By Aimee Raleigh, Principal at Atlas Venture, as part of the From The Trenches feature of LifeSciVC

Just in time for new years’ reflections and resolutions, this year’s JPM felt like a refreshing burst of enthusiasm for a sector that has seen its challenges in 2022 and 2023 but also some green shoots. 2023 was a stellar year for M&A, comeback stories, burgeoning “hot” spaces, and for re-learning the basics of belt-tightening and careful capital allocation. Despite the mixed bag of macro trends (pauses on interest hikes, but challenges inherent in an election year), the mood this year at JPM was one of optimism. With that in mind, below are some key takeaways emerging from the meeting and as we look forward to another productive year in biotech:

Sector-wide optimism is driven by M&A and is focused on a few standout therapeutic areas:

There is a self-amplifying cycle whereby exits (typically IPOs or M&A) influence early biotech investing, which in turn fuel the pipeline for future growth. In lean times such as 2023, we saw a shift towards several “hot” areas driven by massive commercial potential, clinically (± commercially) validated mechanisms, and exits that encouraged further investing, even at the early stage. While “bubblicious” in nature (as my colleague Bruce Booth has coined), unlike the highs of 2020, today we are seeing more focused intensity around several key therapeutic areas: obesity (projected >$80B global market by 2030), immunology (>$150B), advanced modalities in oncology (especially ADCs and radiopharmaceuticals, >$30-40B), and neuro ($20-30B). These are incredible forecasts and CAGRs, which if we assume directionally correct, rely not only on steady growth for approved therapies but also a substantial success rate of, and continued investment in, the development pipeline.

