Milestone payments are an important risk-sharing component in today’s biopharma deal-making toolbox. As it’s a topic I’ve explored in the past (here, here), it’s an opportune time to revisit the stats for how they have performed recently.

These contingent value transfers (a.k.a. biobucks) help to bridge the gap in deal expectations, and provide a future reward if a deal withstands the battering of project attrition and advances successfully towards and beyond product approval. Of the $8.4B in VC-backed M&A “value” in 2014, $3.3B was in the form of these biobucks; upfront payments have only been~50% of the total value for most of the last few years.

The conclusion of the prior reviews of this data (links above) suggested that roughly 1/3 of all the payments that were “due” ended up getting paid by the acquirer. The latter blogpost shared some of the data assembled by Shareholder Representative Services, or SRS, which is a firm specializing in working for the selling party’s shareholders to follow up post-acquisition to ensure that escrows are paid, diligence is done, and milestones are tracked.

As of mid-2012, SRS had assembled a small but meaningful dataset of life science deals (biopharma and medtech) where 25 earnout payments had “come due” and were part of the analysis. All the deals in that dataset were rather young as many of these deals had only closed in the prior year or so, hence the limited number of actual earnout payments in that analysis.

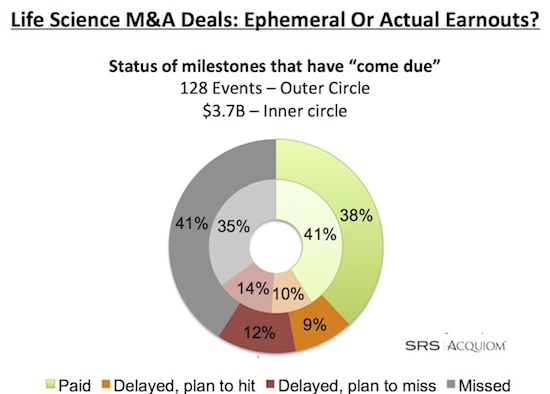

Fast forward to the present and, as of April 2015, this dataset has gotten significantly larger. They now track more than 400 separate milestones, including 128 events that have come due (so 5x larger than the prior dataset). These milestone events represent $3.4B in value. Of these milestones, 55 events were in biotech and 73 in medtech.

Surprisingly, given how small the initial 2012 sample set was, these new data have largely continued to track with the original observations: over 1/3 of the expected milestones have paid out.

As per the chart below, across all life science M&A earnouts in these SRS data, 38% of the events and 41% of the value have already been paid out; 41% of the events and 35% of the value have been missed, with the remainder delayed with roughly equal shots at hitting/missing. For biotech only, the numbers are similar but slightly less: 34% of the events and 36% of the value have already been met and paid.

Other nuggets in their recent data review:

- Almost all the milestones that have been paid to date were associated with “diligence requirements” for the acquirer to use “commercially reasonable efforts” (or more specific language). Those deals with less stringent diligence requirements saw fewer milestone payouts. No surprise here.

- Disputes between the buyer/seller regarding the payment of an earnout have occurred in 30% of the deals in the dataset, mostly related to disagreements over lack of progress or changed timelines.

- Earnout renegotiation occurred in 16% of deals, including a few where acquirers returned product rights to the sellers.

Considering the significance of milestones to generating outsized returns in life science M&A deals, these data are further reinforcement that a meaningful proportion will be getting paid.

Thanks to SRS and Don Morrissey in particular for sharing the data.