This blog was written by Samantha Truex, CEO of Quench Bio and Atlas Entrepreneur-in-Residence, as part of the From The Trenches feature of LifeSciVC.

In early September, I saw my two teenagers off to new destinations where they will live away from home. My son entered college and my daughter moved to Spain to live with a host family as part of a high school foreign study program. While I celebrate their independence, I also find it hard to let them go. I spent so many hours of so many days with them that life feels a bit empty now that they are gone. I find myself wanting to check in with my daughter’s host parents to see how she’s doing and how they are feeling about her. Yet I know I’ve got to let her go and grow, so I try not to check in too often.

In those feelings, I draw a parallel with entrepreneurs whose precious innovations are acquired and thereby become the responsibility of another company. Small teams at start-up biotech companies focus so much time and energy into our fledgling programs that we become attached, a bit like parents. We have visions of bright futures for our drug candidates to become therapies that improve the lives of the patients we serve. We want to see them progress and succeed, but we cede complete control if we are fortunate enough to have a program acquired by a global pharma company.

There is a tension between our desire to see progress and an acquiring company’s desire to proceed as it sees fit. Such tension drives signification negotiation when it comes to definitions of milestones, diligence requirements, commercially reasonable efforts and reporting requirements.

As Bruce Booth covered here in 2016, earn-outs are the norm in private biotech acquisitions. According to SRS Acquiom’s 2017 report, >80% of Biotech deals with upfront over $50M have milestone-based earnouts. In my experience on both sides of the M&A table and according to SRS Acquiom, most acquisition agreements stipulate that a buyer provide an update on progress toward these milestones in some form one to four times per year and an opportunity for sellers to discuss that update with the buyer.

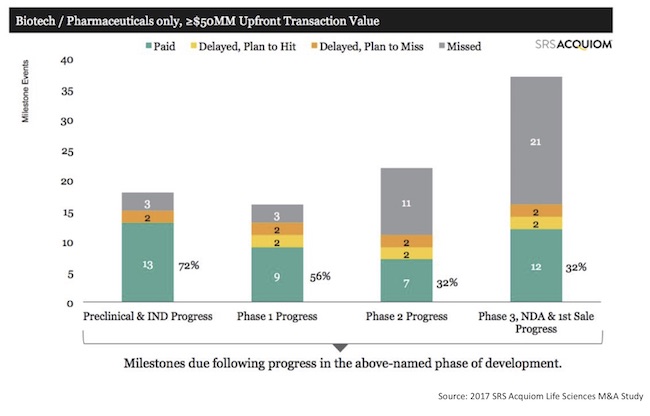

Having been the author of such reports for the buyer, I know that buyers can perceive an incentive to keep these progress reports short and superficial. From a buyer’s perspective, this approach seems like the best path to minimize questioning, concerns and possible meddling from the seller. From an investor’s perspective, a superficial report may suffice if it at least gives a sense of likelihood of the future milestone payments that a fund needs to handicap. Predicting such payments is important for venture funds’ planning and limited partner communications. SRS Acquiom data (below) tells us that the majority of late-stage contractual milestone payments never pay out, so actual reported progress is important input for venture funds.

That said, many reports don’t give enough information for an investor to predict milestone payment likelihood and certainly don’t give enough information to satisfy those parental entrepreneurs who do wonder about milestone payments, but also truly just wonder how their babies are faring with new parents and whether their visions of success may ever play out. A buyer who prepares reports with empathy for those “parents” may be better off in the long run.

According to Chris Letang, Managing Director of SRS Acquiom, “quality of reporting issues is something that we’ve been beating the drum on for a while. In our experience, more and better reporting from the buyer can head off a lot of potential dispute issues before they get started.”

Now as the recipient of the type of diligence reports I used to write, I believe that providing a clear and candid picture of the progress, the challenges, the plans, the predicted timeline and even a reminder of the uncertainty in any program is the best approach. This builds confidence in the buyer’s credibility and accountability, whereas lack of information can give rise to concerning questions, negative assumptions and resentment. Such feelings, positive or negative, may exist only in the noise of the long-term aftermath of any particular deal, but can build to become a decision-making factor in future deals where experienced, connected entrepreneurs have a choice of pharma partner in a competitive situation.

The vast majority of acquisition agreements call for simple reporting and a forum for follow up questions. Yet some recent deals are starting to include more specific, assertive terms regarding post-acquisition reporting. Examples seen by SRS Acquiom include:

- A development plan due from buyer to seller representatives within X months of closing, and reasonably detailed written reports twice a year thereafter

- Update meetings to include named seller representatives

- Until FDA approval, one seller representative sits on a steering committee for non-binding advice

- A milestone committee with 50/50 representation, quarterly meetings and formalities, including tie-breaking by buyer’s senior management

There is nothing stopping a buyer from sharing information more frequently with sellers than an acquisition agreement requires. When buyers and sellers inevitably cross paths post-deal, a well-placed comment on progress from the buyer goes a long way with the seller. Whether the comments tell of grand progress or of prickly challenges, they bely a respect for the “parents” and even offer them a feedback loop, creating a chance to improve their skills at nurturing the next baby.