As 2013 begins, and the JPM conference is behind us, it’s a great time to reflect on the state of the biotech industry and the sentiments around early stage investing in particular. While pessimism abounds in many corners about the current and future health of emerging biotech, the reality is that the sector has been quietly scaling its wall of worry.

For years we’ve complained about a triple threat of worries: FDA obstacles, poor public markets, and a perceived lack of funding in biotech. Some of this we’ve done to ourselves (and deserved), as I’ve noted before (here), but 2012 in particular has challenged these concerns with positive data which should manifest into real improvements in the early stage climate. I’ve been accused of being a Pollyanna about early stage by some, but I think the data support a more optimistic view than is widely held by many stakeholders and observers. Unfortunately even with good data it will take time to turn bearish sentiments into bullish ones, but I think the fundamentals are pointing in the right direction. Let me take on each of the big three “worries” that has plagued our sector of late.

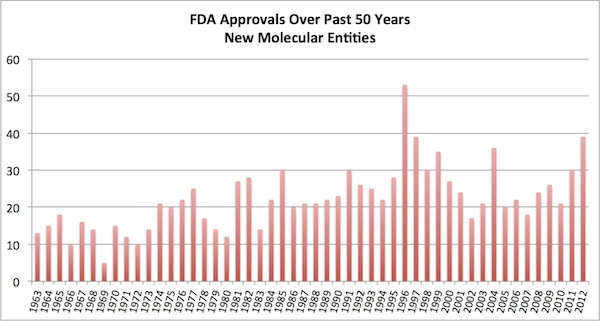

FDA and the regulatory landscape. Last year we witnessed 39 new molecular entity drug approvals by the FDA, one of the three best years in the past half-a-century (yes, 50 years!). 2012 was only bested by the outlier year of 1996, which at 53 included a big “drug lag” cohort pushed through in the wake of PDUFA I (passed in 1992). Coupled with a big year in 2011, this is a great sign that the decline in approvals may be reversing. According to FierceBiotech, McKinsey forecasts 36 or so approvals each year through 2016. This is great news, and would make for one of the best five years in the history of the Agency.

Lots of others have already written about the positive and negative attributes of these 39 approvals (here, here, here). It’s worth noting that most of the critique is that many of the drugs last year were either approved for orphan diseases or were me-too incremental innovations. These criticisms may well be true, but this isn’t much different than others years. Taking the outlier 1996 cohort of approvals as an example, how many readers of heard of blockbusters like Albenza, Cerebyx, ProAmatine, Elmeron, and Zanaflex? All of those were orphan drug approvals. And what about the incremental me-too innovations approved in 1996: Lipitor, Crixivan, Humalog, Zyprexa, and Diovan. They all did reasonably well. I have no reason to believe the Class of 2012 drug approvals won’t have some strong performers.

Lots of others have already written about the positive and negative attributes of these 39 approvals (here, here, here). It’s worth noting that most of the critique is that many of the drugs last year were either approved for orphan diseases or were me-too incremental innovations. These criticisms may well be true, but this isn’t much different than others years. Taking the outlier 1996 cohort of approvals as an example, how many readers of heard of blockbusters like Albenza, Cerebyx, ProAmatine, Elmeron, and Zanaflex? All of those were orphan drug approvals. And what about the incremental me-too innovations approved in 1996: Lipitor, Crixivan, Humalog, Zyprexa, and Diovan. They all did reasonably well. I have no reason to believe the Class of 2012 drug approvals won’t have some strong performers.

Irrespective of whether these drugs help drive big economic gains for Pharma, they certainly reflect an FDA that is increasingly open to approving new medicines, especially those that are real, innovative products. Many of the first-in-class agents approved last year were reviewed faster then their full PDUFA-directed review time. This and other efforts, like the Breakthrough medicine concept, reflect an FDA that is trying, and succeeding at least in part, to adopt a more innovation-friendly posture, and this bodes well for early stage biotech as we need clear paths to regulatory approval.

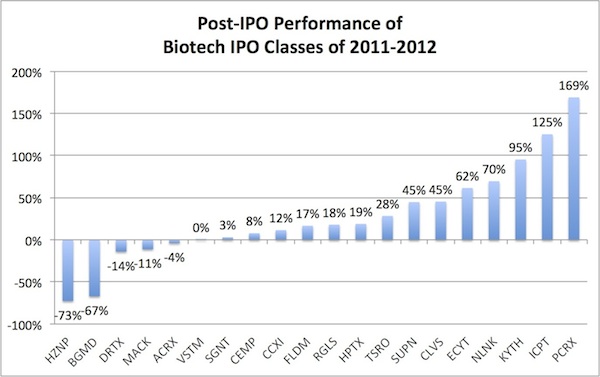

IPOs and the public market for biotech. While I’m often a critic of the “go-public” path for aspiring biotechs, its fair to say that post-IPO performance of the class of 2011-2012 has done exceptionally well. Of the 20 biotechs that priced IPOs in that period, 75% are above their trading price, with an average and median gain of 27% and 17% respectively. Intercept and Pacira have more than doubled, Kythera is up 80%, and even preclinical stories like Regulus and Verastem have held their own. This is much better than in many prior biotech vintages of the past decade where two-thirds traded down in their first 12-24 months under the pressure of future fundraising expectations. However, it remains a real issue that the pricing of IPOs is a massive challenge (and I still won’t advocate for the IPO path for most biotechs), but for much of the 2000s both pricing and after-market performance were issues. At least we’re trending well on the latter and hopefully the former will follow suite. We obviously need both to create a healthy public market for new biotech offerings.

