By Sam Truex, Venture Partner at Atlas Venture, as part of the From The Trenches feature of LifeSciVC.

Holy cow, have we seen the rain lately – both downpours outside and a downpour of SPAC activity.

In October 2020, Bruce Booth delved into the world of Special Purpose Acquisition Corporations (SPACs) in his blog It’s Raining SPACs. He covered the features of SPAC vs IPO and potential benefits of a SPAC in terms of dilution, timeline and control relative to IPO route.

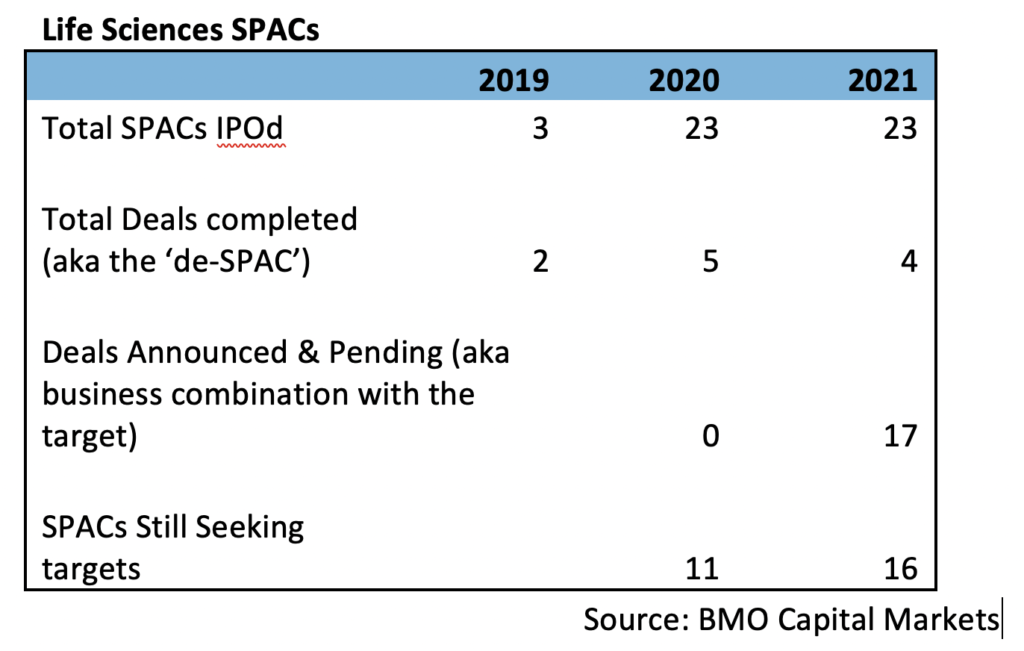

Bruce pointed out that 15-20 biotech-focused SPACs had recently launched. He rightly predicted a flow of SPACs and mergers arising from their de-SPACing in the year to come.

Where do we stand today?

Life Science SPACs continue to be an alternative, potentially-attractive path to access the public markets.

According to data kindly provided by Annette Grimaldi’s BMO Capital Markets team, the first half of 2021 has seen 23 SPAC IPOs and another 13 filed; that’s just the ones disclosed in the life sciences space. According to Susan Graf, CEO of a life science SPAC that is preparing a S-1 filing now, “The life science SPAC is here to stay as another route to access the public markets. It can be a very swift way to gain capital to support pipelines and continued access to public markets. It may be even more appealing when the traditional IPO market becomes choppy.”

