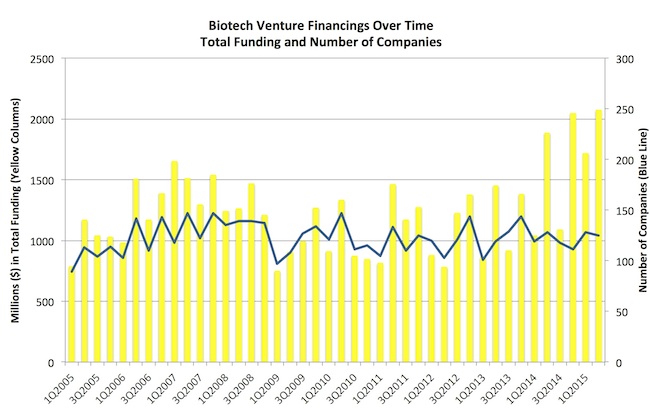

Venture-backed biotechs continue their blistering pace of funding. According to the latest MoneyTree Report from PricewaterhouseCoopers (PwC) and the National Venture Capital Association (NVCA), with data from Thomson Reuters, over $2.1B was invested in biotech companies in 2Q 2015, bringing the year to date total to almost $4B(covered here, here). Four of the last five quarters are amongst the largest record-setting quarters in ten years.

It’s clearly one of the best periods for biotech funding in the history of the industry, offering an opportunity for emerging companies to scale and develop their pipelines more significantly than ever before.

But the averages and top-line data convey only so much – huge fund flows, big year-on-year gains, and meaningless averages. There’s much more than meets the eye, and I thought it worth reviewing a more nuanced, data-rich look at what this hot funding climate is not as a way to frame up a few broader observations. Here are four things the current market is not:

1. It’s not “venture” in the traditional sense. The big recent uptick above the normal $1-1.5B that’s invested quarterly into biotech isn’t coming from the coffers of venture capitalists, it’s coming from hedge funds and public market “crossover” investors. Take as an example the top 10 biotech deals of the second quarter – Denali, Adaptive, RegenX, CytomiX, Melinta, Unum, Dimension, Voyager, Jounce, and Edge. My rough deal-by-deal calculation, based on participating investor mix, is that 67% of the $920M raised by this group came from non-venture sources. These include biotech crossover fund specialists like Deerfield, Brookside, RA Capital, and Wellington, but also significant contributions from alternative investment groups like the Alaska Permanent Fund and Malin Plc. Although lots of new venture funds are being raised, they get deployed over 5-7 years, not a few quarters – so while it is fair to say venture is booming, the real driver of the financing spike in the quarterly data has been from the eager participation of non-traditional biotech investors.

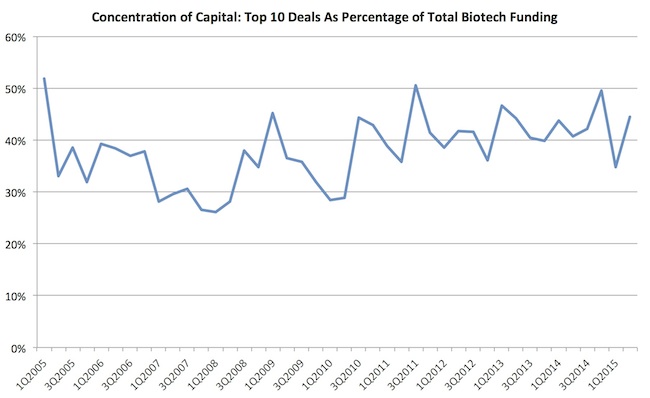

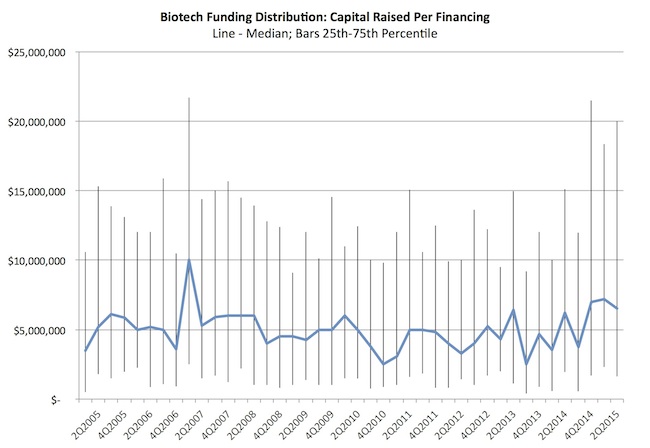

2. It’s not distributed broadly. The concentration of these “venture” dollars in the biggest deals is significant. The top 10 deals (like the list above), which in any given period represent roughly the largest 7-8% of the financings, accrued 45% of all the biotech funding. The top deals have captured a similar proportion for the past twenty quarters, as per the chart below. This concentration of funding reflects a very high Gini Coefficient, to steal a term from income inequality literature; there are relatively few “haves” and lots of “have-nots” when it comes to the flow of funding. More broadly across the distribution of deals, this funding bias creates an enormous skew in the “funding per company” metrics over time, making the “average” an utterly meaningless snapshot (since its not a normal distribution at all). The bottom quartile and median metrics are almost identical, with the top quartile significantly higher (see second graph below). It’s also worth noting that the big financings we commonly hear about (like the top 10 ones!) are in the rarefied few, above the top decile of financings; in fact, the top quartile metric for funding per company has only been above a “paltry” $20M in three quarterly periods across the past ten years. And the median biotech financing, regardless of stage, is still not that much higher than $4-8M – way below the average figures.

