For startup and emerging biotech companies, corporate venture capital and direct corporate equity investing are critically important contributors on the spectrum of funding sources – and over the past fifteen years, their involvement as investors in young biotech companies appears to correlate with a significant enrichment for successful “exit” outcomes.

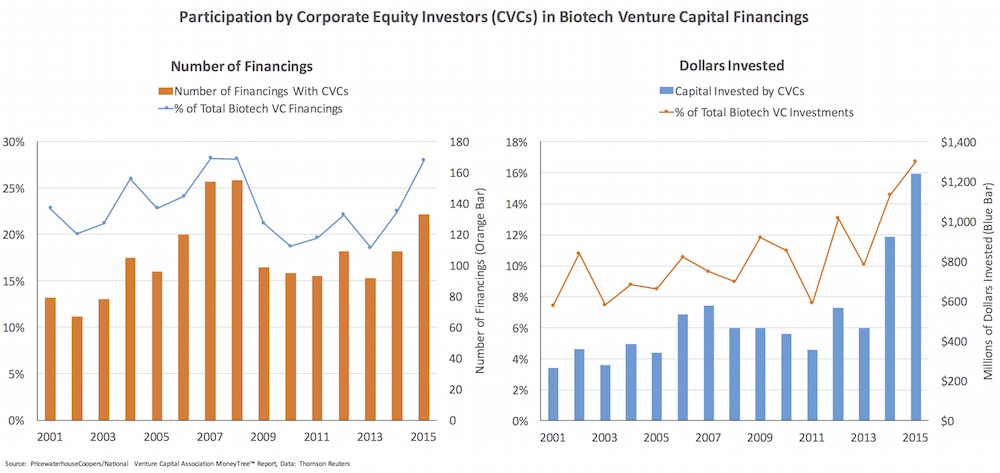

Based on recent data from Thomson Reuters in the PwC/NVCA MoneyTree™ Report, in 2015 CVC investing in biotech hit an all-time high both in terms of both its share of deals (28%, matching the 2007-2008 peak) and dollars invested (~17% to the total, nearly $1.2B in 2015), as described in the chart below.

These contributions are significant and likely to be more sustainably consistent over the mid- to long-term than hedge fund and crossover investors’ recent participation in private financings, which have already contracted considerably in the softening cycle we’re experiencing (here).

I’ve addressed the topic of corporate venture capital (which, along with direct corporate equity investing, I’ll collectively call CVC in this post) multiple times in the past, covering a set of themes back in 2011-2012: common misperceptions about corporate venture investing (here); how CVCs have become preferred partners for many early stage investors, including Atlas, and how their implied fund sizes make them considerable players in the ecosystem (here); and, on whether corporate equity investors participation correlates with improved success odds in the past (here). I’d like to update a few of those analyses and perspectives.

Syndication and value-add

We’ve continued to see CVCs as a key ingredient in our syndication mix – just one example of how important corporate venture capital is to the early stage ecosystem today. I’m sure there are other early stage VCs with similar views, but to illustrate the point I’ll share Atlas’ stats. We recently tallied up the proportion of our biotech deals with at least one corporate equity partner, whether out of a bona fide corporate venture fund or via a direct equity investment; as expected, this represents the vast majority of deals in the last two Atlas vintages (Funds VIII and IX). As described before, and shared below, we’ve moved from 5% of our deals having corporate venture equity partners to nearly 75% over the past four vintages (15 years). In Fund IX, more than 50% of the investments (or two-thirds of those with CVCs) have at least two if not more corporate equity investors.

What’s the value of a corporate equity partner in a venture-stage biotech? We think there are several. In addition to having money that’s green like everyone else’s, and an interest in early stage innovation, CVCs often bring access to strategic Pharma R&D perspectives or capabilities that can help young companies. Many CVC players are also not bound to fund cycles and time horizons due to their evergreen structures, so tend to be patient capital and able to invest in early stage translational science in ways many conventional VCs unfortunately avoid. In some cases, direct equity investments within this CVC bucket are linked to BD deals, which have the obvious benefit of being associated with accretive (hopefully) deal structures. Lastly, and importantly, many CVCs are a pleasure to work with and typically have very low “entropy” in a boardroom; this soft point can’t be underestimated, as functional governance and solidarity in the boardroom can go a long way to having a clear and cohesive strategy. All of these attributes conspire to make them helpful and valuable syndication partners.

