For the first time in over a decade, there’s real talk about an open IPO window for biotech companies. The NVCA’s second quarter update highlighted that venture-backed biotech outpaced all other industry sectors in the number of IPOs and the amount of capital raised. Underneath the exciting aggregate statistics are a set of interesting stories and observations, and I thought I’d share a few based on my vantage point as an early stage investor.

Bankers talk a lot about companies getting out with “premium” valuations as being evidence of an open IPO market. That may be true. But if you raised $200M and got out at $200M that doesn’t sound like a “premium” valuation to me. Those market cap’s are certainly nothing to sneeze at, but recognizing that you spent that amount of capital and didn’t increase your valuation or generate a return is a challenge.

My take on an “open window” is this: it is a truly an open IPO window when the cost of capital for building biotech companies in the public markets is dramatically lower than in private markets dominated by venture capital funding. Said another way, an open IPO window is when early stage risk-takers get paid a premium for putting their capital and time into nascent startups, building them to a point where the public markets will pay up for them. This really hasn’t been the case, as a whole, for much of the past decade.

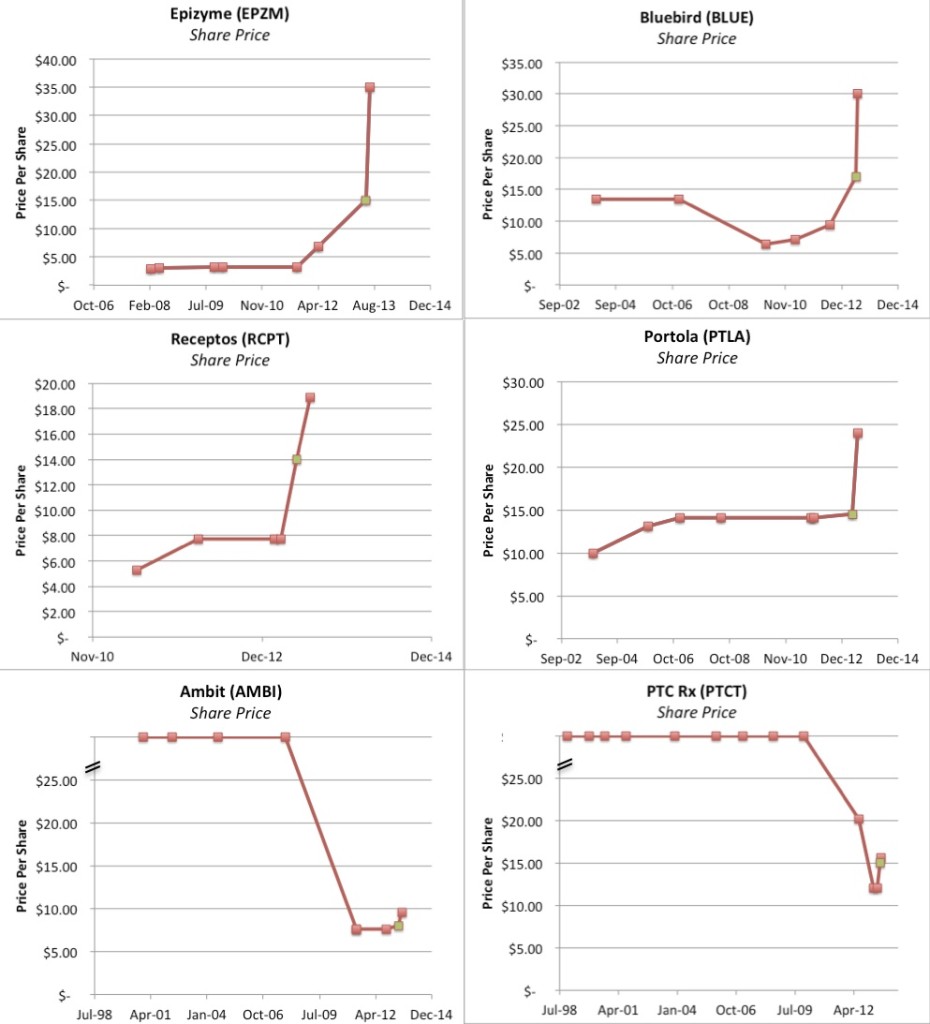

By that definition, though, is the curent IPO window truly open? Like many things in life, it depends. Taking a deeper look at six of the recent quarter’s IPOs, its clear that the markets are selectively offering access to lower cost of capital to strong stories, and younger ones. Here’s my quicktake on these representative examples and their share price charts below:

EPZM: From my early stage investor standpoint, the clear winner of the 2Q appears to be Epizyme. Early Series A investors like MPM in that deal are sitting at over a 10x return at this point on their 2008 financing. The Series A was around $3.00 per share, and EPZM hit $35 this morning. In addition to great science, they only raised ~$75M in equity capital prior to their offering. Five years, $75M in venture capital, and a market capitalization today of nearly $1B – that’s compelling.

BLUE: Since its relaunch as bluebird bio its been a great success story – increasing in value from ~$6 per share in its relaunched Series B up to $30 this morning. The company has raised $250M+ in equity capital but its done so since the 2010 restart at steadily improved prices (and therefore a reduced cost of capital). A handsome return for Third Rock who led the Genetix-to-bluebird relaunch. Unfortunately, in its prior life as Genetix the company raised a good deal of capital at higher adjusted prices back in the early/mid-2000s. At the current price though even those investors must be pleased.

