As anyone following the biotech sector knows, the market for new public offerings has been incredibly strong over the past couple years. And the larger cap stocks in the sector have also outperformed, propelled by product launches and exciting clinical data (like Biogen’s aducanumab data today). The strength of the biotech sector has led many to raise the concern of a BioBubble in valuations (here), and sound the alarm.

While it’s certainly fair to say we’ve been experiencing an extended bull run in biotech, it’s unclear to me how much is driven by the evolving view that the fundamentals of biotech investing are changing. Specialist investor ranks are deeper and more sophisticated than ever before. More emerging biotech stocks are posting positive and compelling clinical data. The fruits of the genomics revolution of the last two decades are finally ripening, enabling better and more targeted therapies. And more mid-cap growing biotech firms are launching their own products, gathering revenues, and, dare I say, delivering profits, than ever before in the history of the industry. So it’s clearly a maturing sector in many respects.

One measure of a mature sector, though, is pricing discipline. Mature markets are by definition more discerning and efficient markets. They should punish companies that have bad data or lackluster stories, and reward those with great data or more promise – rather than simply move with the sector’s overall ‘beta’ with market sentiment. A rising tide shouldn’t just lift all the boats in a disciplined market.

Interestingly, discerning that difference appears to be what is happening in the post-IPO biotech marketplace today.

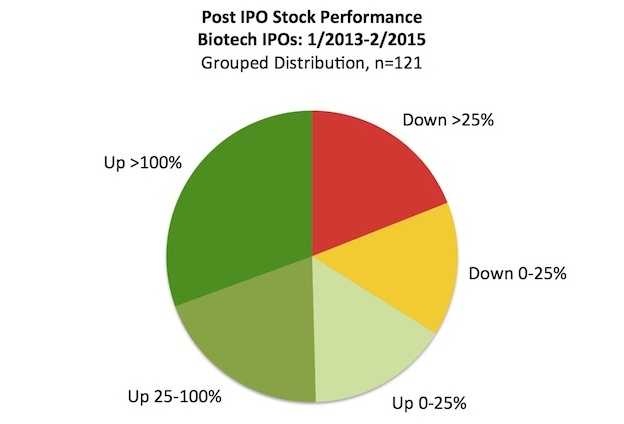

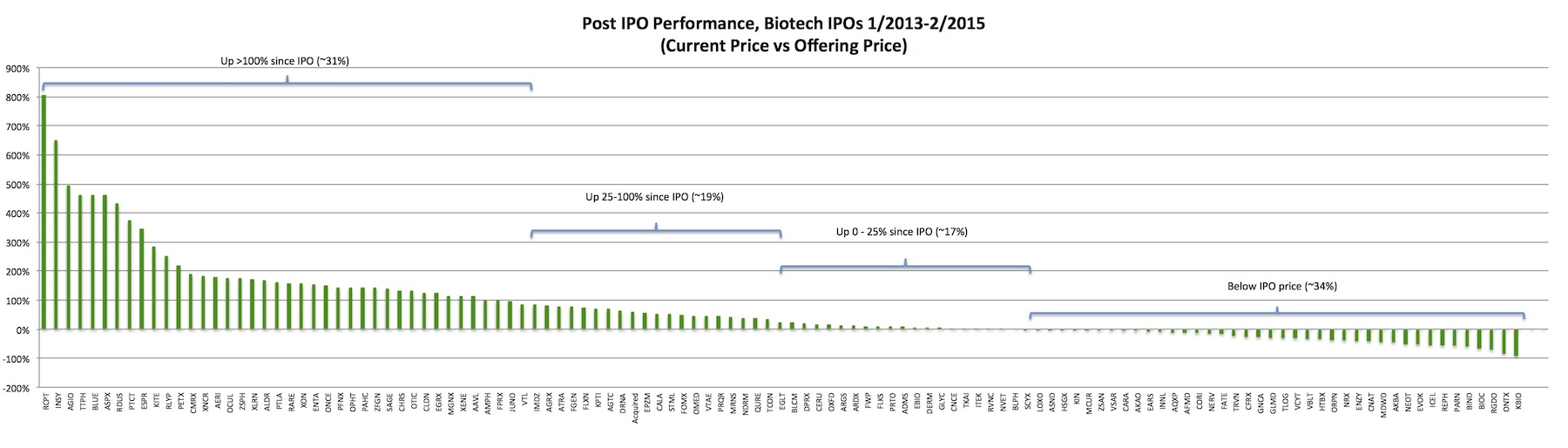

Taking a look at the 121 biotech IPOs that occurred from January 2013 through February 2015, as tracked by BMO Capital Markets, the distribution of post-IPO performance is quite broad. As depicted in the pie chart below, nearly a third of the offerings are below their IPO price, and many well below. Another third are up over 25%, and the remaining third are in between. This is a reasonable distribution of outcomes. A more detailed breakdown as a dense column chart with each offering is shown here.

