Two recent offerings, Kythera and Intercept, both ripped out of the gates with 20% rallies above their offer price last week. A flood of new S1 filings is to be expected. With all that inventory out there of emerging private biotechs, I’d guess there will be lots more confidential S1s heading down to the SEC soon.

But are these recent IPO’s really signaling a change in public market buyside appetites? It’s true that the biotech sector has performed very well this year in the public markets, and the IPO classes of late have outperformed in the aftermarket vs IPOs of other sectors (here). All of us are hopeful that a true IPO window opens at attractive costs of capital – this would enable lots of companies to raise the significant financing required to grow into late development and commercialization. But I’m not sure that’s happening – the early 90s model of a 2x up-round each step of the way from the Series A to the IPO is still not back in fashion.

That said, it’s clearly a good thing to see companies like Kythera and Intercept do well in their offerings – a combination of great assets, strong teams, and smart IPO pricing. And I’m sure there will be more offerings like these over the next few quarters.

Unfortunately though, I think it would be an over-statement to conclude that these IPOs are “lifelines” to venture investors, as my friend Luke Timmerman has suggested (here). IPOs in recent years have traded well in the aftermarket, but in aggregate they have not generated a great return for their VCs (due in part to challenging pricing). And LP’s are wary of celebrating paper values of IPO stories only to see them trade down as illiquid stocks before the lock-up expires.

To better understand the relative attractiveness of the IPO market, and how their venture backers have done so far, I thought it would be illustrative to look at the biotech IPOs that have made it public since early July in greater depth: Durata, Hyperion, Regulus, Kythera, and Intercept.

At present, none of these five offerings reflect fantastic “homerun” returns, but there’s room for optimism around a few of them. In aggregate, they’ve raised nearly $750M privately and in their IPO offerings, and are worth a combined market cap of $1.2B today. The average return for investors who bought into private rounds in these companies is 1.2x or so after 3-5 years (some lower, some higher). By my estimate, none of these on paper are above a 3x for any of their venture backers at this point – so all remain below the top quartile from a current “exit value” perspective (though none of the VCs have sold shares or are likely to in the near term). But these IPOs have provided significant funding for these companies to push their products forward, and hopefully see significant stock appreciate from here.

