As you might expect given the strong IPO market, biotech venture investors are doing less of the heavy lifting in support of their portfolio companies during this receptive climate than in the past few years.

Biotech insider participation was the “dirty secret” (not so secret anymore) aspect of most VC-backed IPOs in the past 5+ years (here): about a third of a typical biotech IPO issuance was picked up by “insiders”. Without strong insider commitment, those offerings would have had trouble pricing: a lack of some meaningful participation was viewed as a negative to the buyside considering a buying into a new offering.

In 2013, with a number of oversubscribed offerings, it’s been the opposite: many of the strongest offerings have seen no insider venture capital participation and buysiders would clearly prefer more of an allocation vs having insiders participate.

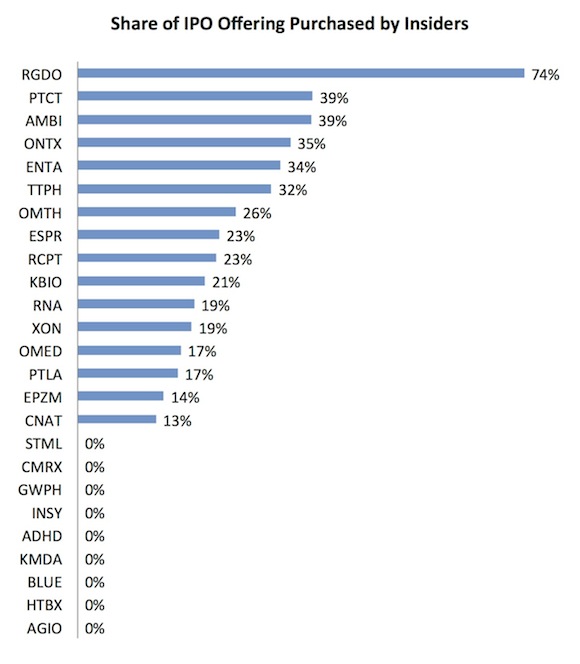

Based on recent data from both Cowen and BMO Capital Markets on this year’s offerings until mid-September, insider participation rates are down by close to 50%: the typical offering having only ~17% participation, and at least nine offerings had “zero”. Only a handful of offerings had participation rates above 30%, with Regado as the outlier. Here’s the chart below:

It’s worth noting that a number of those with zero actually had significant participation from crossover investors who committed in the pre-IPO financing rounds (but they aren’t counted as “insiders” as its expected they will buy up in the IPO). In addition, a number of traditional “venture firms” like New Leaf and Aisling Capital are active IPO buyers – so the lines between VC and the buyside are clearly blurring.

It’s worth noting that a number of those with zero actually had significant participation from crossover investors who committed in the pre-IPO financing rounds (but they aren’t counted as “insiders” as its expected they will buy up in the IPO). In addition, a number of traditional “venture firms” like New Leaf and Aisling Capital are active IPO buyers – so the lines between VC and the buyside are clearly blurring.

Every offering has its own dynamics, and we’ve recently seen both blazing offerings (OPHT, FMI) and weak ones (RGDO, FATE), but it will be interesting to watch this insider participation metric to see if it becomes a general indicator (lagging though it is) of future cooling in the market.