Today Gilead announced the acquisition of Nimbus’ lead program targeting NASH and related metabolic disorders for $400M upfront and up to another $800M in development and regulatory milestones (here). This transformative deal is the culmination of over five years of work on the program, and a real testimony to the Nimbus team and its exceptional drug discovery platform. Upon closing, Gilead will be acquiring the subsidiary, Nimbus Apollo, that owns the acetyl-coA carboxylase (ACC) franchise.

For a brief primer on ACC as target, it’s an enzyme that catalyzes the first committed step in the de novo synthesis of lipids in the body. Inhibiting ACC shuts down this key metabolic step in lipogenesis and blocks the pathological processes downstream of excessive lipid levels, leading to reductions in fat deposition, inflammation, and fibrosis.

The target is therefore an ideal one for NASH (nonalcoholic fatty liver disease), which has been profiled on this blog before (here, here), especially in light of the liver-targeted distribution of Nimbus’ clinical candidate NDI-010976 (‘976). In addition, ACC has real potential in areas like diabetes, obesity, inflammatory disease, cancer metabolism, and lipid-related disorders. Nimbus is presenting the program’s Phase 1 clinical data at EASL 2015 in Barcelona in a few weeks, including the dramatic reduction in de novo lipogenesis in our proof-of-mechanism study. The robust quality of the ‘976 program, and the broader ACC franchise, was clearly what drove the interest we’ve seen from potential partners over the past year. We’re excited to see Gilead take on the continued development of this program given their clear commitment and leadership in NASH and liver diseases in particular.

The target is therefore an ideal one for NASH (nonalcoholic fatty liver disease), which has been profiled on this blog before (here, here), especially in light of the liver-targeted distribution of Nimbus’ clinical candidate NDI-010976 (‘976). In addition, ACC has real potential in areas like diabetes, obesity, inflammatory disease, cancer metabolism, and lipid-related disorders. Nimbus is presenting the program’s Phase 1 clinical data at EASL 2015 in Barcelona in a few weeks, including the dramatic reduction in de novo lipogenesis in our proof-of-mechanism study. The robust quality of the ‘976 program, and the broader ACC franchise, was clearly what drove the interest we’ve seen from potential partners over the past year. We’re excited to see Gilead take on the continued development of this program given their clear commitment and leadership in NASH and liver diseases in particular.

As done in the past, this blog is meant to share a few observations about Nimbus and this Gilead deal. But before doing that, here’s some of the corporate background. Back in the spring of 2009, Atlas founded the company with Schrödinger, a leading computational chemistry software company, after almost a year-long dialogue between myself and Ramy Farid, Schrödinger’s president. At this time, Schrödinger was launching a novel computational tool called WaterMap,  an apt name for a technology that maps the energetics of water sites at the receptor-ligand interface, providing a potential roadmap for efficient ligand-receptor interactions. As this cutting edge technology catalyzed some of our initial thinking, we called it Project Troubled Water Inc (PTW) for the first year or so. The initial seed was only $300K to work on an in silico target triage process, and that seed was “scaled up” over the next two years to a few million dollars in funding. We hired our CSO, Rosana Kapeller, and our initial head of BD, Jonathan Montagu, back in 2010 to help us build the company as Atlas Entrepreneurs-In-Residence. I had the pleasure of being the acting CEO for the first few years or so of the company. The initial Series A, into what was by then called Nimbus Discovery LLC, was closed in 2011 with great partners from Lilly Ventures (Steve Hall) and SR One (Kent Gossett, RIP; followed by Brian Gallagher) to advance the platform across three tranches; in 2015, we closed a Series B, adding Pfizer Ventures (Elaine Jones) and Lightstone Ventures (Chris Christoffersen) – and shortly thereafter changing our name to Nimbus Therapeutics LLC.

an apt name for a technology that maps the energetics of water sites at the receptor-ligand interface, providing a potential roadmap for efficient ligand-receptor interactions. As this cutting edge technology catalyzed some of our initial thinking, we called it Project Troubled Water Inc (PTW) for the first year or so. The initial seed was only $300K to work on an in silico target triage process, and that seed was “scaled up” over the next two years to a few million dollars in funding. We hired our CSO, Rosana Kapeller, and our initial head of BD, Jonathan Montagu, back in 2010 to help us build the company as Atlas Entrepreneurs-In-Residence. I had the pleasure of being the acting CEO for the first few years or so of the company. The initial Series A, into what was by then called Nimbus Discovery LLC, was closed in 2011 with great partners from Lilly Ventures (Steve Hall) and SR One (Kent Gossett, RIP; followed by Brian Gallagher) to advance the platform across three tranches; in 2015, we closed a Series B, adding Pfizer Ventures (Elaine Jones) and Lightstone Ventures (Chris Christoffersen) – and shortly thereafter changing our name to Nimbus Therapeutics LLC.

