Today Alkermes announced its acquisition of Rodin Therapeutics, a leader in the field of synaptic dysfunction and neuronal epigenetics.

Alkermes extensive experience in CNS diseases made them an ideal partner for Rodin, and this acquisition helps expand Alkermes’ efforts into a wide range of neurodegenerative disorders. Importantly, Alkermes appreciated the broad nature of Rodin’s epigenetic HDAC complex-selective pipeline of small molecule therapeutics. Under the terms of the definitive agreement, Alkermes will purchase the company for $100 million and Rodin’s shareholders will be eligible to receive future payments of up to $850 million for development, regulatory, and commercial milestones.

Alkermes extensive experience in CNS diseases made them an ideal partner for Rodin, and this acquisition helps expand Alkermes’ efforts into a wide range of neurodegenerative disorders. Importantly, Alkermes appreciated the broad nature of Rodin’s epigenetic HDAC complex-selective pipeline of small molecule therapeutics. Under the terms of the definitive agreement, Alkermes will purchase the company for $100 million and Rodin’s shareholders will be eligible to receive future payments of up to $850 million for development, regulatory, and commercial milestones.

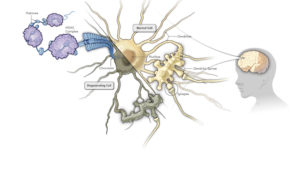

Here’s a summary of the scientific story behind Rodin’s approach. The loss of synapses in neurodegenerative patients is the best correlate of cognitive decline, and synaptic dysfunction drives clinical symptoms regardless of the underlying pathology. Decades of literature have demonstrated the pro-synaptic, pro-cognitive effects of HDAC inhibitors, including compelling work from the MIT lab of Li-Huei Tsai on memory and learning (here, here, here).  Historically, the challenges for using conventional HDAC modulators in CNS diseases have been their hematopoietic toxicity, limited HDAC class selectivity, and poor brain penetration – and Rodin was set up to address these and bring pro-synaptic epigenetic modulators to patients.

Historically, the challenges for using conventional HDAC modulators in CNS diseases have been their hematopoietic toxicity, limited HDAC class selectivity, and poor brain penetration – and Rodin was set up to address these and bring pro-synaptic epigenetic modulators to patients.

Several different discovery approaches were explored by Rodin to overcome those challenges and resulted in an extensive chemistry estate of complex-selective HDAC modulators. As a primer in epigenetics, HDAC enzymes only function in large multi-protein complexes inside the cell that direct their activity towards different loci in the genome: the major Class I HDAC complexes include CoREST, NCoR, Sin3, and NuRD. By using state-of-the-art enzymatic complex assays, the Rodin team was able to establish structure-activity relationships for inhibiting the CoREST complex vs the others. This selectivity profile completely changes their safety and tolerability profile, while maintaining the efficacy on synaptic function. In preclinical studies, our CoREST modulators address the molecular, structural, and functional deficits that occur in many synaptopathies, like Alzheimer’s and other dementias.

Based on its stellar preclinical profile, we took our lead program, RDN-929, into Phase 1 studies in late 2018, where our SAD/MAD data support that the compound is safe, well-tolerated, and active in engaging the target (including pharmacodynamic measures of epigenetic changes). It’s the first reported brain-penetrant, complex-selective HDAC inhibitor and shows no signs of hematological toxicity.

From a corporate perspective, Rodin’s history reveals much about the journey: Atlas Venture started looking at HDAC inhibition for memory and learning as early as 2006, and we almost started a company in the space on several occasions over the next seven years. In 2013, the venture creation stars aligned around a credible non-conventional chemistry strategy, and we embarked on a seed investment with J&J (in the “seed class” of 2013). With emerging signal that the discovery effort was advancing, we closed a Series A in 2014. I had the privilege of being the Acting CEO of Rodin for its early years while it incubated at Atlas, but in 2015 we recruited serial entrepreneur Adam Rosenberg to run the startup. Shortly thereafter, we closed on an option deal with Biogen that brought capital and a possible exit path to the story. As can happen with option deals, a change in strategy and a new head of R&D at Biogen led to terminating that agreement in 2017, which enabled us to raise a Series B financing, bringing several great co-investors to the story, including GV, Hatteras Venture Partners, Remeditex Ventures, and Third Point Ventures.

With the support of the Series B funding, we advanced into the clinic and continued to build out a platform of complex-selective compounds in preclinical studies. Other promising, earlier-stage molecules are being directed at multiple additional indications where safe HDAC-complex inhibitors could be explored, such as sickle cell disease and oncology.  With modest seed, Series A, and Series B funding rounds, Rodin was incredibly capital efficient over the last six years, having spent only ~$40M to deliver the story to this point.

