowledgeable people in the world engaged with your startup is critical.

- Conviction on the innate immune biology. Gary and the team are passionate about the role of innate immune biology. After delivering the agonist programs – which enhance the innate stimulation of the immune response – to BMS for cancer back in 2017, the team focused all their attention on blocking innate biology for autoimmune disease.

The NLRP3 inflammasome has been a hard to drug but well-validated target for years: human genetics links it to a number of conditions (e.g., NLRP3 mutations are implicated in Muckle-Wells Syndrome and other rare fevers); pharmacological pathway validation exists with broad range of IL-1-related approaches; and lastly, the CRID3/MCC950 tool compound has been out in academic and industry hands for almost a decade helping elucidate more about the approach in preclinical settings. That said, CRID3’s drawbacks as a drug were challenging, and limited success was made in getting new chemical matter beyond those tool compounds. That’s where Gary and his team stepped up, armed with conviction around the biology and a commitment to cracking it.

The NLRP3 inflammasome has been a hard to drug but well-validated target for years: human genetics links it to a number of conditions (e.g., NLRP3 mutations are implicated in Muckle-Wells Syndrome and other rare fevers); pharmacological pathway validation exists with broad range of IL-1-related approaches; and lastly, the CRID3/MCC950 tool compound has been out in academic and industry hands for almost a decade helping elucidate more about the approach in preclinical settings. That said, CRID3’s drawbacks as a drug were challenging, and limited success was made in getting new chemical matter beyond those tool compounds. That’s where Gary and his team stepped up, armed with conviction around the biology and a commitment to cracking it. - Focus on targeted product execution vs diffuse platform building. These days we often read about huge mega-financings to explore big new areas of biology or novel modalities. Nothing wrong with that kind of deal in the right setting, but IFM Tre wasn’t one of them: it was a clean, focused, high-powered execution machine and a case study in capital efficiency. Gary and the team, and its investors, dedicated significant capital to driving the NLRP3 inflammasome programs forward, but the spend was all geared to generating new drug candidates, not exploring the unknown edges of novel science. At one point, over 70 chemists were actively deployed against optimizing the chemical space that IFM was pursuing; for context, that’s a massive effort, and a 3-4x multiple of the number of chemists on a “typical” drug discovery program. Fair to say the campaign was well worth it – IFM went from inception of the program into the clinic in a remarkably fast 19 months.

The IFM story has been breathtakingly productive and created an enormous amount of value. The company was co-founded less than four years ago by Gary Glick and Atlas Venture, was seeded with its initial financing in October 2015, and was incubated early in its life inside of Atlas. Since then, two of their therapeutic programs are in the clinic, a third is about to enter FIH clinical studies, and three more are in advanced preclinical studies – and all of these were originally de novo discovery programs addressing various aspects of innate biology. During this time, they’ve raised less than $60M in equity capital from investors and generated $610M in upfront payments and future milestones that could exceed $3B. Truly impressive delivery of value.

Even more exciting – it’s not over. We’re all super keen on IFM’s third chapter – IFM Due (pronounced du-way) – a subsidiary focused on advancing a portfolio of cGAS inhibitors and STING antagonists to block excessive interferon production via those innate immune pathways. Given their track record and demonstrated nose for drug discovery, we suspect this crew of incredible serial biotech entrepreneurs will be back with more progress soon.