3. It’s not increasing the number of biotechs that get financed. Unlike software venture capital, which is backing 2x more companies today than five years ago, the biotech venture community isn’t funding an expanding ecosystem of private companies. It’s been a relatively constant funding pace for the past decade of around 100-150 per quarter. So the uptick in funding of late is just leading to more money for the same number of companies; and, in light of #2 above, its really just more money for the top few companies. Hopefully it’s being deployed wisely in a manner that can efficiently convert invested capital into value creation (the essence of “capital efficiency”).

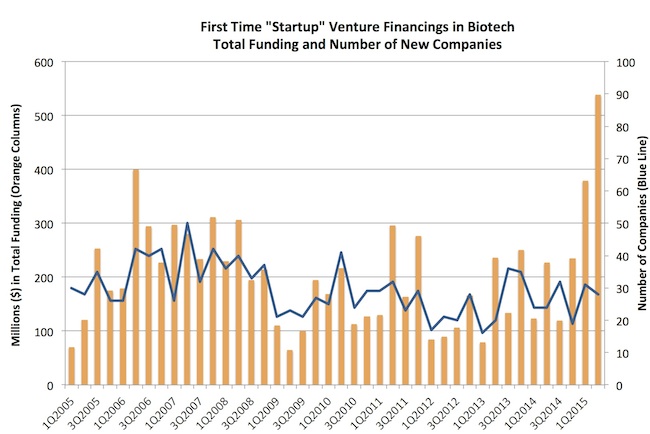

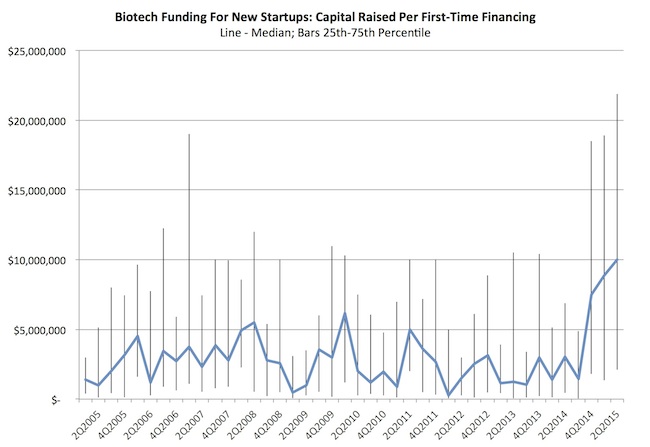

4. It’s also not leading to increased startup formation. The number of biotech startups receiving their first financings continues to be flat despite the unprecedented later stage demand, reflecting the massively constrained startup ecosystem discussed previously (here, here, here). While the numbers of startups are flat (25-30 per quarter), there’s an even bigger spike in funding amount per first financing in recent quarters. The median funding per first financing in a biotech startup company hit $10M this quarter, which is 300-400% higher than the last decade’s running average. In fact, the top quartile of these first financings are now very similar to the top quartile of all stages of financings – around $20M – which is a real surprise. It’s fair to say that significantly more capital is backing a constant number of new startups – reflecting the “launching” of larger, more highly powered-up startups by a handful of venture groups.

So what does this all mean, besides being a good reminder that averages and top-level data always leave a lot of nuanced insight behind? Here are three questions worth reflecting on:

What will happen when the public and non-traditional investors decide they don’t want to allocate their capital to private biotech companies? They have significantly inflated the pool of capital available today, but they could quickly depart if they start losing money in the space or if the overall market sentiment turns against the biotech sector (big clinical failures?), healthcare (pricing issues?), or equities as a whole. Its unclear how long-term and sustainable many of these non-venture players are in the biotech funding environment. It would be great to have them around for the long term, helping us launch and build great companies. But I think its likely more a matter of when, not if, this cadre of investors cools towards biotech (at least temporarily), and so young companies should be executing strategies today that account for these future funding contingencies (e.g., identifying and cultivating potential partners, creating flexible operating models with variable burn rates, etc…).

Are we over-funding and losing discipline? Anytime buoyant markets channel more capital than the historic norms into a space, questions around bubbles and over-funding get raised. It’s a frequent refrain in biotech today – is their a funding and valuation bubble? As a long-term investor and company-builder, the critical question to focus on is whether the current wave of funding is leading to governance complacency and a lack of discipline in how companies use the proceeds of these financings. Is the capital efficiently being deployed? Common mistakes one would expect in an overly permissive environment would be building excessive amounts of non-critical fixed infrastructure, hiring big teams too rapidly, locking into long-term expensive leases for too much space, funding immature science projects before they prove themselves, etc… I’m sure there are examples of these happening right now, but its not endemic: I still sense that most biotech teams and their boards are being thoughtfully disciplined around most of these areas of growth and spending.

Is there sufficient venture creation of new startups to refresh the ecosystem? Asked another way, what’s the right number of private biotech companies at steady state in a healthy ecosystem? I’m not sure, but it’s clear we aren’t creating an expanding pool of venture-backed biotechs, and the IPO and M&A exit markets are removing them from the venture ecosystem at a rapid clip. The number of compelling private biotechs today is far less than it was just two years ago, and many BD teams in Pharma know this as they struggle to identify compelling early stage partners – especially in areas like cardiovascular disease and neuroscience. We simply aren’t creating enough new corporate substrate as a sector. As a supplier of new companies, Atlas and other early stage firms are in a good position to feed future demand for innovation, which bodes well for venture returns – but a healthier ecosystem would be one that expands the number of participants, albeit at a modest and measured pace.

With this funding backdrop, it’s an exciting time to be a young biotech company – especially if you can broaden your sources of long-term investment capital, scale your company with less dilutive financing rounds, and deploy the funds with discipline and diligence. Only time will tell how all these variables play out, but every company (and its investors) will get judged by hindsight soon enough.