With the biotech IPO window still open for business, and valuations of the recent classes of 2013 and 2014 remaining robust, all eyes have been focused on this part of the value chain. Significant mezzanine pre-IPO rounds are getting done at companies like Intarcia and Juno in preparation for what are likely to be great offerings early in the new year.

IPOs are the apparent prize-winners in the eyes of many. But what often gets overlooked when talking about biotech exits is the important – and more frequent – role of the M&A exit in driving liquidity in biotech, even in the current marketplace.

We’ve seen some fantastic exits this year on the VC-backed biotech M&A front, just to name a few:

- Anti-viral play Alios Pharma was acquired by J&J for $1.75B. This will return 18-20x cash-on-cash multiples to several corporate venture capital firms, or roughly $300M a piece by my guesstimate, including funds like SR One, Roche Ventures and Novartis Ventures, as well as Novo Ventures (here)

- Seragon’s purchase by Genentech for $725M upfront and $1B in milestones, providing handsome returns for Column, Aisling, venbio, and others (here). Column likely returned double its entire fund on this deal and sale of its parent, Aragon, to J&J last year.

- Civitas’ acquisition by Acorda for $525M right before their pending IPO. Significant returns to a blue chip list of venture and public market crossover investors after raising about $125M in private funding (here)

- After Arteaus’ CGRP antibody established PoC for the target in migraine and was picked up by Lilly (here), Teva moved quickly to acquire Labrys Biologics for $200M upfront and $625M in development-stage earnouts, even before they generated clinical data. After only raising $31M in venture equity, this is a big win for venbio, Canaan, InterWest, and Sofinnova (here).

- Immuno-oncology startup CoStim Pharma’s early stage acquisition by Novartis provided a very nice return to MPM and Atlas earlier this year (here)

These are great deal stories that compare well on the returns with the high-flier IPO stories of Agios, Ultragenyx, Receptos, Epizyme, bluebird, and others.

But it’s hard to argue with the fact that IPOs seem to have more “sex appeal”; these companies retain the possibility – however slim – of becoming the next Gilead. Importantly, we also can track and follow them, their performance can be monitored everyday; newsflow reminds us frequently of these emerging stories and their drug programs, and media outlets help pass along their news with great fanfare.

By comparison, once an M&A deal is done, we rarely if ever read about the company again – despite the success of their products in the buyer’s portfolio. Pharmasset isn’t mentioned when discussing Sovaldi very much anymore, or Calistoga when referring to Zydelig, or Organon Biosciences when mentioning Merck’s Keytruda. The loss of a company’s identity in an acquisition makes it easy to quickly forget the importance of M&A in a world that wants and loves to talk about companies and their products.

So that brings me then to the question about venture capital and returns – what’s the relative contribution of M&A and IPO exit paths to liquidity in the biotech world?

There aren’t great sources of data on the exact returns back to VCs and their Limited Partners from individual deals, but I’ve found two datasets that provide some directional context.

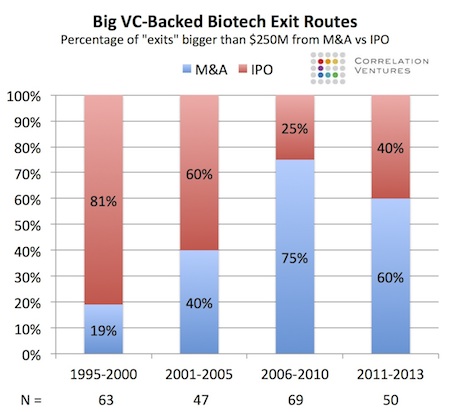

First, the relative contribution of M&A and IPOs to “big wins” over time – exits above $250M in value. Our friends at the data-savvy firm Correlation Ventures (CV) have examined their industry-leading database and come up with some interesting trends. CV counted the number of deals above the valuation threshold of $250M, measured as either the market capitalization six months following an IPO, to reflect when lockup periods often expire, or the amount paid by an acquirer at the date of the acquisition, plus any realized milestone payments since the acquisition. Their dataset tracks all these metrics. Obviously those aren’t perfect definitions (e.g., VCs often hold for a long time after the lockup expires), but they allow for a directionally useful exploration of the relative contributions of different exit paths. Using those two definitions, the chart below plots the percentage contribution of M&A and IPOs to these “big” >$250M deals:

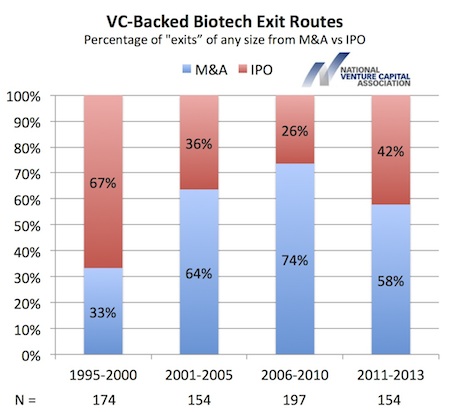

Second, the NVCA tracks the number of all VC-backed exits in their annual Yearbook – either IPOs or M&As, irrespective of their value. I thought it would an interesting comparison to Correlation’s data; their data is presented in a similar format below.

Observations:

- As both charts highlight, IPOs used to be the only real game in town. Driving 67% of the exits and over 82% of the >$250M exits in the late 1990s. This observation certainly holds true for our experience at Atlas: almost all of the big biotech exits of that era were IPOs like Exelixis, ArQule, Morphosys, DeCode, Actelion, etc. This story, as both an industry and at Atlas, has changed a lot since.

- By the 2006-2010 period, almost all the exits, upwards of 75% – regardless of size – were M&A driven events. The recent IPO window in 2013 pushes the data a bit, but not enough to eliminate the dominance of M&A exits: more than 60% of the big >$250M exits in our space in the last few years have been M&A. My sense is that’s a far higher percentage than widely perceived.

- The share of big exits vs all exits contributed by either path has converged over time. In the last 7 years, roughly identical percentages exist in the two charts above, suggesting that the relative contributions of IPOs and M&As at big and small valuations are similar. This is different than the pre-2000 world, where IPOs were clearly of average higher value based on these data.

I’ve written in the past on subjects related to this topic, so won’t harp on them again but here are a few topics: the likelihood of earnouts getting paid on M&A deals (here), the tradeoffs between IPO-and-exit-later vs M&A today (here), and the liquidity challenge of exiting newly minted public biotech shares into the market after the lockup (here).

The most important message in all this – it’s a healthy dynamic for private biotechs to have both IPO and M&A avenues open to them, with roughly equivalent opportunities for driving top decile returning exits via either route. This interplay bodes well for the biotech sector.