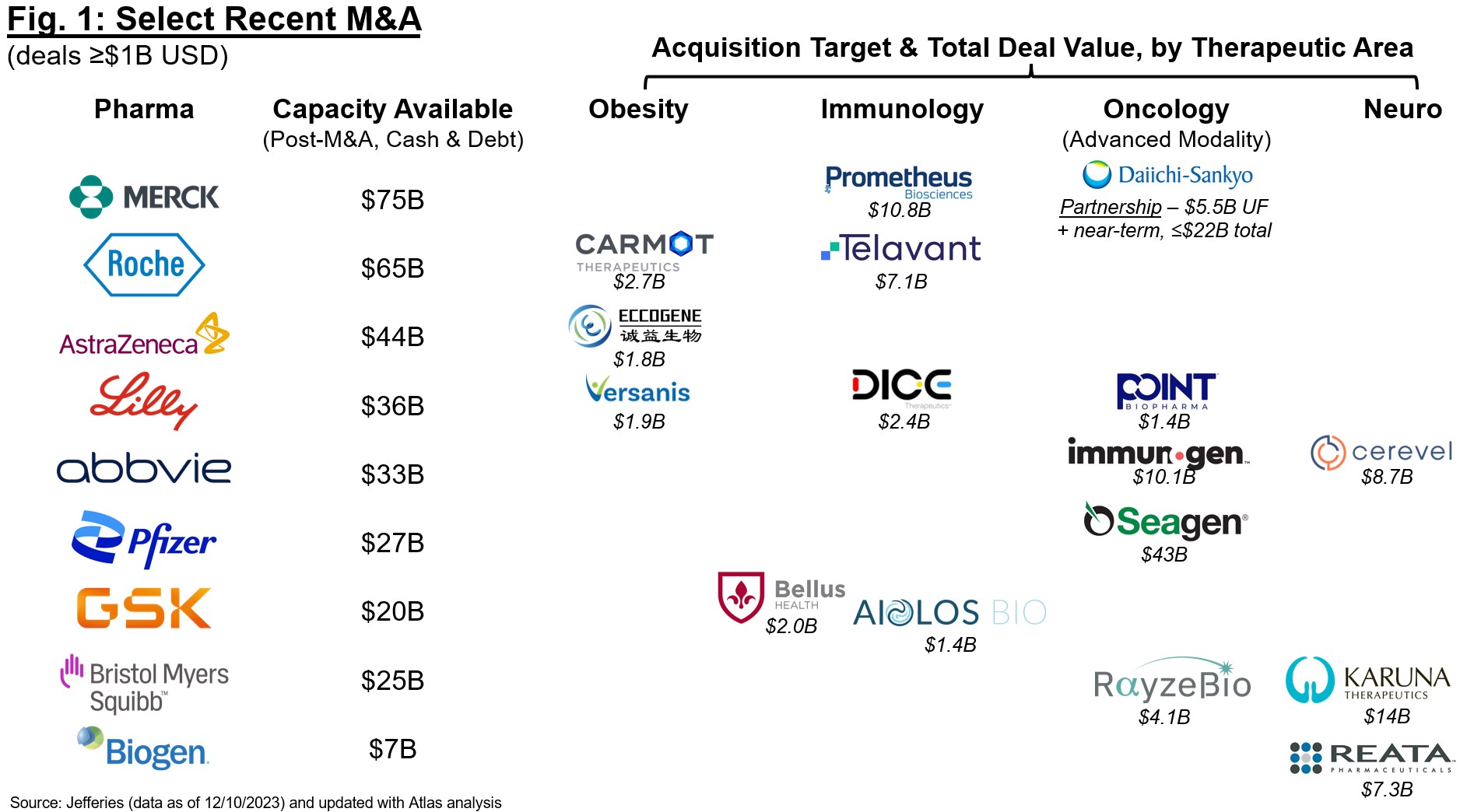

Unsurprisingly, many of these “hot” areas became so with attractive valuations and exits via M&A or IPOs, further encouraging venture investment in earlier-stage companies. This enthusiasm is stage-agnostic, but most focused on deals involving clinical-stage assets with “de-risked” biology. This shift towards best-in-class rather than first-in-class is exemplified by this year’s M&A landscape (Figure 1). The field has been betting that patent term expiration for Pharma blockbusters will drive M&A for the past two years, and we are starting to see a real shift in buying patterns, especially in the back half of 2023. Naturally many of these acquisitions are driven by enthusiasm for clinical-stage assets that may contribute meaningfully to revenues in 2030+, and we are seeing Pharma build deeply in several key areas (obesity, immunology, oncology, neuro) as they add on to existing franchises or build new ones. The expectation that Pharma will continue buy-ups here is helping to fuel conviction for another strong year ahead for M&A, especially for those acquirers who will rely on inorganic acquisition to build in areas under-represented by internal R&D (e.g., recent announcements from Merck and Sanofi for obesity and broader metabolic disease).

Rise of the best-in-class biologics plays:

Are you looking to in-license or invest in “de-risked” biology that is already in the clinic? Join the club. The past year has seen an explosion in “fast follower” approaches to improve on existing target product profiles for select mechanisms, and was exceptionally apparent for antibodies and other biologics. There are several modality-specific trends driving this enthusiasm, in addition to the aforementioned attractive valuations in the space:

- Improved administration & dosing:

- Antibody half-life extension technology is now widely available given the original MedImmune patents covering the popular “YTE” mutations have expired, increasing use of this validated approach to achieve every 3 months (or even less frequent) dosing

- Subcutaneous formulations are increasingly becoming a requirement to enable more convenient and at-home use. SC formulations benefit from the increased availability of approaches (e.g., from Halozyme) to improve bioavailability, further reducing dose

- Viability of bi- and tri-specifics: increased know-how on biology and CMC has enabled a number of clinical multi-specific antibody (or other format such as nanobody) programs, enabling enhanced potency and PK compared to historical precedents

- Intellectual property considerations: the recent Amgen vs. Sanofi ruling by the Supreme Court substantially restricted IP for antibodies, limiting claims to specific sequences with enablement support vs. broad epitope coverage. This ruling is good news for “fast follower” approaches where sequences can be selectively mutated to achieve similar (or better) potency while still having freedom to operate for a given target or epitope

- Commercial potential: market research for a given indication often suggests strong commercial potential for cannibalization of existing q2w-q4w therapies if next-gen biologics can be extended to q3m+