There are, of course, considerations around CVC engagement. Will they be good fiduciaries for the startup vs their parent company? Will they interfere inappropriately in BD dialogues? Will they “leak” confidential information back to their R&D groups? All are reasonable questions to ask, but in the last decade, across many investments, I’ve not found any of these concerns to manifest in reality.

Success enrichment?

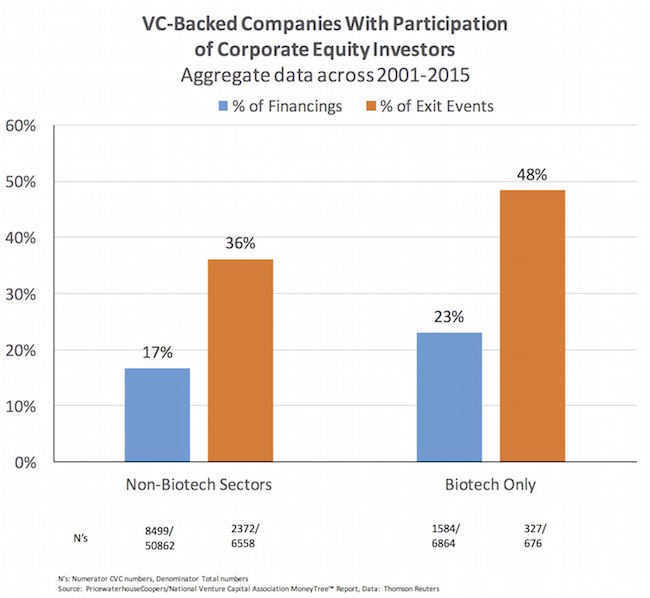

Most intriguingly, having a corporate venture equity partner in a deal appears to lead to a very large enrichment in successful exits over the past 15 years. This holds true across both biotech and other sectors, albeit slightly more extensive in biotech – with huge sample size n’s supporting the conclusion.

As the chart below reveals, while CVCs have participated in 23% of biotech financings over the past fifteen years, they’ve been equity holders in 48% of the sector’s IPOs and M&As – a 2x enrichment factor relative to the rest of the industry. IPOs have seen more enrichment than M&A exits: in aggregate, 60% of IPOs and 40% of M&A deals from 2001-2015 had CVC participation.

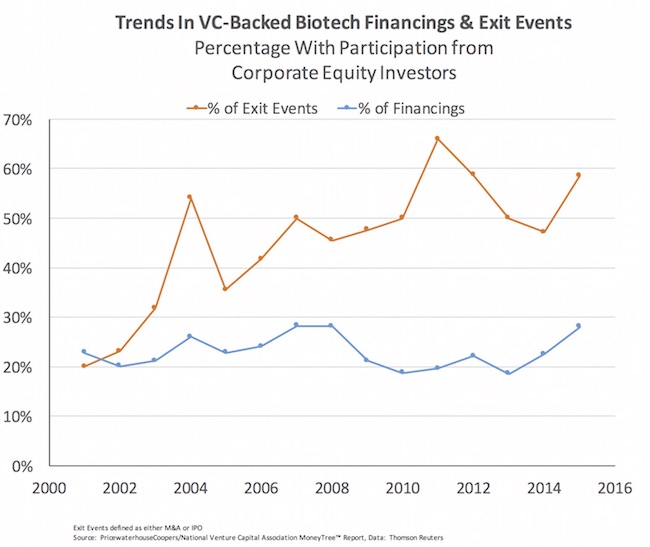

Digging deeper, its also interesting to look at the trend in this “enrichment” factor over time in biotech. Below is a chart that captures the annual percentage of financings and the percentage of exit events (M&A or IPOs) with a corporate equity participant. CVCs aren’t increasing their market share of financing events (participating in 20-25% of biotech rounds), but they are definitely enriching for a greater proportion of positive outcomes over time. Although not shown here, this trend as a whole doesn’t exist outside of the biotech sector, where the enrichment rate has been flat for most of the last 15 years. This trend may reflect the increasing convergence and synergy between the innovative VC-backed biotech sector with Pharma R&D.