Just in the past week, the following three stories told a rosy picture of SPACs in their glory:

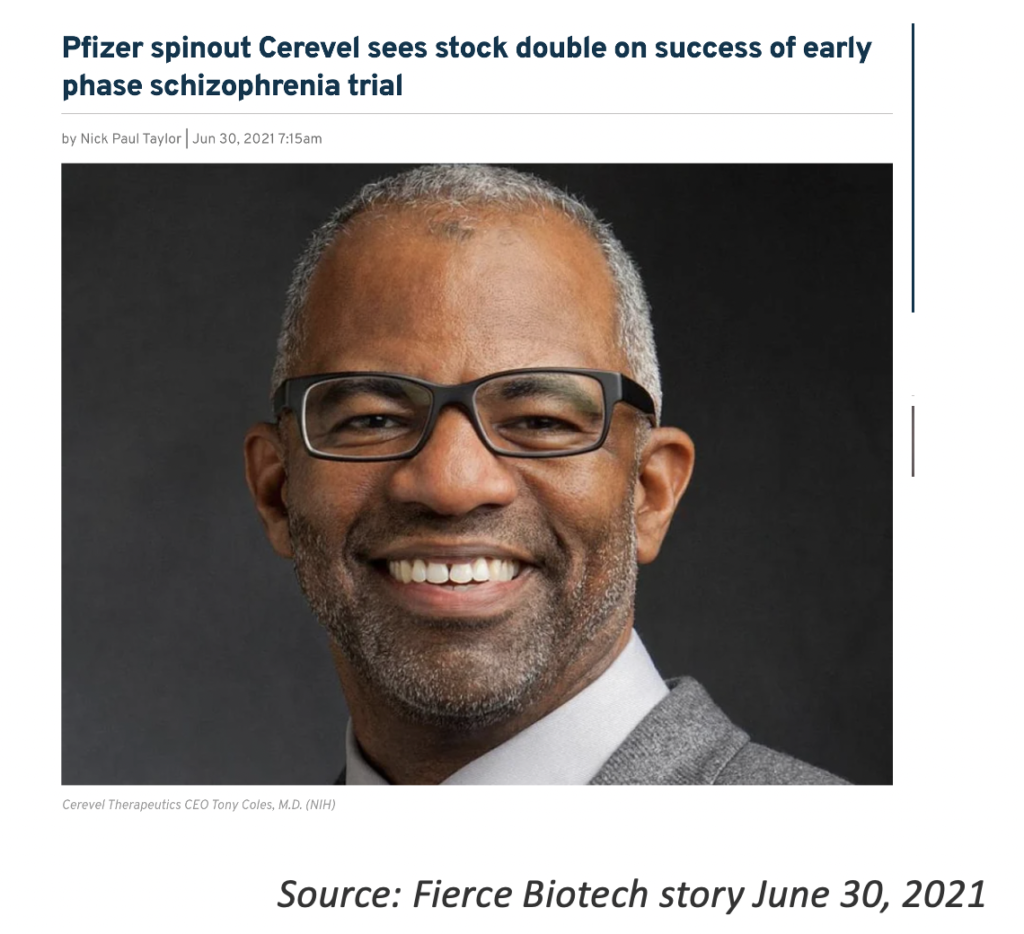

First, Fierce Biotech reported on impressive P1b results from Cerevel’s schizophrenia drug trial. Recall that Cerevel entered the public markets via merger with Arya Sciences II, a SPAC sponsored by hedge fund Perceptive Advisors. Perceptive worked with Cerevel to round up an impressive list of investors including Fidelity, T. Rowe Price and RA Capital, as well as existing Cerevel shareholders Pfizer and Bain, to infuse over $400M into Cerevel at its public market debut+PIPE in late October 2020. The close of the deal, also known as de-SPACing, occurred just four months after the June 2020 IPO of Arya Sciences II.

Cerevel’s strong phase 1b clinical trial sent the stock price soaring up >130% on the day of the announcement. Returns like this no doubt continue to fuel investors’ interest in sponsoring SPACs. Indeed, Perceptive already de-SPAC’d Arya III (target: Nautilus Biotechnology) and IPO’d Arya IV in February 2021, then filed on Arya V in June 2021.

Kudos to Cerevel CEO Tony Coles and team for this important outcome in a very difficult disease. This is a great story of the value SPACs can play in resourcing clinical progress on therapeutics for the patients we all serve.

Kudos to Cerevel CEO Tony Coles and team for this important outcome in a very difficult disease. This is a great story of the value SPACs can play in resourcing clinical progress on therapeutics for the patients we all serve.

