Biotech and the overall equity markets have been under siege the past few months from macro forces, like oil and the economy, as well as sector-specific concerns like drug pricing.

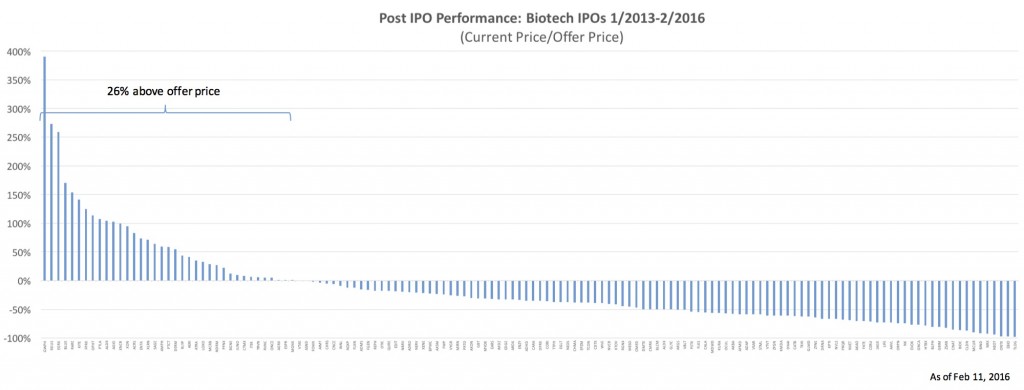

After watching the carnage in 2016 wreck havoc with small and large cap stocks alike, I figured it was time to revisit the post-market performance of the recent biotech IPO cohort. It’s grim, as you might expect. A rising tide lifts all the boats, and a falling one leaves a lot of small ones exposed on the shoreline. Here are a few metrics on the VC-backed IPO cohort since 2013, as of February 11, 2016:

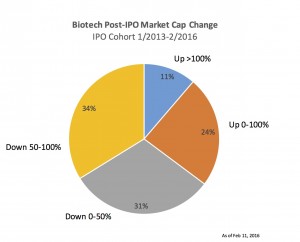

- The vast majority are now below their offer prices. Of the 142 IPOs since January 2013, 74% of them are below their IPO prices. The median stock is down 35% since its IPO; the median return of the NASDAQ Biotech Index (from each company’s offer date) is down only 3%.

- The aggregate market value of the group is actually up despite these stock numbers. The group has an aggregate market capitalization today of ~$54B, and had ~$52B of value at IPO. This is biased upward by the bigger winners, as the median market cap in this cohort is down 30%. Only about one third of the group have seen their overall valuations go up (slightly larger than the one quarter with stocks above offer). The reason for the disconnect is simple: market cap’s go up when companies raise follow-on capital even if stock prices don’t. A few striking examples including Trevena Pharma, who’s market cap has nearly doubled since IPO but the stock price is only up 6%, or Concert Pharma, which has seen its market cap go up 15% despite trading 6% below its IPO price. As discussed in a recent prior blog, many of these companies took advantage of the more accommodating markets of the past couple years to raise significant amount of capital in follow-on financings (here).

- As expected, all of these companies have stock prices way off their all-time highs. Irrespective of whether great new data has recently been reported, not a single company in the entire group is within 20% of its peak daily closing stock price, including the recent IPOs. The median peak-to-current drop is 70%. For comparison, the NASDAQ Biotech Index is down 37% off its peak in July 2016.

- Big Biotech has taken a beating as well, in particular on an absolute value basis. Gilead and Celgene down 25% off their peaks, and Biogen nearly 50% (since that one day close at $475). Amgen is down 18%. These four alone have seen their valuations collapse by nearly $150B since their peaks in 2015. To put that in context, that’s the destruction of ~3x more market value than the entire capitalization of the 142 biotech companies in this IPO cohort. Alternatively, it’s the complete destruction of ~100 bluebird’s or ~50 Juno’s just in the value change of those four stocks in the past few months. While the changes in the stock prices of the newly-minted biotech IPOs have significant emotional costs to the ecosystem (and material financial costs to VC’s and IPO buyers), the absolute impact of the valuation changes of these Big Biotechs on public equity fund manager’s portfolios is far more detrimental to the broader investment community.

Last spring it appeared the markets were discerning between good and bad R&D performance: punishing companies that failed to deliver positive product stories, and rewarding those who had – some stocks were up, some were down (here). Today, everybody is getting hammered. Certainly the companies with big product failures have seen the biggest collapse in their market value (e.g., EBIO, ONTX, TLOG, CLDN, AAVL), but everyone is way off their prior valuations. Fortunately, many companies have the cash horde and runway to weather the current storm (here).

Few takeaways:

- Public markets are a fickle master. Its great when macro forces and sector fund flows drive up valuations and there’s abundant IPO interest from generalist investors. But those same forces turned negative can be painful; no newsflow and your stock can still be down 25+% in a month. As a small cap biotech story, you should expect forces other than your performance to dictate your stock price over the short-run.

- If you want to go public today, strong insider participation required. The only IPO’s that are getting done today at reasonable prices are those with significant insider support, whether it be from “crossovers” or VCs. But don’t count of your mezzanine round participants to just step up to the plate by default as they may have in 2014-2015; rumor has it a number of so-called crossover investors have not joined a few of the recent offerings or have signaled they are stepping back from pending ones.

- Boards should revisit those M&A vs IPO considerations. As discussed in a prior post (here), IPO’s aren’t always the best answer for companies and their shareholders. Pharma is still eager to buy, as AbbVie and others have recently stated publicly. Going public has both dilution and stock performance expectations that need to be factored in – this chart (here) highlights their impact – and in today’s market its hard to feel confident about where stock prices will go in 2016. That’s not to say that going public isn’t a great financing path for many, just that it’s full of explicit and implicit tradeoffs versus either M&A or even staying private.

The last few months of this global equity “risk-off” trade has punished these small cap biotech stocks disproportionately, as they are both less liquid and face higher volatility – and therefore exhibit a much higher market beta than bigger names in biopharm and beyond. However, while this has hurt on the way down, if the markets do turn positive in the near-term, it’s reasonable to expect the stronger companies in this cohort to see their stock prices perform well – as the same macro equity forces that have unwound them should reverse and play to their favor.

A swooning stock market is never easy to stomach. But taking a long term view of the capital markets, Pharma’s desire to source innovation, and biotech’s solid fundamentals, it’s hard not to believe we’ll weather this current crisis if we focus on innovation and prudent governance. As I was reminded yesterday here in New Hampshire when it was -18F in the morning, staying indoors and waiting for a better day is sometimes the right answer.