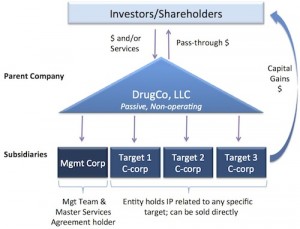

In early 2011, the company came out of stealth mode in an early LifeSciVC post called “Discovering Nimbus” when Bill Gates and Schrödinger founder Rich Friesner joined a final extension of our seed round; that post highlighted the three founding pillars of the company, all of which remain true today: a unique discovery partnership with Schrödinger; an ultra-lean “virtually integrated, globally distributed” R&D operating model; and, an asset-centric LLC holding company corporate structure.

Let me start with a few reflections on those three founding pillars:

- Our unique platform partnership with Schrödinger has enabled a powerful drug discovery engine. As many readers will know, Erwin Schrödinger’s Cat, penned in 1935, was used to describe how one thing can be in two states simultaneously, as part of quantum mechanics. By analogy, our unique model effectively created a dual-state “cat” with our partner at Schrödinger: while they continue to be a leading software developer selling licenses to Pharma, they’ve simultaneously enabled a totally proprietary and unparalleled drug discovery collaboration as co-founders of Nimbus. In short, while Schrödinger technology licenses are highly valuable, and most Pharma companies have access to at least some of their suite of applications, it’s fair to say that no other partner has been able to centrally integrate their computational firepower, functions, and forcefield into the complex engine room of drug discovery the way Nimbus has. This team and technology integration goes well beyond the software itself and is part of the unique “state” of this partnership. Since inception, it’s been a truly enabling, unique, and exclusive collaboration on a broad basket of programs; our successes with ACC, IRAK4, Tyk2, and others are clear evidence of this.

- We’re indeed global – “the sun never sets on Nimbus’ programs.” We have run (and will continue to run) a globally-distributed R&D network to prosecute our programs across multiple continents and many time zones. Not without its challenges, this model has worked well, and the team has excelled at integrating across this network. Recently Rosana Kapeller compared this operating model’s disruptive potential to Uber (here). While our core team is roughly 20 FTEs, we have 150+ contributors working around the world on our project teams. Worth noting that unlike Padlock’s sole-source approach with Evotec, Nimbus has efficiently built a broad portfolio of contract research partners and collaborators, including Pharmaron, ChemPartner, Proteros, Wuxi, Boulder BioPath, Hooke Labs, Reaction Biology, Nextcea, Confluence, Covance, Charles River, Tandem, Kinemed, and many others. In addition to this vast CRO network, Nimbus has established strong relationships with some of the premiere academic labs working on the targets and fields of interest, which has allowed Nimbus to crack complex biology without its own wet labs. Juggling all these external partners requires skilled program leadership and project management, which we have invested behind at Nimbus.

- Our asset-centric LLC holding company model enables the sale of the eggs, not the goose. This transaction is, to our knowledge, the first significant demonstration of an LLC therapeutics platform model working to tax efficiently distribute proceeds from sale of an asset-centric subsidiary (the egg) – without having to sell the entire company (the goose). I’ve discussed the LLC model many times on this blog (here, here), so it’s great to see it work in practice rather than theory.

Not without its often cumbersome accounting needs, the model has enabled a unique set of deals, like those with Monsanto and Shire in 2013 (here). We partnered IRAK4 last fall with Genentech via our Nimbus Iris Inc subsidiary. As mentioned above, Nimbus Apollo Inc housed the ACC franchise, and with this announcement is being acquired by Gilead. Another portfolio company, F-star, has similarly partnered some of its subsidiaries in a similar LLC-like structure (here). As I’ll describe below, the parent LLC and the rest of the programs/subsidiaries will all continue to operate as they have after this Apollo acquisition.

Not without its often cumbersome accounting needs, the model has enabled a unique set of deals, like those with Monsanto and Shire in 2013 (here). We partnered IRAK4 last fall with Genentech via our Nimbus Iris Inc subsidiary. As mentioned above, Nimbus Apollo Inc housed the ACC franchise, and with this announcement is being acquired by Gilead. Another portfolio company, F-star, has similarly partnered some of its subsidiaries in a similar LLC-like structure (here). As I’ll describe below, the parent LLC and the rest of the programs/subsidiaries will all continue to operate as they have after this Apollo acquisition.