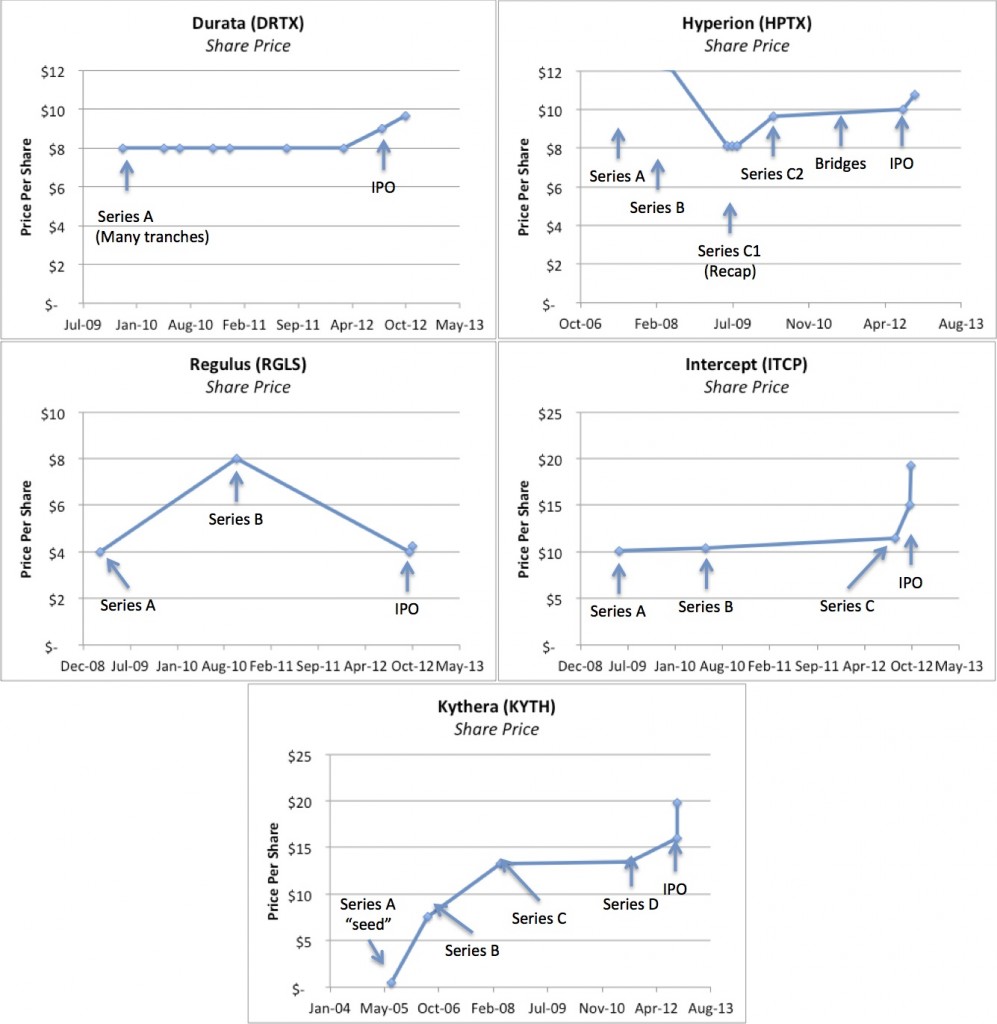

To highlight the nuances around the pricing and financing of these stories more clearly, I’ve taken a look at their share value over time. These data are gleaned from their S1’s, so may be wrong (not always easy to calculate) and likely miss the potentially large impact of warrants and other conversions that provide lower implied cost-basis for some investments.

But the snapshot below shows the trends:

Durata: This was a deal with a heavy-weight syndicate from the start to support the company through its public offering. They knew they’d need a lot of money to get dalbavancin approved and the syndicate funded it each step of the way at a pre-defined $8.00 a share for $78M. The IPO was at a slight step-up, and involved insider participation as expected. VCs in the deal are now sitting at a 1.2x (20% up) on their investment from 2009. Despite the lack of paper returns, they are now well-financed to get dalba across the goal line and see the stock appreciate over time.

Hyperion: A tougher story than others in this IPO lineup, with over $110M raised prior to the IPO and real FDA challenges. The original $22M into the Series A and B rounds of 2007-2008 were washed out to zero essentially in the $60M recap of the large Series C. Then a series of bridges in 2011-2012, convertible into shares at the IPO price, were put in place for $32M. The extra burn was almost entirely due to the FDA issues around the SPA on the lead program (so much for late stage deals being less risky). This makes the implied private share cost basis for the VCs in the deal from the start above $12+ per share, even with the warrant coverage of the bridges. They were able to dollar-cost average downward with their insider IPO purchases. So at today’s share price, this one feels like a paper loss right now; but like Durata, its now well financed to be able to turn the card and create value from the program. Onward and upward.

Regulus: This is a unique one. Not only is it the sole preclinical stage company in the mix, it also is the only IPO (in a long time) to have never been priced by institutional investors as all the shares sold privately went to its parents, Isis and Alnylam, or its strategic partners. In fact, the participation of its partners in the IPO was considerable and certainly helped in getting this early stage company out into the public markets (kudos to them on using smart BD to anchor the IPO). On pricing, it was tough: the IPO valuation was at the same share price as the Series A round back in 2008, and Sanofi’s shares are underwater. I’m a big fan of microRNA biology so am hopeful that they (and others in the field, like Miragen and Mirna) help deliver great therapies and real value from the approach.

Intercept: Another relatively unusual deal in that Intercept raised most of its capital from the Genextra SpA group: both its Series A and B rounds (~$50M) were committed by them at ~$10 per share, according to the S1. Their position is now sitting close to a 2x. The recent Series C was at ~$11.50 in August 2012, where Orbimed joined the syndicate. Based on the current price, Orbimed is already sitting at 1.7x (up 70%) in a few months. New Leaf looks like they also bought into the IPO according to the S1; already sitting at 30% uptick in a handful of days, so looking very smart right now.

Kythera: This aesthetic medicine company is probably the most interesting IPO of the group from a venture perspective. It began life as AestheRx in 2005 with a $900K seed investment from Versant, backing CEO Keith Leonard and the founding team. It raised a Series B less than year later at ~$7 per share with ARCH and Prospect. Both a Series C and D followed, at ~$13 per share, where the existing investors and others committed the bulk of the private financing for the company – they’ve raised nearly $110M privately to drive their lead dermal fat reduction therapy. Based on the ownerships in the S1, the average cost basis for Versant is probably around $8 or so. At the IPO price of $16, and the first day close near $19, this looks like a solid 2.5x return for Versant at the current valuation. Congrats to them for a solid investment here. If the team continues to deliver, this could be a significant winner over time.

Time will tell if these five IPO’s shares will appreciate in value in the public markets, which is obviously the hoped for plan for the venture investors. As of right now the jury is out on whether these are really worth celebrating with LP’s as homeruns or even “lifelines” for raising funds. But several have lots of promise. The reality is the top decile of venture exits in today’s environment, or north of 5x returns on invested capital, continue to be had at a higher frequency from M&A deals with Pharma than from going public. It will be nice if this changes, but for structural reasons this is unlikely.

Its not that the public markets are tough places to make money: its fair to say that the public markets, and PIPES into beaten up stories in particular, have generated sizeable returns of late (e.g., witness Sarepto’s 12x swing upwards in 90 days, Jazz’s 50x return from the spring of 2009); unfortunately, these aren’t typically coming from recent IPO stories.

But maybe they will soon. I’m hopeful these and other recent IPOs will bring life back into this part of the market. But hope isn’t a strategy, so I’ll keep focusing on finding acquirers for the portfolio in the meantime.