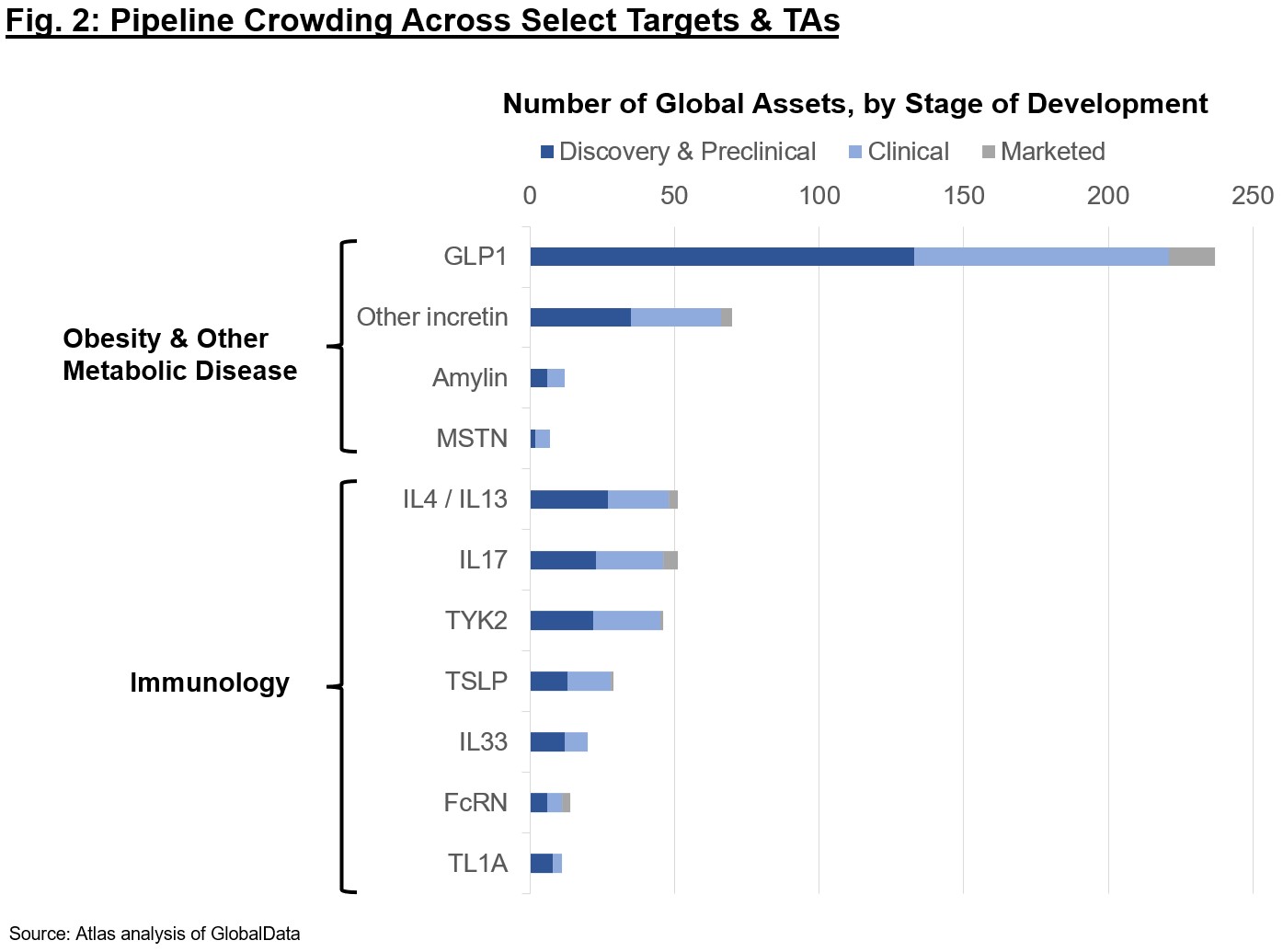

Despite these advances, it is clear the enthusiasm may be going too far. The market for each target class likely asymptotes with the number of Pharma or large biotech who can clinically develop and commercialize such assets; thus, there is intense focus on the first handful of assets to market. Figure 2 shows pipelines across modalities for some of the competitive targets today. If you’re a company or investor proposing early-stage programs, think carefully about the ultimate differentiation for the patient – just because a program is technically differentiated doesn’t mean it’s worth doing. Small molecule GLP1s? Still may be some merit if they are clinical-stage and can achieve once-daily dosing without too steep a cut in efficacy or worsened adverse events vs. peptides, but be wary of the intensely competitive landscape. A permanent gene edit to produce a difficult-to-titrate supply of GLP1 in the liver? Probably challenging given Cmax-driven adverse event profile, safety requirements, and COGS constraints for an obesity or related indications. While companies may attract “momentum” investors for hot targets and a new mechanism, they won’t get far if the TPP is impractical. Finally, I would be remiss if I didn’t caveat that we still see many clinical failures even for “de-risked” biology, as nothing is ever truly low-risk in our industry. Whether trial design, execution, or otherwise, drug development even where there is precedent is a challenging road and should not be taken for granted.

Enthusiasm for obesity is driving development in broader metabolic disease:

The obesity space has seen tremendous growth since Wegovy (high-dose formulation of semaglutide, Novo’s GLP1 agonist peptide) was first approved in mid-2021 and started flying off the shelves almost overnight. Since then, we are now starting to see the fruits of a carefully planned indication expansion campaign by Novo and Lilly, most notably the SELECT-CVOT that demonstrated protection from CV-associated mortality and nonfatal MI and stroke in obese patients with pre-existing CV disease. Additional trials (e.g., ongoing tirzepatide CVOT to assess head-to-head CV outcomes vs. Trulicity in T2D) will continue to build the case for weight loss (and incretins) in broader metabolic disease and suggest overall healthcare system cost benefits to anti-obesity therapies.

The incretins as a class also look interesting across a number of follow-on indications, as evidenced by clinical trials in these areas (below). In addition to building support for ≥10-15% weight loss alone as an intervention in these diseases, these data also help set the proof-of-concept trial efficacy bar for future alternative non-incretin approaches:

- Heart Failure (HF) in Obese Patients: semaglutide recently readout in a Phase 2 trial in obese, nondiabetic patients with heart failure with preserved ejection fraction (HFpEF) (here and here), showing substantial improvements in the QoL measure KCCQ-CSS, 6-minute walk test, and a blood marker for cardiac function (BNP) over a year of dosing. Clearly weight loss alone (± additional beneficial CV mechanisms) is having a profound impact on this segment of the HF population. Tirzepatide is also trialing in a Phase 3 obese HFpEF trial, and top-line readout in 2H 2024 will suggest whether the increased weight loss achieved with dual GLP1/GIPR modulation further improves QoL and functional endpoints.

- MASH (formerly known as NASH): weight loss and liver defatting have proven effective for NASH improvement without worsening of fibrosis in obese patients, with increasing mechanism involvement (GLP1 plus additional GIPR and / or glucagon receptor modulation) potentially increasing magnitude of this benefit. Whether the incretins can improve fibrosis is still an open question, but key readouts from tirzepatide Phase 2 in F2/F3 (1H 2024), semaglutide Phase 3 (biopsy data likely 2H 2024), among others (e.g., ALT) continue to build momentum in the indication. Will incretins “solve” MASH in obese patients? My take is definitively no, though they will likely increasingly be used in early stages (F0-F2) and as backbones to combination therapy.

- Kidney disease: outcomes in CKD are likely to benefit from weight loss as well, with the semaglutide Phase 3 FLOW trial stopped early last October after an interim efficacy read (full data expected this year).

Investors are bullish on both incretin and alternative therapies for obesity and metabolic disease, though I would caution we are approaching unrealistically high valuations for many of the clinical stories emerging over the past quarter.

Small molecules are still in vogue despite IRA headwinds:

We continue to hear optimism for the convenience of orals even in indications with high-commercial potential and enriched for CMS coverage (likely to fall in crosshairs of IRA). Whether it’s small molecules to target the incretins (GLP1R ± GIPR), targeting well-validated signaling nodes in I&I (e.g., STAT6), or enhancing the TPP via next-gen approaches (PROTACs, glues, covalent binders, etc.), small molecules continue to be enthusiastically funded even at the discovery stage. That said, 2023 has shed light on the huge disconnect in how our industry is perceived externally and the many ways it is distorted as a political tactic. Let’s agree to make 2024 the year we take action and voice concerns for legislation that encumbers the ability for biotech to deliver on its promise to patients and caregivers.