RCPT: Receptos looks like its been successful at accessing improved cost of capital to fund its clinical programs; formed out of Apoptos after the latter ran into issues, the company repositioned itself in 2011, got its S1P program into the clinic, in-licensed an Abbott mAb, and is up 2x+ since that time. It’s traded nicely up since it’s offering. Unfortunately, several of the venture investors in Apoptos didn’t follow the story through its pivot into Receptos, and presumably missed out on the value accretion. Congrats to Venrock and others for sticking with the story.

PTLA: Portola has been a fundraising machine for a decade, raising nearly $300M in equity capital before its IPO and much more in partnership funding. But its very hard to reduce your cost of capital when you’ve raised that quantity of cash; it was roughly the same share price for 7 years, since the Series B in 2005 ($13.10) through its $14.50 IPO price. But since its IPO, the stock has done great in the aftermarket – up nearly 65% – so even the early investors are ~2x at this point. Not a homerun, but better than lots of alternatives. And this IPO positions them well for their late stage clinical work and potential future appreciation.

AMBI: Ambit has been a long haul and reworked its business model dramatically in the middle of the last decade, pivoting from services to drug discovery and now clinical development. It has burnt over $225M in equity over its 13 years. Bridges and recapitalizations in 2009-2011 make it very hard to calculate price of the early rounds – especially since it likely depends on who participated going forward. Based on my read of the S1, it looks like the Series A-D (from 2000-2008) are all sitting at adjusted prices above $30/share. The share price in the recap of 2011 is just below $8, which was also the IPO price. Trending up since it’s offering, Ambit is a good example of where being early didn’t pay, nor did getting into the story when it was private frankly. Hindsight is always 20:20 though. Only time will tell if its clinical program can drive value from here to restore to value to those earlier shareholders.

PTCT: Like Portola, PTC Therapeutics raised piles of cash since its 1998 founding – over $300M. But unfortunately, it wasn’t able to maintain its price privately and experienced several serial recaps in recent years. The S1 is one of the most complicated around the nature of these recaps, but from my estimate it looks like the Series A through G, which were recap’d into Series Two and Three in 2012, and then were recap’d again into Series Five in early 2013, are all sitting at an adjusted price above $30. The company’s lead program, ataluren, is now well positioned to advance in Phase 3 development in the hot DMD space – so this could be a winning story in the future. But for all those early stage investors, their chart isn’t very inspiring at this point.

These are just a subset of the 11 biotech IPOs of the past quarter. Each have their own story to tell, some good, some not so good, but some great as well – Epizyme appears well poised to deliver homerun returns to their early investors. We certainly love to see more stories like this.

Amidst all these stories, its fair to say that the biotech IPO window hasn’t been this open for 13 years, and it will be interesting to see how it evolves over time. Many biotech boardrooms are for the first time actually discussing IPOs. If it stays open, and public capital steps up as truly less expensive capital than the private markets, then it’s likely to change the way companies are built. There is no reason to raise $100M+ privately, much less $300M, if the public markets can provide growth equity at better, less dilutive prices. This could alter the aggregate inventory of private companies – less capital intensive plays remaining private, more early stage innovative startups as a percentage of the private universe, etc… We are a far cry from that now, and we’re only a quarter or two into an interesting market. Its way too premature to know, but it sure is fun to speculate – only time will tell.

That said, I think there are a few positive observations that support the perspective that the window is likely to be open going into 2H 2013:

- Many IPOs have gotten out in the range and have traded up. This post-market performance is a huge confidence builder for buyers into these offerings. Although just short-term gains, these moves help support more interest in future offerings.

- Most pre-IPO crossover rounds are in-the-money, further supporting continued interest in these types of financings. For buysiders wanting bigger positions, these crossover rounds are the only way to get a sufficient bite size with over-subscribed books.

- Longer term, the performance of several of the 2011-2012 IPOs are helping buoy confidence in prospects for new offerings. Big returns are accruing to those investors that are holding, not selling, after their lockup periods expire. For example, both Clovis and Tesaro are way up from post-lockup price, their IPO price, and their pre-IPO private round prices (here). Intercept and Regulus are up 2.5x since their fall 2012 IPOs.

- Non-deal roadshows and the use of the JOBS Act’s confidential S1 filing process appear to be greasing the skids considerably. Almost all the 2Q offerings used the confidential process early on (80% according to NVCA). It will be interesting to see in late 2013 the number of biotech’s coming out of stealth with public S1s given the excitement of the 2Q and the 3-6 month lag time.

Lastly, I think one of the biggest implications of the opening of the IPO market is its material impact on Pharma M&A discussions. There is now a credible alternative to M&A for private shareholders to achieve liquidity at interesting prices. This will put pressure on Pharma to step up their game. A viable and vibrant alternative to an earlier M&A deal creates real leverage for a biotech weighing its strategic options, and aids in “price discovery” around comparable stories. If Pharma can’t match a likely IPO price, it’s not likely to be an attractive choice in many cases. Aragon’s recent $650M upfront M&A deal speaks to that – they could have gone public with their data. I expect we’ll see more big ticket M&A later this year.

The recent excitement in biotech is in striking contrast to a year ago when the “death of biotech venture capital” was all the rage. Fear and greed are powerful emotions; the latter appears to be winning out right now.