With modest seed, Series A, and Series B funding rounds, Rodin was incredibly capital efficient over the last six years, having spent only ~$40M to deliver the story to this point.

We look forward to watching Alkermes progress Rodin’s platform forward to longer term studies in patients.

A few notable themes jump out from the Rodin experience:

- Biotech, like life, isn’t linear. We started out on 2013 focused on a chemistry strategy with one discovery partner, but followed the data to find a new path with a different angle. J&J was involved, and then wasn’t. We had a deal with Biogen, and then we didn’t. The story evolved, and like most stories in the real world this one wasn’t a straight line. But amidst all the chutes and ladders in this story we’ve brought a potential medicine forward into the clinic.

- Success is 100% dependent on the team. The Rodin team, under Adam’s exemplary leadership, has been an incredibly productive and capital efficient crew, and the esprit de corps of this tight roup is very strong. I’ll call out the leadership team specifically – Michael Ryan, Anne Sullivan, Ajim Tamboli, Magnus Ivarsson, and Steve Sweeney – but there is also a great bench of scientists behind this story that have delivered impressively, including Nate Fuller, Rodin’s head of chemistry, who was instrumental in driving Rodin’s successful efforts to design complex-selective molecules. Teams also change over time, as per the first theme: it’s interesting to note that the current leadership team all joined after 2015, recruited to the story by Adam as he added talent over time, reflecting a common reality in many biotechs around team turnover and evolution.

- Better living through chemistry. Riffing off that great DuPont slogan, it’s very true here that the chemistry advances made by the Rodin team have been central to our success. Cracking open new frontiers in complex-selective modulation with novel chemotypes created the opportunity to bring these medicines to patients. Nate and the rest of the chemistry team (along with our very engaged chemistry advisory board of “greybeards” John McCall, Bill Greenlee, and John Lowe) delivered an impressive chemical estate for Rodin (here).

- New tools can open up translational research. Because neuroscience is so challenging, early translational tools are critical. One of the reasons for our optimism has been the advances in disease-relevant fluid and neuroimaging biomarkers, like the SV2A PET ligand that we’ve explored in a non-interventional clinical study in both healthy volunteers and Alzheimer’s patients. A key Rodin team member, Berkley Lynch, was part of the group that characterized SV2A years ago at UCB Pharma. This allows for the imaging of synaptic density in the brain real-time, and has now been used across multiple diseases to observe the changes in the brains of patients over time.

- Contrarian neuroscience is exciting neuroscience. Neuroscience isn’t easy and with large pharma’s deprioritizing R&D in the space (like Amgen recently, and Pfizer, AZ before that), it’s been a contrarian bet for years. Even within neuro, there’s been a lack of diversity in approaches (e.g., all the investment “oxygen” has been consumed by amyloid in AD), and typically small biotechs generally shy away from diving into Alzheimer’s and other dementias. Further, epigenetics outside of cancer has also fallen out of favor, amplifying the contrarian nature of Rodin’s approach. Adam has been on the bully pulpit multiple times with his blogs on the subject (here, here, here).

- Conviction of the few is critical. Because it’s contrarian, finding partners to help fund projects in neuroscience isn’t easy. But we found a great group of likeminded co-investors at Rodin, who share the conviction that these are approaches worth advancing to patients: Clay Thorp of Hatteras, Ben Robbins at GV, John Creecy at Remeditex, and Jason Hong at Third Point. Neuroscience isn’t in the risk appetite for every investor, but finding a coalition of the willing is critical – and we found that with these great partners.

- Rodin’s science is personal. Everyone knows someone with dementia, and almost all of us have a family member that suffers or did suffer from it.

Rodin embraced that and really integrated that aspect into their culture. In fact, the “Why” page of their corporate website (look at it soon before it disappears!) so beautifully captures the personal nature of dementia by showing pictures of our team’s loved ones affected by dementia.My grandmother, Evelyn, is one of the pictures. She passed away from dementia, likely Alzheimer’s Disease, almost 25 years ago.

Rodin embraced that and really integrated that aspect into their culture. In fact, the “Why” page of their corporate website (look at it soon before it disappears!) so beautifully captures the personal nature of dementia by showing pictures of our team’s loved ones affected by dementia.My grandmother, Evelyn, is one of the pictures. She passed away from dementia, likely Alzheimer’s Disease, almost 25 years ago.

It’s been a wonderful and dynamic six-year journey for Rodin, and it’s been an honor to be a part of it.

I’m truly excited to see Rodin’s cutting-edge neuronal epigenetic approaches advance deeper into the clinic and to patients in the hands of a neurology leader like Alkermes.