Misery loves company, and so it goes with the stock market for the innovation ecosystem these days.

The general risk-off market environment has been crushing both the emerging tech and biotech sectors alike. Last year, generalists in many ways capitulated on both sectors, shifting out of growth stocks. Lately, fears about less “transitory” inflation, tight labor markets, multiple interest rate hikes, and geopolitical conflagrations have pushed sentiment even more negative, towards less risky asset classes and defensive sectors. For example, asset allocation to inflationary commodities is now at a record high of 33%, reflecting a low confidence in the equity markets.

Innovative technology and biotech markets witnessed a ~50% drop since peaking in Feb 2021, a deep and sustained stock pullback. This was especially true for names that boomed in 2020 and early 2021: biotechs, in particular COVID-focused names like Moderna and BioNTech (off 50% since their peak last fall), have been hit hard. But so have former tech darlings like Roku, Peloton, Rivian, Zoom, Beyond Meat, Pinterest, and Robinhood, to call out a few “nearly” household names – all down over 70% in the past year.

For those of us with our heads down, solely focused on biotech, it’s important to bring the periscope up and survey the broader market in times like this, especially in our quest for answers as to why the bio markets have experienced their longest downdraft in decades. Our sector has faced some real and perceived headwinds with negative data/newsflow on R&D and commercial fronts, drug pricing issues, hypercompetition in many innovative categories, and the “relevancy challenge” for investor attention, among other things.

But the reality is that while biotech has looked bleak for the past year, so have nearly all high innovation-quotient sectors.

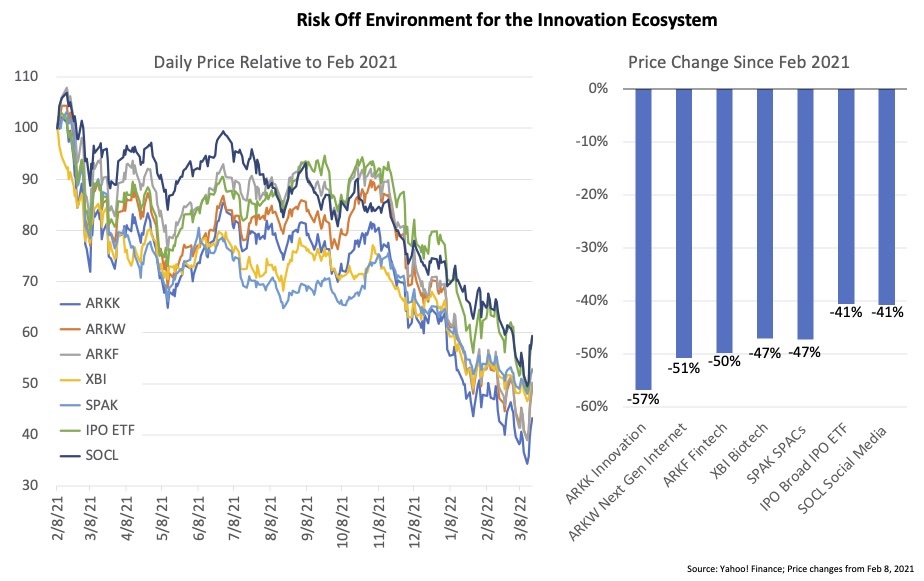

Here’s a quick comparison of the biotech market ($XBI) to a few well-known indices and ETFs: Cathie Woods’ triple of $ARKK (Innovation broadly), $ARKF (Fintech, crypto), $ARKW (Next Gen Internet), Renaissance Capital’s $IPO ETF (holds mostly tech IPOs of past few years), Defiance’s SPAC ETF ($SPAK) to capture the predominantly tech SPAC craze, and Global X Social Media ($SOCL) ETF for consumer internet. While there’s some biotech exposure in $ARKK and a small percentage in $IPO, there’s a strong emerging tech weighting in each of these names.

As the chart below shows, the daily price trends across all of these correlate well over the past year, overlapping nearly entirely, leading to losses in the 40-60% range for this group since the peak in early Feb 2021. For comparison, the median performance of all biotech IPOs since that peak, offer to current, is down 35-40%. Looking at all biotech IPOs since Jan 2019, its off 45-50%. All of these downdrafts are broadly inline with each other.

For the first few months of 2022, biotech ($XBI) is down -18% YTD as of March 20, after some recent gains; by comparison, the ARK funds are down 27-30%, and the Renaissance IPO ETF is down 24%. So despite the real and perceived headwinds for specific to biotech, the innovation ecosystem as a whole is largely moving in tandem.

There’s a simple conclusion from these charts: there’s nothing specific or unique about the biotech sector that has driven this downdraft in the market since peaking in Feb 2021. It’s been a general risk-off and value-over-growth sentiment that’s demolished these sectors in a largely indiscriminate manner. Individual names, of course, are deeply impacted by company-specific news flow, which is a volatility inherent to biotech; but as a whole, the sector’s trendlines are really no different than their tech counterparts, suggesting a more general sentiment change.

