Getting a drug from discovery to market requires more than a dozen years, so you just can’t do biotech in a 10-year venture fund – it just takes too long, right? Fortunately, wrong. The data just don’t support this premise, although this common misperception of biotech continue to be promulgated by industry pundits, and I hear them within the institutional investing community in particular.

I’ve written in past blogs on holding periods in VC-backed biotech, often charting data for different vintages for the sector’s time from founding to exit, for instance. In the summer of 2011 (here), IPOs in the decade of the 2000s were explored showing no difference from other sectors. In spring 2013, largely before the current IPO window, looking at both IPOs and M&As (here), the 2009-1Q2013 dataset revealed that VC-backed biopharmaceutical companies experienced M&A and IPO events at a younger age than technology companies in that vintage. The bias was especially true for M&A events valued at greater than $100M.

Since the public markets have changed dramatically over the past two years, I thought it worthwhile to re-examine the latest data on the venture-backed IPO Class of 2014.

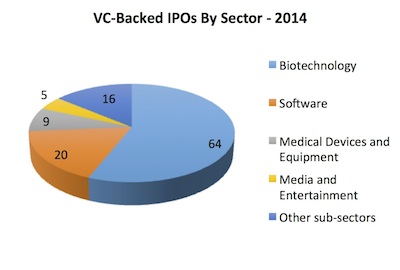

According to Thomson Reuters data shared by the National Venture Capital Association (NVCA), there were 114 venture-backed IPOs in 2014.  This doesn’t include IPOs that didn’t have US-based venture capital investors involved or were on foreign exchanges. The majority of these venture-backed IPOs were in the Biotech sector (56%), as per the pie chart here.

This doesn’t include IPOs that didn’t have US-based venture capital investors involved or were on foreign exchanges. The majority of these venture-backed IPOs were in the Biotech sector (56%), as per the pie chart here.

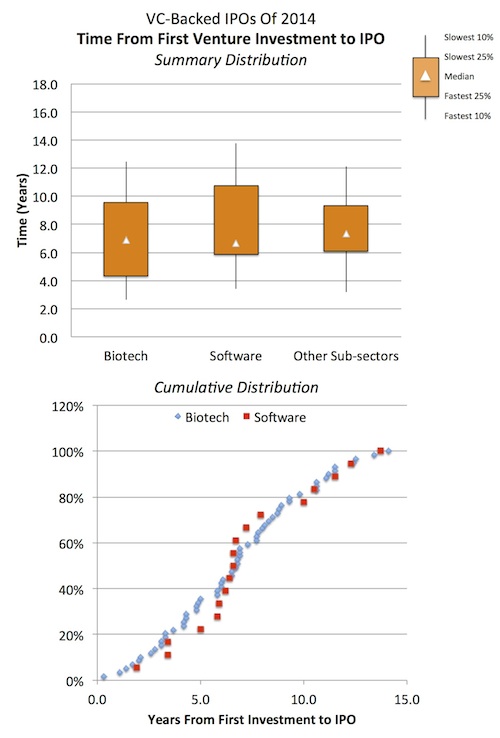

These ThomsonOne data also track the initial investment date for these companies, enabling one to examine the “time from first investment to IPO” for the dataset. The two charts below depict both a summary distribution (with terminal deciles, quartiles, and median data) as well as a cumulative distribution (with each company datapoint for Software and Biotech).

As the charts above reveal, Biotech’s median time to IPO was essentially identical to Software and other VC subsectors. However, the faster end of the data’s distribution is strongly skewed towards Biotech: 33% of Biotech’s 2014 IPOs occurred within five years or less of their initial investment date versus only 20% of the offerings in software and other VC subsectors. Some of these have been incredibly fast, like Juno Therapeutics, Loxo Oncology, and Atara all going public less than two years from their initial venture investment. This skew in the distribution explains why Biotech as a sector has a ~10% faster arithmetic mean (average) time to IPO than Software: 7.4 years versus 8.0 years, respectively.

There are many reasons for this faster path to IPO in biotech, and the topic was explored in detail in an earlier post (here). Simply put, in biotech we are largely taking exciting R&D-stage companies with enormous promise and financing them in the public markets to develop their drug candidates further, whereas in software, the buyside typically requires $100M+ revenue run rates with double-digit growth multiples and often profitability in order to get public. These are very different types of businesses, and the latter often takes many years to build.

So in the more recent vintage of IPOs the conclusion still hold: Biotech is certainly not the tortoise of venture capital. The time period from first funding to IPO is at least as fast, if not faster, in Biotech as it is for other venture sectors.

It might seem redundant with past blog posts, but more data, and more recent data, confirming the same findings are always helpful in framing investment perspectives about the sector.