Delivery is still a bottleneck for novel modality genetic medicines:

Just as in 2023, extra-hepatic delivery continues to dominate discussions for many platform companies. Once a pipe dream, we are starting to see real advances in several key areas that are worth highlighting…is 2024 the year extra-hepatic delivery finally starts to hit its stride?

- TfR1 is almost becoming table stakes for Pharma and biotech looking to deliver to the brain and / or muscle. While names like DNLI, JNJ, DYN, and RNA were real pioneers in the space for delivery of antibodies and oligos, more and more companies are developing their own TfR1 shuttles or partnering to bring in the capability. In the past 6 months alone, TfR1 shuttles have made an appearance in several R&D Day decks, including for ALNY, ARO, Lundbeck, and IONS (partnering with BCYC for peptide binders), among others.

- What comes next? TfR1 took many decades to crack, especially for successful transcytosis across the blood-brain-barrier. More recently, we are starting to see data to suggest that different formats (e.g., Fab vs. mAb) and epitopes may increase the therapeutic window (i.e., reduce on-target anemia). Despite these advances, we are merely scratching the surface when it comes to potential ligandable targets for delivery of biologic, oligo, or other cargo – 2024 promises more development in this area of huge unmet need.

- Capsid evolution approaches for AAV are also undergoing a huge step change, with Voyager’s TRACER platform pioneering the way and recently enabling several high-profile partnerships with Novartis, Neurocrine, and others. Other companies in the space (e.g., Affinia Therapeutics, Capsida) are focusing both on CNS and other ex-liver tissues – 2024 may be the year we see real progress towards the clinic for these novel capsids.

- Extra-hepatic targeting of LNPs has also been making strides in late preclinical pipeline, with advances from ReCode in the lung, GBIO for immune subsets, and Capstan for HSCs and T cells.

All in all, delivery of genetic medicines has never looked more promising, though many investors are still wary of investment and time required for very early discovery plays given historical challenges with translation.

Likely increased rate of capital deployment in 2024:

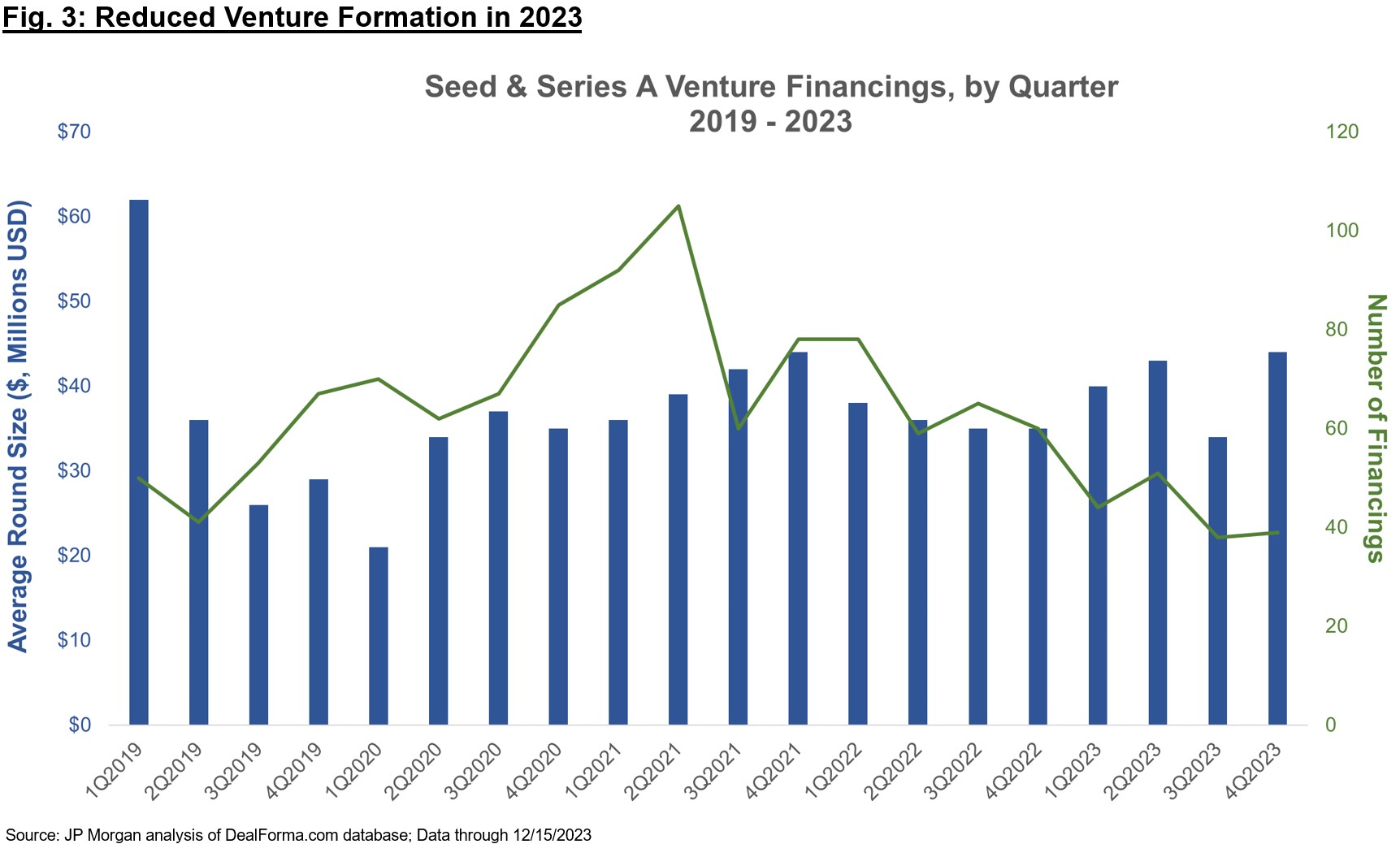

Therapeutics-focused venture funds have raised record amounts over the past two years, and yet 2023 saw a sharp contraction in company formation via Seed and Series A financings (Figure 3, and also commented on in Bruce’s recent post). The “haves” in this environment are still able to raise capital to fund through critical inflections (which are increasingly viewed as Ph1b / Ph2a “proof-of-concept” for Series A companies), but the number of financings have dipped quite a bit, suggesting many “have nots” that are unable to raise in these environments.

Many of the biotech VCs that raised recent funds are sitting on ample capital, and GPs will start feeling the pressure to invest more aggressively in 2024 given the “typical” fund deployment lifespan of 4-5 years. The phrase “watchful waiting” was frequently cited in meetings with other investors at JPM to describe the sentiment in 2023, but firms expect to be more active this coming year. As for later-stage financings (Series B and beyond), many firms have also been contributing meaningfully to insider-only raises, especially if new investors are tepid (of stage, valuation, platforms more broadly, etc.). The new investors who pass on these raises are likely stretched thin from continuing to fund their own portfolio, helping to invoke a cycle of insider-only investments across many later-stage private companies. My guess is that we will see sidelined investors come into early-stage Seed and Series A financings well before we see a return to normal syndication at the Series B+ stages, given residual risk-off mentality and valuation sensitivity for anything deemed to have “clinically unproven” biology.

Gratitude is always in style:

Sometimes it takes tough markets and hard conversations to appreciate the positive sentiment and changing tides. JPM this year gave the impression that our industry is turning a corner, with sunnier skies (literally and metaphorically in SF this year) ahead for biotech. There is plenty to be excited about for the year ahead, and I am always grateful to work in an industry so motivated to improve the lives of patients and families. Cheers to all the innovative medicines we will collectively shepherd through discovery and development in 2024, and can’t wait to discuss at JPM in 2025!

Many thanks to Michelle Levine and Maurizio Fazio for their editorial advice.