A related point to the improving IPO landscape is that many of the buysiders that would buy into these offerings are recognizing that great companies are getting plucked off by Pharma before they get to the public markets. This has led to a influx of buyside interest in late stage stories again. Take Agios and Foundation Medicine – both have raised considerable amounts of capital from buyside investors at very high valuations. In fact, Agios may be the highest valued preclinical stage company I can think of, reflecting the confidence the market has in David Schenkein, his team, and the cancer metabolism field. Seeing some of these emerging success stories come to fruition with solid IPOs or M&A deals will be further catalysts for addressing the public market worry that many early stage investors currently have.

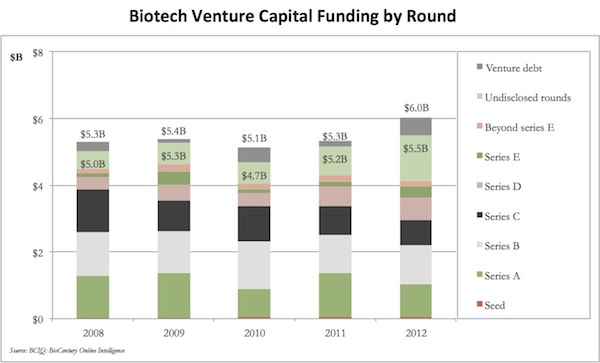

Funding. The quarterly vacillations in venture funding usually create lots of fanfare, especially amongst the Chicken Little’s of the sector, but the aggregate annual funding numbers for the past few years are surprisingly strong. Based on BioCentury data, $5.5 Billion was invested in venture-backed biotechs in 2012, up from 2008-2011, and it includes ~$1 Billion for Seed/Series A investments. Given the outcry about funding drying up, this is pretty robust.

At the New Paradigms meeting (a satellite of JPM Conference), a panel I was involved with discussed the perceived funding gap and whether great companies were still getting financing. The unanimous view was that innovative new startups were continuing to attract capital. I do share the concern of many about the number of new startups being formed in biotech; its down from its historic range of 80-100 per year, and is worth watching closely. These new startups will be what feeds the later stage funding cycle and future IPOs. That said, a flip side to this is that as an early stage investor involved in creating these new startups, the supply-and-demand dynamic reinforces my belief that this a great time for early stage venture creation. Many entrepreneurs I know feel the same way.

Although the aggregate funding numbers remain strong, its very clear that the mix of investors in these financings has changed. As noted above, the buyside and in particular hedge fund investors are supporting some of the later rounds. In addition, the early stage rounds have seen a significant increase in corporate venture capital involvement (discussed here, here). As I’ve commented previously, some 80%+ of our new deals are now syndicated with Pharma VCs. These corporate players are also actively filing the coffers of standalone venture firms through an increasing number of LP relationships. Lastly, a new crop of life science VCs have emerged. Beyond big new players, like Third Rock Ventures and VenBio, there are a number of smaller and/or regionally focused LS investors including Remeditex Ventures (coinvestor with me at Miragen), Allied Bridge Gap Ventures in Boston, City Hill Ventures, NaviMed Capital in the device space, and a number of others.

I’d be remiss if I didn’t acknowledge that there’s a huge bias against Life Sciences in the current LP environment; LS is clearly a contrarian bet today, and its not easy to raise funds from traditional LPs for either hybrid funds (Tech + LS) or LS-only vehicles. This negativity is a major concern, but hopefully continued solid data on LS returns, coupled with an embrace of data-driven decision-making by LP’s, will change this sentiment for the better.

Beyond the directional improvement around these big three worries, I am encouraged to see that innovation is continuing to be rewarded, through both earlier stage M&A deals with great venture returns (like Phase 1-2 exits at Calistoga, Amira, Avila, Stromedix, Enobia), as well as in the public markets, as I’ve written about recently (here). Further, Pharma’s posture has changed for the better towards early stage innovaiton, and it appears keen on helping facilitate but not suffocate translational efforts beyond their walls (here). These trends also bode well for early stage biotech.

We live in an era of big biology: we’ve taken ten years, but the real fruits of genomics are finally ripening and exciting new medicines are being developed. This is a great time to be in early stage translational research, and I’m hopeful the FDA, the public markets, and the funding environment continue to trend favorably. As a sector, we’re scaling the wall of worry and I look forward to a great run of successful investing in innovation over the next few years.