This blog was written by Rosana Kapeller, CSO of Nimbus Therapeutics, as part of the From The Trenches feature of LifeSciVC.

Love it or hate it, no one can deny that Über has revolutionized the fundamental nature of the taxi industry. By deploying a new GPS-based technology to link drivers to customers, Über has disrupted a deeply entrenched conservative structure and streamlined some of its most fundamental concepts: take passengers from point A to point B, but let passengers choose instantaneously where and when to get picked up and the type of car to be “chauffeured” in, while never having to reach into their wallets.

The disruptive nature of Über’s business model is exemplified across multiple industries, such as hospitality (Airbnb, HomeAway), financing (Lending club), real state (Zillow) and even healthcare (One Medical Group, Doctor on Demand). And let’s not forget pioneers like Amazon, delivering books and other items to our doorstep, and Netflix, adopting to customers’ needs and giving them instant gratification when choosing movies.

What all of these companies have in common is the use of cloud-based technologies to create a differentiated experience for the customer without changing the end product. Moreover, they all focus on the immediate delivery of the end product to the consumer, be it a cab ride, a room to stay, a doctor’s visit, a book or a movie.

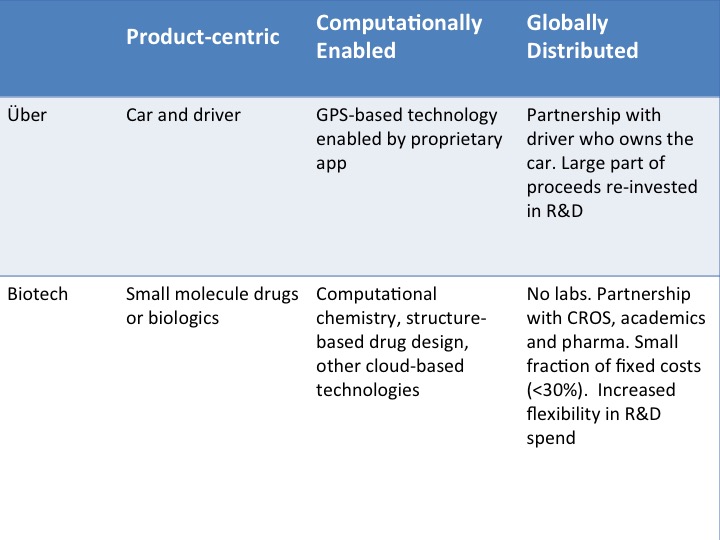

What if the product-centric, computationally enabled, globally distributed Über model could be extended to biotech?

- Would this model work?

- How would it differ from companies that outsource heavily and deploy a hybrid model?

Today’s biotech and some pharma companies are nimbler than their predecessors, and typically operate under a sophisticated hybrid model where most commoditized capabilities (e.g. chemical synthesis, in vitro ADMET assays) are outsourced to contract research organizations (CROs). The companies, in turn, invest to build internal expertise and capabilities to develop and deploy what they do best: new technology creation, clinical development, regulatory interactions, commercialization and complex manufacturing. This hybrid model provides more flexibility, but the fixed infrastructure costs remain, ultimately restricting resources. This leaves decision makers with the task of choosing whether to expand internal resources or invest in outside R&D to complement the internal pipeline.

Resource allocation continues to be a challenge in these organizations, and every time there is a shift in strategic direction, we are all too familiar with the downstream effects: layoffs, paused or out-licensed projects, etc. For biotech companies founded by venture capital dollars, exit strategies vary; often, though, they are acquired by bigger companies, leading to the dissolution of the team and the underlying platform. Over the last three years, many companies have often chosen to go public, which creates pressure to focus investment on clinical assets and not the platform.