So the foundational pillars have very much delivered on their promise and potential; here are four more general but important observations to highlight:

- As is always the case, it’s all about the people – and the flow of talent in our industry. Rosana Kapeller has led the R&D effort since joining in 2010, after stints at Aileron and Millennium. Others that were instrumental in the program’s success include: Geraldine Harriman as the head of the ACC program (ex-Galenea, Millennium); Wes Westlin as head of preclinical (ex-Avila, Praecis, Pharmacia); newcomer Annie Chen as our CMO (ex-Merck, Genentech, Celera); Jeremy Greenwood and Leah Frye, both leading contributors from Schrödinger; Jim Harwood as key program advisor (ex-Pfizer); and many others in the Nimbus family (here, here) that I wish I had room to mention. In addition to our scientific leadership, in late 2014, we were fortunate to recruit Pharma veterans Don Nicholson as CEO (ex-Merck) and Jeb Keiper as CBO (ex-GSK), both exceptional additions to the Nimbus leadership team and the driving architects of this Gilead partnership. Don’s leadership has been truly catalytic for the company over the past eighteen months. I highlight this great group and their backgrounds to emphasize yet again the importance of the flow of talent in our industry and how it works in a deep cluster like Boston/Cambridge. Don, Jeb, and Annie all “emigrated” north from the NJ/PA Pharma corridor, like dozens of others in the past few years. Rosana and Gerry were trained early in their careers in the dynamic culture of Millennium, before tours in smaller biotechs. Wes is another serial biotech entrepreneur – before Nimbus, he’s been at two prior biotechs that were acquired (Atlas-backed Avila by Celgene, and Praecis by GSK). All clear evidence that talent flows and positive network effects are critical in building the teams that drive successful biotechs.

- Nothing is ever linear, and strategic adaptation of the initial hypothesis is a requirement. Our original thesis for Nimbus (f.k.a. PTW) was that we could create a discovery engine where we’d monetize preclinical candidates before they’d enter formal IND-enabling work via the clever corporate structure. This proved elusive in the first few years, although we often got close. Instead, as we advanced programs like ACC, we clearly could see the path to much greater value-creation by going “deeper” into early development. The team and board frequently discussed the merits and opportunities/challenges of this progression (like the asymmetry of stage challenge). In the heat of the 2015 crossover market environment, we even seriously considered a run at an IPO supported by our clinical ACC franchise – which would have required folding up our LLC structure before seeing its magic deliver. We were open to all of these along the way; it’s really important not be dogmatic about the thesis and myopic on strategic direction. And more generally, one can’t adopt a one-size-fits-all approach to building companies. By having different models in our portfolio (big biology plays, discovery platforms, single asset stories), and some fluidity between them, we’re able to access different value creation models in an uncorrelated manner. For any individual company, flexibility and adaptability are key – as much so as the power of persistence.

- Disciplined execution of this model can efficiently deliver therapeutic candidates. Using the ACC program as an example, we achieved a bona fide Development Candidate in roughly 2 years and ~$8M from a novel virtual screen hit at an allosteric pocket. We achieved definitive clinical proof of mechanism in our Phase 1b for an aggregate, fully loaded project spend of ~$20M. These metrics for a first-in-class, chemically novel program are impressive by any measure. Fair to say not all programs were as fortunate, but target triage and disciplined prosecution has been key to Nimbus’ success. We successfully killed multiple programs early on with limited capital as we assessed the viability of applying our approach to those targets. Disciplined decision-making and focused execution are clearly critical to drug discovery value creation.

- Top decile returns and the golden goose. Proceeds from this ACC transaction provide both top-decile venture multiples and significant absolute returns for all Nimbus shareholders. Sharing only the publicly available numbers show that Nimbus has raised ~$70M in venture equity since 2009. The multiple on invested capital in the face of an aggregate deal value of $1.2B is obviously quite attractive. It’s worth noting that although seven years from founding is typical holding period in biotech (here), Nimbus was less than five years from its Series A, and two-thirds of the invested capital was deployed in the last two years – making for a very solid IRR. In aggregate, if ACC is fully successful, this deal could return nearly all of Atlas Venture’s Fund VIII. Importantly, the rest of Nimbus – the golden goose – remains intact and continues to prosecute our existing therapeutics projects. We fully expect those to continue contributing to the return profile in favorable ways.

Nimbus 2.0: The goose’s next hatch

As part of the LLC model, we’ll be recycling some of the proceeds to power up our existing programs and initiate several new drug discovery campaigns over the next few years. As already disclosed (here, here), we’ve got a hyper-selective Tyk2 inhibitor that spares the other JAKs – which is the ideal profile for the genetically-validated autoimmune indications. We’ve also got a STING non-dinucleotide discovery program in place. And several others in stealth mode.

Don and the team are actively discussing broad drug discovery collaborations with Pharma enabled by the unique asset-centric corporate model. These dialogues have been catalyzed in large part by this recent demonstration of success with ACC’s Phase 1 results and our IRAK4 partnership.

So to finish up, congrats to Nimbus on discovering and advancing such an impressive ACC program, and congrats to John Milligan and his team at Gilead on securing it – we’re thrilled to have such a committed partner for our ACC franchise and look forward to its success in NASH and beyond.