To confirm these observations, we looked at other datasets (i.e., Thomson Reuters’ summary data is reflected in these charts, but we’ve not reviewed their raw data); while differences in datasets exist, the confirmation of enrichment is clear. We found based on a Pitchbook dataset that 44% of the biotech IPOs in the 2013-2015 window had some corporate equity investor involved, despite corporate investors participating in only one-fifth of the biotech financings leading up to this window – again reflecting a ~2x enrichment.

Most of the high-flier biotech deals of the past few years have had at least one corporate equity investor: Acerta (Amgen), Aduro (JJDC), Agios (Celgene), Alios (four CVCs), bluebird (Genzyme), Ophthotech (Novo), Receptos (Lilly), and Seres (Nestle), to name a few.

Some of success enrichment in these data may reflect that some CVC investing tracks with BD deal-making. Equity investments as part of broader R&D or product collaborations are increasingly the norm, and these deals are presumably accretive and help make those young therapeutics companies successful. So some correlation is intuitive: exciting biotech companies attract the interest of Pharma BD groups, they strike deals with an equity component, and those companies go public or get bought by Pharma at a higher frequency than those without deals. Take the Celgene-Agios deal as an example: Celgene led the Series B round of financing, and participated in future rounds. Celgene also invested in equity rounds of Epizyme, Acceleron, and many others as part of their deal-making.

However, deal-making alone doesn’t account for the significant enrichment in success here, based on the magnitude of the overall numbers. As shown in the first chart above, CVCs invested about $500M per year into biotech equity rounds for most of the past decade, spiking recently in 2015. If you add up the investment activity from the bona fide fund side of the CVC spectrum, it represents the clear majority of the equity dollars and deal numbers in the CVC dataset. Novartis Venture Fund, SR One, and J&J Innovation (JJDC) each commit more than $100M per year into deals, based on recent disclosures, and have very large recent and past biotech portfolios (here, here, here, respectively). Dozens of other players with significant annual capital deployments are active: Amgen Ventures, Lilly Ventures, Sanofi-Genzyme Bioventures, Roche Ventures, Merck, Merck Serono Ventures, Medimmune Ventures, etc… As I mentioned in a past post, CVCs represent a considerable amount of implied assets under management (AUM). Aggregating the investments of these major CVCs and most of the historic equity is accounted for – across hundreds of biotech deals; in light of the large n’s in the dataset, this CVC investment activity must contribute significantly to the strong enrichment signal in these data.

Since this enrichment for successful exits is not simply a proxy BD deal-making, it’s worth speculating on what might else may be driving it. Correlation is obviously not causation, and we should be cautious about over-interpreting these data. But the striking enrichment does raise a few questions. Are corporate investors better at picking deals than other investors because they “know” what big companies want? Are they better at adding value to companies after investment to help shape them? Or do they tend to co-invest alongside blue chip investors more frequently than average investors? I don’t have the answers to any of those questions.

It would also be interesting to understand what governance structures across different CVCs might make them more successful than others at building high-value portfolios of equity investments. Some have purely strategic investment goals (e.g., Sanofi, AbbVie, Takeda), whereas others are predominantly financial (e.g., Novartis, SR One, Lilly, Pfizer). Some do it via funds, others via direct equity investments (e.g., Celgene). There are also different reporting lines – some into the CFO/BD, others into the CSO/R&D. These enrichment data suggest that a more thorough examination of the drivers of success may be warranted.

Continued evolution

Corporate equity investing into biotech has been a significant positive over the past decade. As the sector continues to evolve, and new models of biotech company creation come into practice (here), the role of CVC investing is likely to change. With less syndication happening in early rounds, it’s likely CVCs will shift the type of deals they invest in. Some groups may move into direct company co-creation with entrepreneurs. Others may form closer ties with established venture funds, through LP relationships or privileged co-investment models. Some corporates may decide to deprioritize their “fund” structures in favor of direct equity engagements; others may be scaling up their fund-specific activities. One thing is for certain – there’s lots of movement and flux in the various models right now and “no one size fits all”.

But in light of the long-term strategic convergence of our sector between large pharma, emerging biotech, and startup venture, I’m confident CVCs in some form will continue to be active, positive partners in the ecosystem going forward.

This blog also appears at the NVCA’s Corporate Venture Connection.