Taking a look at the specific circumstances, the vast majority of the companies that have at least doubled since their offerings (up over 100%) are up because they released great clinical data (rather than just holding onto their first day euphoric “pops”), for example:

- Receptos ($RCPT): Since their IPO in spring 2013, they’ve released multiple positive data updates, including the TOUCHSTONE trial last fall (here) with RPC1063, a sphingosine 1-phosphate 1 receptor (S1P1R) small molecule.

- Agios ($AGIO): Both AG-221 and AG-120 programs have delivered positive results since the company’s spring 2013 IPO, including last fall with the latter deliving single agent activity in AML (here).

- Bluebird bio ($BLUE): In addition to prior data updates, in December 2014 announced striking data in beta-thalassemia (here) with their LentiGlobin BB305 drug product

- Tetraphase ($TTPH): Similar to the other examples, the company reported positive newsflow over time but late last year reported positive pivotal Phase 3 IGNITE trial data (here).

- Many others with strong post-IPO performances have also had significant and positive clinical progress since their IPOs, including Portola ($PTLA) with ANNEXA (here), Zafgen ($ZFGN) in hypothalamic injury associated obesity (here), Auspex ($ASPX), PTC Therapeutics ($PTCT) in DMD (here), and others. Compelling clinical data has driven the majority of the big stock moves in the IPO cohort.

Of the laggards that have underperformed and are below their IPO prices, most of them have struggled to catalyze investor support because of challenging post-IPO data and newsflow. Again, here are a few examples:

- Kalobios ($KBIO): One of the first IPOs on 2013, it has suffered multiple setbacks and is down over 90%: its lead respiratory product failed to demonstrate efficacy in Phase 2 back in Jan 2014 (here), and then a second respiratory product failed in a pseudomonas study (here).

- Regado ($RGDO): after a brutal IPO and financing process, the company’s Phase 3 program, REGULATE-PCI, was terminated by its DSMB, sending the stock into a tailspin (here) and eventually a reverse merger with Tobira

- Onconova ($ONTX): it’s lead drug, rigosertib, failed in a late stage pancreatic cancer study in fall of 2013, and then again in a MDS trial in early 2014; the stock lost 75% of its value over the first year (here)

- Akebia ($AKBA): Originally a high flier, after it published its Phase IIb efficacy data last fall investors questioned the safety issues raised by the study (here); stock is now off 30% or so since its IPO

Certainly there are exceptions to the theme of the “great data, great stock” correlation implied above. Some companies popped because of exuberant sentiments on the day of their offerings and just haven’t retreated, despite a lack of any material new data. But by and large, companies need to have their pipelines perform to be rewarded with appreciating share price above their initial offering in today’s public market.

Another observation worth noting, in line with my prior August 2014 analysis, is the virtuous-vicious cycle at work here: the big are getting bigger, and the small are getting smaller. Companies with “premium” post-money IPO valuations above $200M have posted a median stock performance of 84% since their offerings. Said another way, nearly half of the premium offerings have already doubled in value. In contrast, the median performance of those IPOs with post-money valuations below $200M is a small loss of -1.0%. That’s striking. Interestingly, it’s a variation of a theme that is reminiscent of the Feuerstein-Ratain Rule for oncology startups – that small cap companies have historically not been able to deliver positive data later in the clinic. Are the sub-$200M companies just not posting good data? Its not quite that simple, for sure, though the discrepancy in performance is significant.

To conclude, if there were widespread disregard for negative news, and only euphoric (rather than measured) responses to good news, we’d all be very worried about being at “Peak BioBubble”. Instead, though, the fact that we’re seeing a broad range of performance post-IPO, and a cooling off of the pace of new offerings in 1Q 2015, is suggestive that we’re in a marketplace with some reasonable hallmarks of buyside discipline.

But only time will tell whether the current environment reflects measured data-driven optimism around evolving biotech fundamentals, or just overwhelmingly irrational exuberance. We’d all like to believe the former is possible as the sector matures.