There are a handful of biotech companies that have moved beyond the hybrid model, altogether eschewing the bricks and mortar, vertically integrated, traditional pharma/biotech structures in favor of fully embracing Über model-like principles. A number of single program virtual startups have gone this route, including Zafgen and Stromedix about a decade ago. Here at Nimbus Therapeutics, we helped pioneer extending this model as applied to drug discovery platforms; since the company’s inception, prosecuted multiple programs and operated within a completely distributed model (no labs, small core team of scientists living in different locations, strategic partner owns underlying computational technology!). For more on the Nimbus model, I refer to Jonathan Montagu’s blog (here). Another broad platform company that has similarly been conducting virtual drug discovery is Padlock Therapeutics, Padlock, however, recently decided it was time to move to the hybrid model and invest in a small lab footprint, and have done so in the past couple of months. For an excellent read on why virtualization is happening in biotech/pharma, I would recommend Mike Gilman’s blog, “The Virtues of Virtual- And Why We’re Devirtualizing,” and Jeanne Whallen’s WSJ article, “Virtual Biotechs: No Lab Space, Few Employees.”

Translation of the Über model into Biotech:

Product-centric:

These companies are all in the business of delivering novel medicines utilizing traditional drug modalities (e.g. small molecule, biologics). This is very different from companies like Intellia Therapeutics or Editas Medicine, for instance, that are developing CRISPR-based therapeutics, in which the therapeutic modality itself is disruptive; in cases such as these the fully distributed model will not work, since the novel technology needs to be developed in-house.

Most companies embracing the “Über model” use in silico-based technologies to drive and support the drug discovery process. Just like the Über app, these companies develop their own proprietary approach to creating medicines (their “common” end product) by fusing their unique internal skills and areas of expertise (e.g. medicinal chemistry, proprietary knowledge of complex biology) with the technological capabilities. Since each company is focused in different areas of research and building a unique platform, this tailored application of in silico-based technologies is necessary.

Computationally-enabled:

In addition, these companies are enabled to invest heavily on the delivery of their products, enabled by strategic partnerships with companies that provide the required computational power or another enabling technology. The continued innovation needed to develop these technologies costs millions of dollars a year and requires scientists with different skills and expertise. With the technology being developed by another party, biotech companies can focus on their core strength: making drugs.

In Nimbus’ case, we were co-founded by and partner with Schrödinger, a New York-based computational chemistry company. Schrödinger’s mission is to provide “software solutions and services for life sciences and materials research.” Schrödinger invests in developing the new, bespoke technologies we use in drug discovery, freeing Nimbus to focus on the complex nature of activities required to discover and develop new medicines. Unlike other companies that use Schrödinger’s software, we do not use Schrödinger off-the-shelf software to crack critical drug discovery challenges. In the past six years, we have developed our own proprietary approach with Schrödinger that is as unique as our relationship with them.

The chief challenge in this type of partnership is ensuring alignment on goals between the two companies. This alignment needs to be established by the drivers of the collaboration and must percolate down to the trenches, or execution will suffer. Both companies must recognize a reliance on one another to be successful and, to that end, create a mutually beneficial relationship.

Globally-distributed:

At the time of Nimbus’ inception, the fully distributed drug discovery platform model was a somewhat novel concept. As I mentioned above, other companies were already operating under the hybrid model and outsourcing “commoditized” activities to CROs. In addition, single-program discovery-stage companies were experimenting with a fully virtual model (like Zafgen, and more recently Quartet and Rodin).

However, having the underlying platform technology owned by a different company — that was unheard of at the time. A couple of questions we have been asked multiple times over the years are: “Why should I work with Nimbus and not directly with Schrödinger?” and “”Does the ‘secret sauce’ come from the biotech company or the technology partner?” My answer: it comes from neither independently, but rather from the integration of the two companies and how the biotech uniquely deploys the partner’s technology. Nimbus and Schrödinger use computational chemistry to prospectively drive the drug discovery process, and similar to Über and other app-based platforms, these companies have developed a unique proprietary platform towards product development.

In addition to not “owning” the underlying platform technology, companies like Nimbus do not have their own labs to execute on bespoke biology/pharmacology. Some of the comments I have heard about this aspect, include: “You will have no control of the science,” or “It will be too slow,” or “It is hard to innovate”,”etc. While some of these could represent potential pitfalls, with foresight, persistence, resilience and focus the problems can be solved one at a time – and often times averted. These and other myths were explored in a prior LifeSciVC blog post (here).

