Many venture-backed companies assume they can escape the gravity of historic valuation ranges, and an anecdotal few may accomplish the feat. But figuring out how to live within its probabilistic reality is an important element of successful venture portfolio construction.

A thesis we believe in at Atlas is that one needs to be able to make a reasonable return at a median exit valuation – i.e., the math needs to work for a deal outcome at the 50th percentile. Of course, most venture investors live in the “top quartile only” world of Lake Wobegon, so medians don’t tend to engage our sector’s thinking. But as an asset class, we should focus on them more.

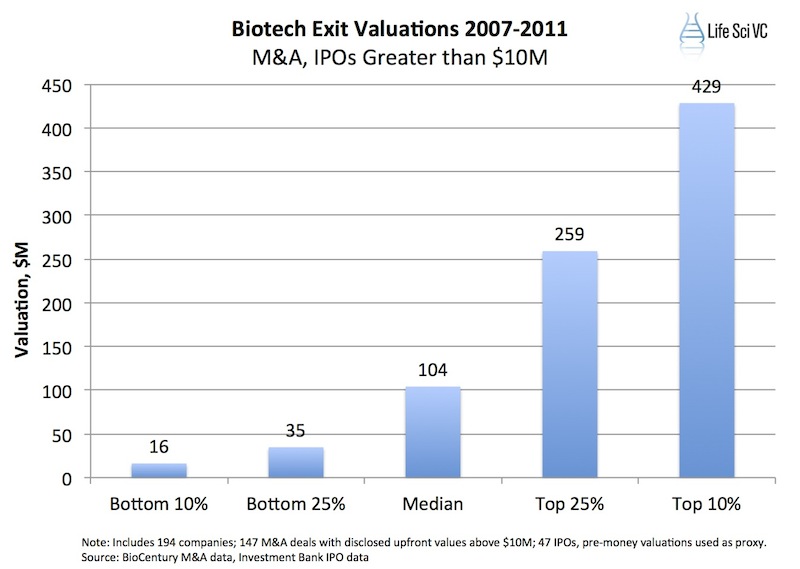

So what are median value exit outcomes in biotech? The data are not readily available, so to put some meat around that number I’ve pulled together a few datasets. Using BioCentury M&A data along with some banker-provided IPO statistics, I assembled a list of the 194 biotech deals that either were sold as private companies for more than $10M upfront, or went public from 2007-2011. Keep in mind these data don’t include the ~20% or so of biotechs that go bankrupt or liquidate for zero value, or those that sell for marginal values of <$10M upfront. For IPOs, their pre-money valuation is used as a proxy for exit value.

The median valuation in this five year dataset is ~$105M, and the top decile is ~$430M. With this dataset, that means about 20 exits were at or above $430M during this period. The average exit value was $185M, skewed above the median as expected due to some of the larger deals.

Here’s the broader distribution:

There are multiple implications of a distribution like this. If you believe this historic range of returns set up a reasonably stable constant like gravity, then building companies with these metrics in mind is critical.

One observation is around the equity capital intensity that supports venture returns: $25-40M appears to be the sweet spot for the amount to raise before a major value inflection or “exit” via M&A or IPO. The simple math is hard to argue with: by keeping to this range, if a biotech is unfortunately only able to hit a median valuation ($104M), it is still feasible to return a modest 2-3x on invested capital. But if a company can achieve a top decile valuation (>$430M), the exit delivers a 10x+ return. Lots of room in between for great outcomes. But if a company raises $60M or more in equity, the median outcome starts to look less interesting, and above $80M there’s a good chance of a loss on the invested capital. This math is undeniable.

As discussed previously (here), the probabilities of getting to top decile exit valuations aren’t different for companies that have raised $25M vs $100M – but the differential returns are considerable. The corollary to this point is that high capital intensity late stage deals, with ingoing assumptions requiring $100M+ in fundraising, need to bet they’ll be well above top decile outcomes or they just don’t make sense to back. That’s arguing against the gods of chance.

This $25-40M target sweet spot of equity is entirely feasible today given the dynamics of the ecosystem for both single asset plays or drug discovery platforms. Both of these models of biotech can and have be done in a lean, capital efficient manner (as discussed here). Stromedix only raised $32M before Biogen acquired them; Amira was in a similar ballpark before BMS picked them up. Leveraging large Pharma balance sheets and their lower cost-of-capital is an important part of this equity capital efficiency through either less-dilutive R&D collaborations or risk-sharing earnout deals.

We think about this lifetime “equity capital” bogey before we start a new company or invest in an early round; knowing that the initial plans won’t survive contact with reality, spending and equity requirements are almost always much higher than a priori expectations. An entrepreneur who initially thinks he will need to raise $60-80M to get to an exit is likely to require $120-160M if he’s lucky enough to get that far. I’d rather back the lean entrepreneur who initially thinks $20M will do it, knowing we’ll be closer to $40M once time has passed.

Another implication is about capital titration and allocation. By tranching your capital into a deal over time, as risk is discharged, you can assess where on the distribution curve a deal is tracking. This is where dynamic allocation of reserves across deals can play a big role in enhancing the capital-adjusted returns of a fund. If it looks like a deal is going sideways, then facilitating a median value exit might be appropriate Board and investor strategy. If things are going well, this may be the time to inject more equity capital at higher valuations to support the growth of the story. With a supportive public capital market, this is where they’d in theory step in. We’re still waiting to see that happen with any real cadence, and in their absence focusing on the sweet spot for equity returns is more likely the winning strategy.

Importantly, we’re not in the business of shooting for medians. We don’t push our biotechs for $100M exits at the start. That isn’t in our investment memos. We aim and aspire to create and fund innovative companies with top decile valuations supported by high impact medicines. The median isn’t the goal. But it can and often will be the endgame, so being conscious of the gravity of valuations while we’re building new companies is a key to overall portfolio returns.