Second, Foresite is at it a 2nd time with its FS Development Corp II SPAC announcing last week the acquisition of Pardes, focused on COVID-19 antivirals. As is common in SPAC transactions, the deal closing will come with a PIPE. This time Foresite joins RA Capital, Frazier and strategic investor Gilead in the PIPE. Foresite’s first SPAC went public in August 2020 and de-SPAC’d 6 months later with a February 2021 deal closure with Gemini Therapeutics. With this 2nd SPAC, it only took Foresite 4 months to land on a target. This is another example of a SPAC providing runway to a therapeutic that could be game-changing for patients.

Third, LWAC’s (Locust Walk Acquisition Corp) de-SPACing plan was featured on Benzinga’s SPAC Attack last week. Steve Worland, CEO of the target eFFECTOR spoke highly of the process and experience that SPAC CEO Chris Ehrlich brings to the deal. “eFFECTOR looked at the traditional IPO route, but ultimately decided to go public via a SPAC because of the SPAC route’s shorter time frame to market, increased deal certainty and the expertise that Ehrlich could bring to the company’s board,” Worland told Benzinga.

That’s just 3 recent examples of the great stuff from the SPAC downpour. Seems like everyone wins in these SPAC deals, right?

Perhaps. Here are a few realities of today’s SPAC landscape.

- Many, many SPACs have launched IPOs already this year – 345 SPACs in 2021 across industries including 23 in life sciences.

- The explosion of SPACs across industries has brought more regulatory and shareholder concern to the space. SEC issued guidance in April regarding accounting for the warrants often featured in SPACs. This brought concern to the broader SPAC market, as described here and here. Continued activity in life science SPACs suggests that the industry has found a path through this accounting maze.

- Increased concern has also driven a substantial impact on pricing and availability of D&O insurance. A recent quote priced premiums for $5M of SPAC D&O coverage at $600K-800K.

- While initial SPACs included warrants for the investors, many SPACs are now including modest or no warrant feature, making them more favorable financing routes for the target companies.

- SPACs are competing for target companies – with target companies now inviting multiple SPACs to “bid” rather than vice versa. Target companies can look across SPACs for the most favorable combination of attributes, including available capital, target valuation, likely investors in the PIPE, potential for analyst coverage, potential board members from the SPAC board, lack of warrants (and lack of accounting complexity that may go with warrants), etc.

- As a consequence of intense competition, SPACs are looking far and wide for targets. There are life science SPACs focused on international target companies (EU, Israel) seeking a NASDAQ listing. There are those looking to pharma to spin out assets directly into a SPAC deal.

- It’s conceivable that some 2021 vintage SPACs may not find a deal during their allotted 2-year timeframe. I haven’t heard of this occurring yet, but it may happen with the number still seeking deals and more continuing to launch. According to BMO data, 11 of the 2020 vintage life sciences SPACs are still in search mode. That’s 70% of them. They are competing with 16 still seeking targets from the 2021 class. This said, with greater market volatility, where a traditional IPO path may be less certain, the SPAC option may become more attractive. Perhaps SPACS are a means to keep the rain coming when traditional IPOs have a drought?

I am no expert on SPACs, but rather an industry observer. Based on my observations, it seems like many sponsors and many companies have, indeed, been successful with life sciences SPAC deals. With experienced life science investors often providing additional capital via a concurrent private investment in a public entity (PIPE), the SPAC route can clearly provide substantial funding with high-quality, long-term investors in the mix. As a biotech company leader, I certainly appreciate the optionality of having high-quality life sciences SPACs available as an alternative path to the public markets. Let it rain.

Enormous thanks to Susan Graf, Adam Keeney and Adam Rosenberg, fellow biotech CEOs who reviewed and contributed to this blog and to Chris Ehrlich, recent SPAC CEO, and Samantha Singer, SPAC board member, for their insights. Special thanks also to Alber Najjar, Associate in BMO Healthcare Investment Banking, who swiftly gathered, assessed and provided recent SPAC data upon my request.

|

|

||||