Importantly, in light of this, it’s fair to say that biotech’s yearlong meltdown is not likely due to the sector’s unusual taste for R&D-stage loss-making IPOs, including those still in preclinical, or the oft-cited criticism that bio VCs are pushing out too many public companies: as a comparison, Renaissance’s overall $IPO ETF, which holds 106 names (only 8 biotech’s, a 5.5% weighting), is off roughly the same 40+% as biotech. Seven of its top ten holdings (all large tech IPOs) are negative, and some hugely so.

So what’s been behind the innovation ecosystem’s dozen disastrous months? Several common themes across these sectors exist.

First, markets often overshoot valuations that are based on new markets during bullish environments, because future cash flows are discounted and risk-adjusted at lower (more favorable) rates than they should have been. This is often evidenced by huge price-to-earnings ratios and/or significant terminal values (“R&D value”). Growth stocks whose big revenue assumptions are way out in the future are obviously near-impossible to model accurately, so often become sentiment or momentum stories. We all know that DCF models typically only tell us what we want to see. Probability of success (PoS) assumptions around future markets or for technical outcomes, a huge driver in these models, are largely just “scientific wild ass guesses” (SWAGs). This holds for innovation-rich emerging tech as well as biotech. And this is a inherent property of the equity markets – overshooting and undershooting in the near term, but hopefully getting it right in the long term.

Second there’s also been a relative lack of M&A in some of these areas, as big buyers are largely sitting on their hands with early-stage valuations priced to perfection. Although maturing tech businesses had a boom year for M&A throughout much in 2021, emerging tech M&A was not nearly as exciting and some pundits today think a tech M&A boom in 2022 will need to wait for a further cooling on valuation. With biotech valuations way down, many analysts anticipate larger biopharma players getting more aggressive with their huge balance sheets of cash. More M&A activity across the innovation ecosystem would obviously be a positive.

Further, across these growth sectors, there’s been cooling newsflow with regarding to many of the momentum names, especially as post-COVID expectations reset forecasts to lower for use of exercise bikes, videoconferencing, streaming, as well as vaccines and antivirals, as examples.

Inside of biotech, we’ve obviously seen the recent newsflow bias to the negative, which I covered last week, and this is of course a real concern; the SMID-biotech sector, and more broadly the biopharma industry, needs a higher cadence of “wins” regarding clinical and regulatory outcomes to help reverse sector-specific sentiment. Excitement around new products and platforms – and permission to believe in the promise of biomedical innovation again – needs to return to the markets to help turnaround the malaise.

With the 20/20 vision of hindsight, these innovative sectors were obviously overbought back in Feb 2021; that said, I’m confident that in the long run, at least for biotech, today’s market will be viewed as oversold.

Cathie Wood is frequently laughed at on social media for her bold statements on innovation, and significant equity under-performance over the past 12 months. I don’t agree with her on everything (e.g., deflation vs inflation), but I suspect a good number of her innovation calls will likely be right over a long-time horizon. Of course, we’re all dead over a long-time horizon too, so investors have to get their overall timing right with regard to backing long-dated innovation cycles as well.

So what’s going to happen this year? I’m not a crystal ball gazer, but here are my two cents.

On the macro side, digesting the Fed’s recent and future interest rate changes should be a market clearing event (and hopefully will tame “transitory” inflation), as would some positive news on the geopolitical side of the equation. This would create a more constructive backdrop in the equity markets. The positive response in biotech over the last week could be the beginning of this, but it’s too early to know.

As for the innovation-rich sectors themselves, whether momentum returns in the equity capital markets is more a question of “when” and not “if” – we know these cycles happen, as markets often “miss” in both directions. Things will get better. When the momentum does return, it’s also hard to know if it will it be a V-shaped response, or a more tepid U-shaped version, or a rather challenging L-shaped one; hopefully more of the former and not the latter.

Given the rather strong correlations over the past year, positive news and renewed momentum in the emerging tech space is likely good news for biotech, and vice versa: a rising tide around the investor sentiment toward “risk-on” innovative growth names should lift all the boats. Same is true if the markets sink further, unfortunately. That said, correlations aren’t set in stone. It’s possible that the biotech markets could diverge from other innovation-rich tech sectors in the coming months and quarters, in either direction.

Stepping back from the details, I’m reminded of the famous Buffett axiom: in the short term, the markets will be a voting machine, and the innovation sector, tech and biotech alike, have been moving together in sentiment – as votes against risky equity investments. But in the long term, the correlations likely dissipate for individual companies as the markets will become a weighing machine: only those firms with actual innovations and valuable new products will get sustainably rewarded.