First and foremost, the initial focus needs to be on building a team who is up to the challenge. Nimbus, Quartet, Padlock, Rodin and Zafgen all hired seasoned scientists and managers with 15-20 years of experience in biotech/pharma industry and kept all the ideation in- house, but externalized execution. These scientific leaders shifted the R&D paradigm to a fully outsourced one, and selected the CROs with whom they needed to establish the right level of partnerships. At Nimbus, we learned quickly that if the CRO team is involved from the get-go of a project, if they have intellectual input, and are trusted and treated with respect, they will go the extra mile for the program. We have been working with some CROs for the past six years and the process today is virtually seamless. Instead of having a lab down the hall, with the right processes in place, the lab can literally be on the other side of the world.

Some of the advantages of the distributed biotech model approach:

- No need to build labs, hire and train people. Not limited by geographic location, which is a major advantage when looking for less expensive alternatives or very specialized work.

- It is “plug and play”; you can kick off a project as soon as you have funding without having to wait for lab space.

- Opportunity to collaborate with some of the best teams/experts in the world.

- Strategic shifts that lead to program termination can be done in a more streamlined fashion. As little as a one-month notice may be required to shift resources into a different program within the CRO.

- Working with multiple CROs helps hedge some of the risks inherent to research.

- The initial investment burden for the company is smaller since there is no need to build labs, buy equipment and hire a lab crew.

Potential challenges:

- Data quality can vary from team to team, even in the same CRO. So you have to make sure you are working with the CROs “A Team”.

- Intellectual contribution to the project is sometimes limited, and the program leaders need to spend a lot of their time guiding their CRO colleagues (this is changing as the CROs acquire more expertise).

- Sometimes there are timeline delays because of queue time.

- Don’t underestimate a geographical time difference; sometimes it can work in you favor, but it may require both teams to work at odd hours.

Of course, all of these potential pitfalls can also happen in your own lab, and resource allocation within the same company is one of the major struggles faced by companies that operate under traditional structures. As I mentioned above, with a globally distributed company, where the fixed cost is kept low, the company has the flexibility of adding more resources to its priority programs.

Another question I am always asked is “How does Nimbus address complex biology problems that can’t be handled by CROs?” We tackle this challenge by selecting targets that are supported by human genetics, with good validation in animal models and by establishing strong relationships with some of the top institutions in academia, such as Massachusetts General Hospital, Dana Farber Cancer Institute, NIH, and Salk, to name just a few. We are very deliberate in selecting our collaborators and tap into their specific knowledge to accelerate the understanding of new/emerging biology. In turn, our collaborators benefit by having access to chemical tools to address questions that they are particularly interested in. These collaborations have resulted in new insights and rapid progression of compounds into particular indications.

The end game:

The goal is to deliver a high-quality product. In the case of Über, it is on-demand car service; for a biotech company, it is a new medicine that shifts the paradigm on how a certain disease is treated or managed. Time will tell whether the Über model is a sustainable and scalable option for biotech. But for our team at Nimbus, and the other companies mentioned above, it has been quite successful thus far. Nimbus’ Acetyl CoA Carboxylase (ACC) allosteric inhibitor for nonalcoholic steatohepatitis (NASH) is Phase 2 ready and has been granted fast track designation by the FDA (here). We have two additional programs partnered with Genentech (here) and Monsanto (here), and other programs in the pipeline. Same is true for other “virtual” companies: Padlock Therapeutics has advanced its PAD inhibitors towards development; Quartet Medicine announced earlier this year a deal with Merck to develop first-in- class BH4 inhibitors for chronic pain (here); and, Rodin Therapeutics has joined forces with Biogen in a neuronal epigenetics collaboration (here).

Advancing disruptive models, despite the industry, is an exciting and, at times, daunting prospect – and usually attracts fans and detractors alike. As a believer, I eagerly look forward to seeing (and helping) this maturing distributive model for drug discovery and development evolve. Whether undertaken in measured doses or quantum leaps, disruption, and its lessons learned, are the only true path to growth and progress.